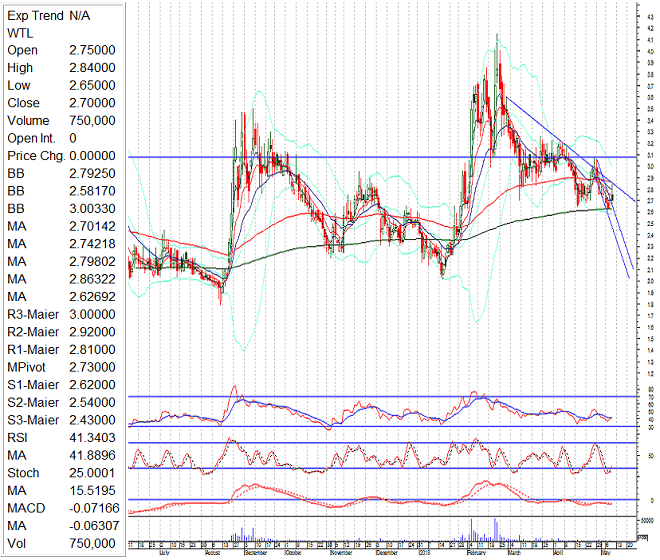

WTL Worldcall Telecom Limited Analysis 10 May 2013

WTL Bullish Bias above 2.62

Our Pivot: 2.41

Our Short Term Preference: Buy WTL as long as 2.62 is sustained as support with strict stop loss of 2.41 and profit target at 3.23

Our Mid Term Prefrence: Buy WTL as long as 2.62 is sustained as support with strict stop loss of 2.36 and profit target at 3.23 and 4.50

Alternative Scenario: Downward penetration of 2.41 will call for 2.13

NOTE: WTL have recovered from its daily downward channel and is moving towards 3.23, for its short and mid term bullish sentiment its necessary for WTL to close above 3.10 today. If it will become able to close above 3.10 then on weekly basis it will generate a bullish engulfing patter which will be strongly helpfull for its bullish sentiment. Today's closing above 3.10 will also support WTL to recover from its weekly bearish channel. All Middle impact indicators like MACD, Stochastic, MARS are falte along bollinger bands which are also supportive for bullish run.

Recommendations:

For New Entries ( buy above 2.62 )

Existing buyers short term (wait for closing above 3.10 if it will become able to close above 3.10 then next target will be 3.95 and 4.50)

Daily Chart with Supports and Resistance:

Daily Weekly with Supports and Resistance:

Daily Weekly with Supports and Resistance:

Monthly Chart with Supports and Resistance:

Monthly Chart with Supports and Resistance:

3 COMMENTS

John Doe

June 29, 2014 - 11:23 Proin eget tortor risus. Cras ultricies ligula sed magna dictum porta. Pellentesque in ipsum id orci porta dapibus. Lorem ipsum dolor sit amet, consectetur adipiscing elit.Diana Doe

June 29, 2014 - 11:23 Proin eget tortor risus. Cras ultricies ligula sed magna dictum porta. Pellentesque in ipsum id orci porta dapibus. Lorem ipsum dolor sit amet, consectetur adipiscing elit.Melissa Doe

June 29, 2014 - 11:23 Proin eget tortor risus. Cras ultricies ligula sed magna dictum porta. Pellentesque in ipsum id orci porta dapibus. Lorem ipsum dolor sit amet, consectetur adipiscing elit.Peter Doe

June 29, 2014 - 11:23 Proin eget tortor risus. Cras ultricies ligula sed magna dictum porta. Pellentesque in ipsum id orci porta dapibus. Lorem ipsum dolor sit amet, consectetur adipiscing elit.LEAVE A COMMENT