Morning Market Brief 15th April. 2021

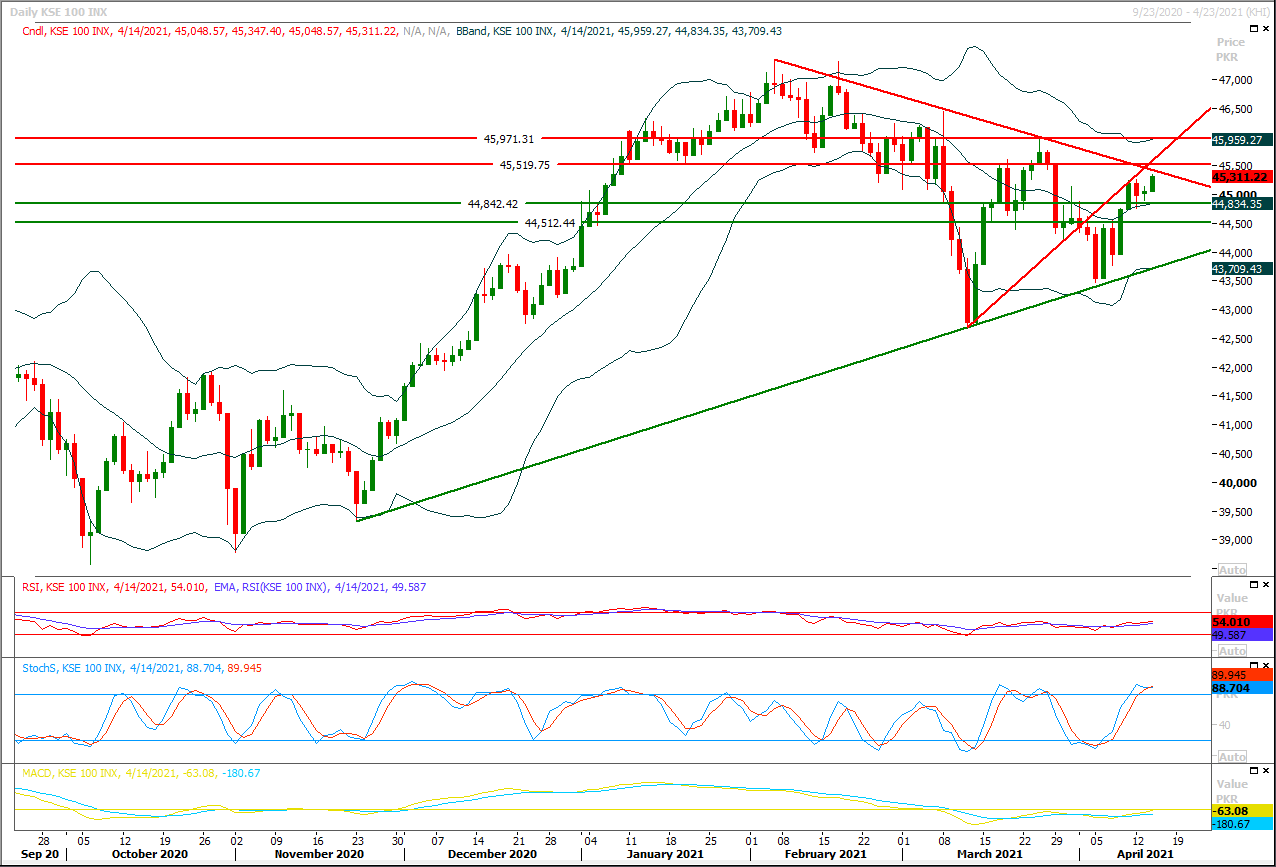

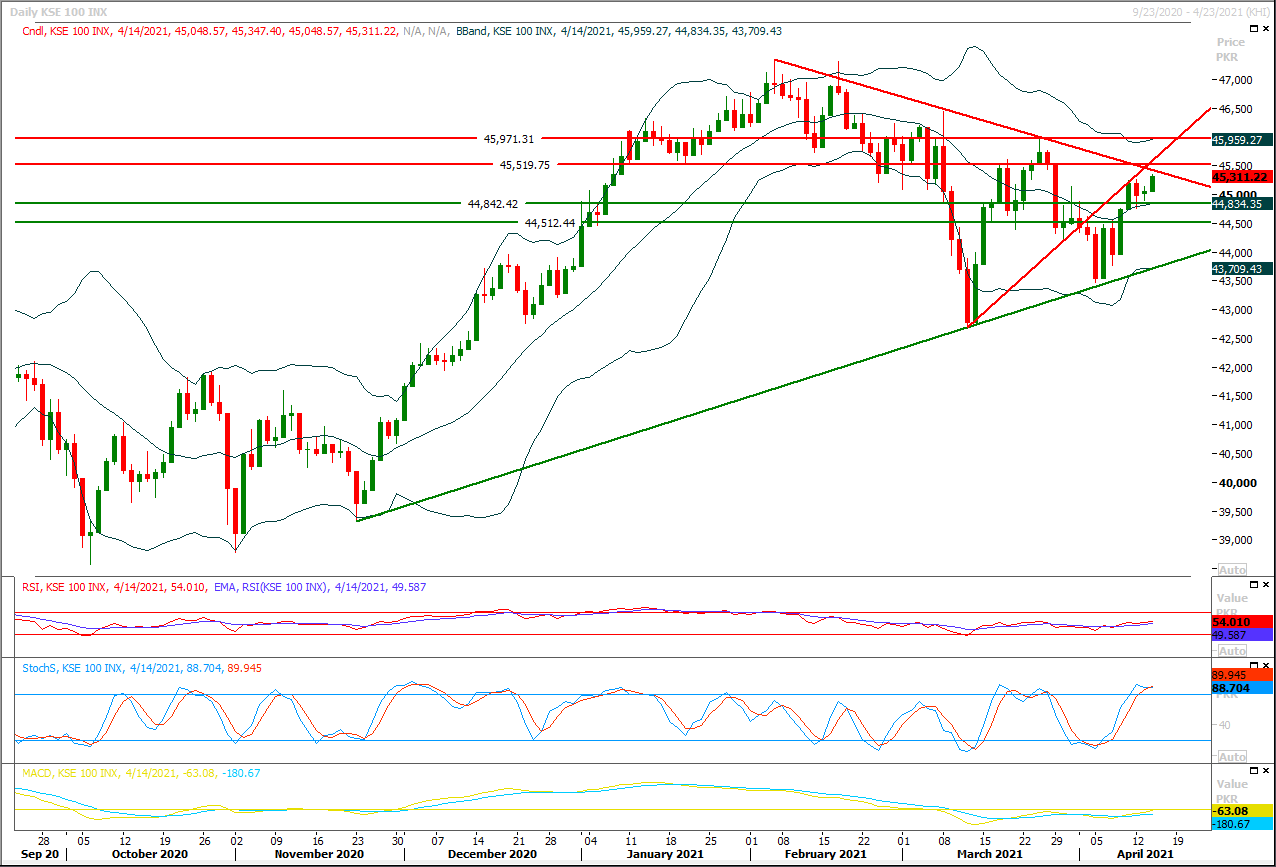

Technical Overview

The Benchmark KSE100 index had continued its bullish journey during last trading session and succeeded in closing above its initial resistant region of 45,200pts at day end. As of now index have major resistant regions ahead at 45,380pts and 45,600pts. Initially it's expected that index would face rejection from its initial resistant region which falls at 45,380pts where 74.6% correction of its last bearish rally would complete but breakout above this region would call for 45,500pts-45,615pts region. It's recommended to stay cautious because hourly and daily stochastic are ready for bearish crossovers and if index would face rejection from above mentioned resistant regions then some serious selling pressure would try to push index in downward direction. On bearish side index would find initial supportive region at 45,000pts which would be followed by 44,860pts-44,700pts region. It's recommended to post trailing stop loss on existing long positions because if index would start sliding downward from this region then short term sentiment would reverse toward bearish side. Overall index would remain range bound until it would not either succeed in closing above 46,200pts or below 44,500pts.

Regional Markets

Asian shares defensive, dollar struggles near one-month lows

Asian shares were on the backfoot on Thursday following mixed cues from Wall Street where a sharp sell-off in the largest bitcoin exchange Coinbase hit tech shares while the dollar index struggled near one-month lows. MSCI’s broadest index of Asia-Pacific shares outside Japan paused after two straight days of gains. It was last at 690.53, a long way from a record high of 745.89 touched in February. Japan’s Nikkei rose 0.2% while South Korea’s KOSPI index was up a tad. Australia’s benchmark index slipped 0.4% as miners were dented by weaker prices for iron ore and coal. Global shares have surged in recent weeks led by successful rollouts of COVID-19 vaccines around the world, U.S. stimulus packages and higher U.S. inflation expectations.

Read More...

Business News

SDGs-related projects unveiled to attract FDI

Pakistan has introduced eight selected projects covering sustainable development goals (SDGs), with high potential to attract foreign direct investment (FDI). The projects presented at the two-day virtual SDG Investment Fair 2021 which concluded on Wednesday, organised by the United Nations Department of Economic and Social Affairs. The projects were from varied sectors including infrastructure, hydro power, medical devices development center, silicon solar PV panels fabrication, production of agriculture drones and smart farms, university technology parks and IT incubation centers across Pakistan.

Read More...

Govt moving towards PSM revival: minister

Minister for Privatisation Muhammadmian Soomro on Wednesday said the government was moving towards revival of Pakistan Steel Mills (PSM) in a transparent manner. He was speaking at the weekly ministerial meeting chaired by Minister for Finance, Industries and Production Hammad Azhar. It was unanimously agreed that the work for the revival of PSM and resolution of related issues should be expedited. The current status and progress besides probable timeline for the completion of the PSM transaction were discussed during the meeting. A new subsidiary will be formed that will run the steel mills. The inter-ministerial meeting discussed the new subsidiary, carving out of key operating assets and core land including verification and fair market valuation of the plant and machinery

Read More...ECC exempts three Punjab power plants from LNG purchase

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday exempted three Punjab-based power plants of 3,900 megawatts from compulsory purchases of liquefied natural gas (LNG) quantities from January 2022, removed a major power plant from privatisation list and withdrew customs duty on import of cotton yarn. The meeting presided over by Minister for Finance, Revenue, Industries and Production Muhammad Hammad Azhar also approved a Rs11.7 billion supplementary grant for financing four mother and child hospitals in Punjab. Already cleared by the Cabinet Committee on Energy (CCoE) in September last year, the Power Division presented a summary regarding waiver of minimum 66pc take-or-pay commitment in Power Purchase Agreements (PPAs) and Gas Supply Agreements (GSAs) of three RLNG-based public sector power plants. Located in Punjab, these plants included Quaid-e-Azam Thermal Power Plant, Balloki Power Plant and Haveli Bahadur Shah Power Plant.

Read More...

Pakistan set to achieve fiscal sustainability: IMF

Pakistan is all set to achieve some major goals including fiscal sustainability under the Extended Fund Facility (EFF), International Monetary Fund (IMF) Country Representative Teresa Daban Sanchez said on Wednesday. Speaking at a webinar at the Sustainable Development Policy Institute (SDPI), Ms Sanchez said it is being achieved through the strategy by removing exemptions and privileges, enhancing social and productive spending, coordination with provinces, and elimination of quasi-fiscal circular debt and losses of state-owned enterprises (SOEs). The IMF representative emphasised that these goals are very important for the future direction of the country and include a market determined and flexible exchange rate as well as an independent central bank with a primary focus on price stability.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3