Morning Market Brief 16th Dec. 2020

Technical Overview

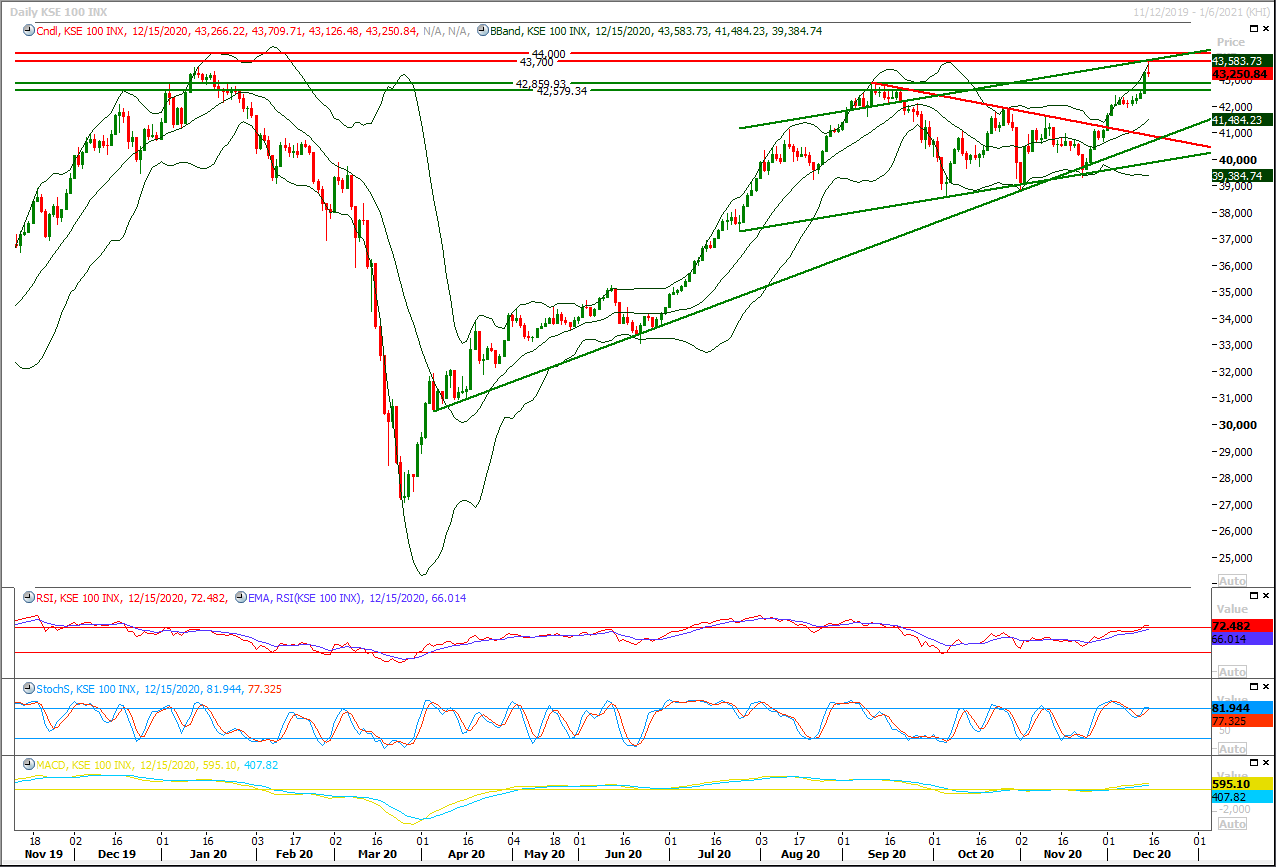

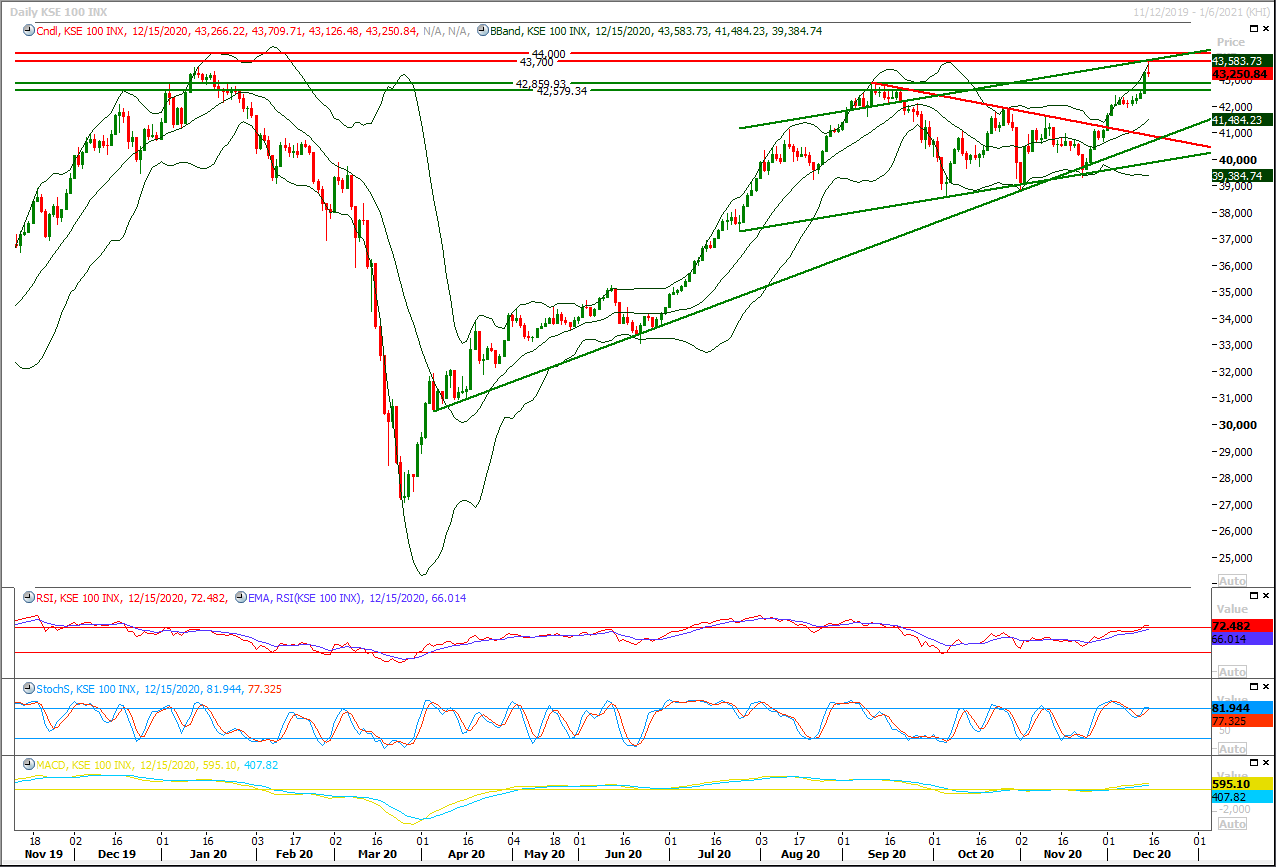

The Benchmark KSE100 index has faced rejection from resistant trend line of its bullish price channel during last trading session on daily chart. As of now it's expected that index would try to bounce back in bullish direction during current trading session therefore buying on dip would be beneficial in case index would take a dip at start of the session. It's expected that index would try to target its resistant trend line once again during current trading session and a bullish rally could be witnessed during the day. For day trading it's recommended to start buying start of the day and off load these positions around 43,700pts before day end, it's recommended to stay cautious until index would not succeed in closing above 44,200pts on daily chart. Closing above 43,700pts on daily chart would open doors for 44,200pts and 44,660pts or 45,000pts in coming days where expansion of breakout of its previous triangle would complete.

For current trading session index have supportive regions ahead at 43,000pts which would be followed by 42,860pts and index would remain bullish until it would not succeed in penetration below 42,500pts. Daily momentum indicators have entered into an uncertain region, mean while index is standing at a crucial level on monthly and weekly charts therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. on weekly chart index is trying to complete a cup and handle formation which is a continuity pattern for previous bullish rally but it depends on this week's closing that either index would continue its bullish sentiment or a correction would be witnessed. On longer run index would be considered bullish until it would not succeed in closing below 41,500pts or 41,000pts.

Regional Markets

Asia stocks climb on vaccine, U.S. stimulus optimism

Asian stocks rose on Wednesday as hopes of effective coronavirus vaccines and the growing prospect of more U.S. fiscal stimulus cheered investors ahead of the Christmas holiday season.MSCI’s broadest index of Asia Pacific shares outside of Japan added 0.6% after two straight days of losses. The index, hovering near record highs, is up 3.3% so far in December and is on track for its best yearly performance since 2017 thanks to generous government and central bank stimulus around the world. Australian and New Zealand shares jumped over 1% each while South Korea’s KOSPI and Japan’s Nikkei were each up about 0.3%. Chinese shares started firm with the blue-chip CSI 300 index adding 0.25%. Hong Kong’s Hang Seng index climbed 0.8%..

Read More...

Business News

Pakistan, China likely to sign Framework Agreement for Industrial Cooperation

Pakistan and China is likely to sign Framework Agreement for Industrial Cooperation (IC) during upcoming Join Cooperation Committee (JCC) of CPEC, it is learnt reliably here. It has been decided to include the Frame Work Agreement on Industrial Cooperation as a deliverable in the agenda of the 10th JCC meeting, official sources told The Nation here Tuesday. Pakistan and China has already signed MOU on industrial cooperation and now in the upcoming meeting of JCC it will be taken to next level, the source said. Meanwhile a statement issued here stated that the 5th meeting of Joint Working Group (JWG) on Industrial Cooperation (IC) under China Pakistan Economic Corridor (CPEC) was held via video conference here on Tuesday.

Read More...

Pakistan needs to focus on competitiveness, reducing imports even further: SBP chief

Governor of State Bank of Pakistan Reza Baqar has said that the exports have recovered to their pre-COVID monthly level of around $2 billion, with the strongest recovery in textiles, rice, cement, chemicals, and pharmaceuticals. Pakistan needs to focus on competitiveness and reduce imports even further to support local businesses. Addressing the plenary on “Pakistan’s Economic Response to COVID-19 and Way Forward for an Inclusive Economic Recovery” on the second day of the 23rd Annual Sustainable Development Conference of the Sustainable Development Policy Institute (SDPI) here Tuesday, the governor of State Bank said to boost economic activity and job opportunities in the country, the State Bank of Pakistan is working with the banks to see that lending to small and medium enterprises (SMEs) and housing financing facilities are increased in collaboration with banks.

Read More...

Cutlery industry’s problems will be solved: Aslam Iqbal

Delegation of Pakistan Cutlery & Utensils Manufacturers and Exporters Association (PCUMEA) called on Punjab Minister for Industry and Commerce Mian Aslam Iqbal at Civil Secretariat on Tuesday and sought government support for meeting export targets. The minister said that the national economy can be strengthened by increasing exports. The government is implementing the policy of decreasing imports and encouraging exports, he said. The cutlery industry’s problems will be solved on a priority basis. He promised reviewing development work in all four small industrial estates during Gujranwala visit next week. Meanwhile, soft loans up to Rs.10 million were being given under Punjab Rozgar Scheme and the government has restored the confidence of the local industrialists besides encouraging foreign investors. This has resulted in huge investment opportunities in the province, he added.

Read More...

LSM output grows by 6.66pc in Oct as economic recovery gathers pace

Pakistan’s large-scale manufacturing (LSM) output grew 6.66 per cent in October on the back of higher auto and cement production in the country. The growth of large-scale manufacturing (LSM) industries was recorded at 5.46 percent in first four months (July to October) of the current fiscal year, showing that economic activities had revived in the country after the end of first wave of coronavirus. The latest data of Pakistan Bureau of Statistics (PBS) showed that LSM output has rebounded after suffering months of damage inflicted by Covid-19 mainly in the construction, sugar, automobile, and pharmaceutical sectors. The uptick during the month under review clearly reflects a revival in economic activities in the country. Federal ministers have expressed satisfaction over the growth in LSM sector.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3