Morning Market Brief 16th Feb. 2021

Technical Overview

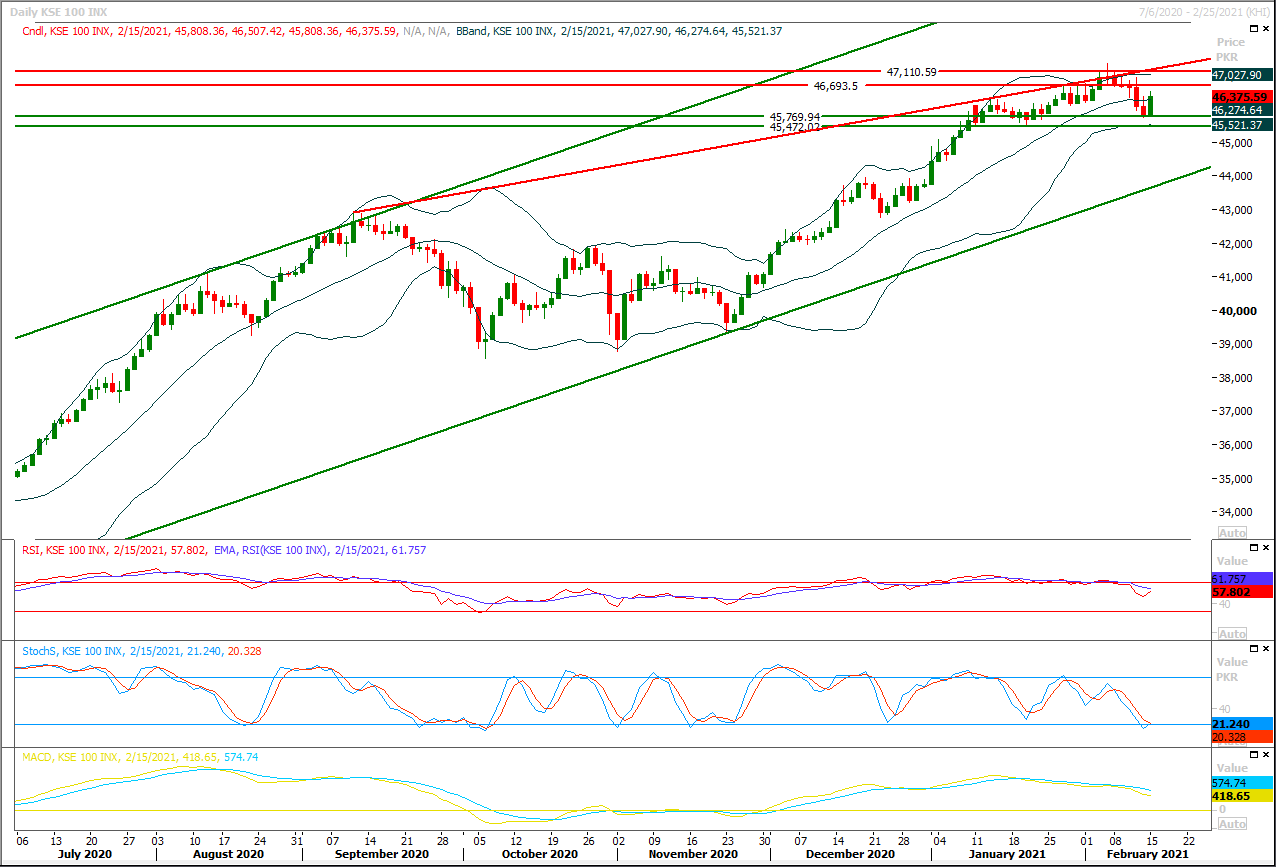

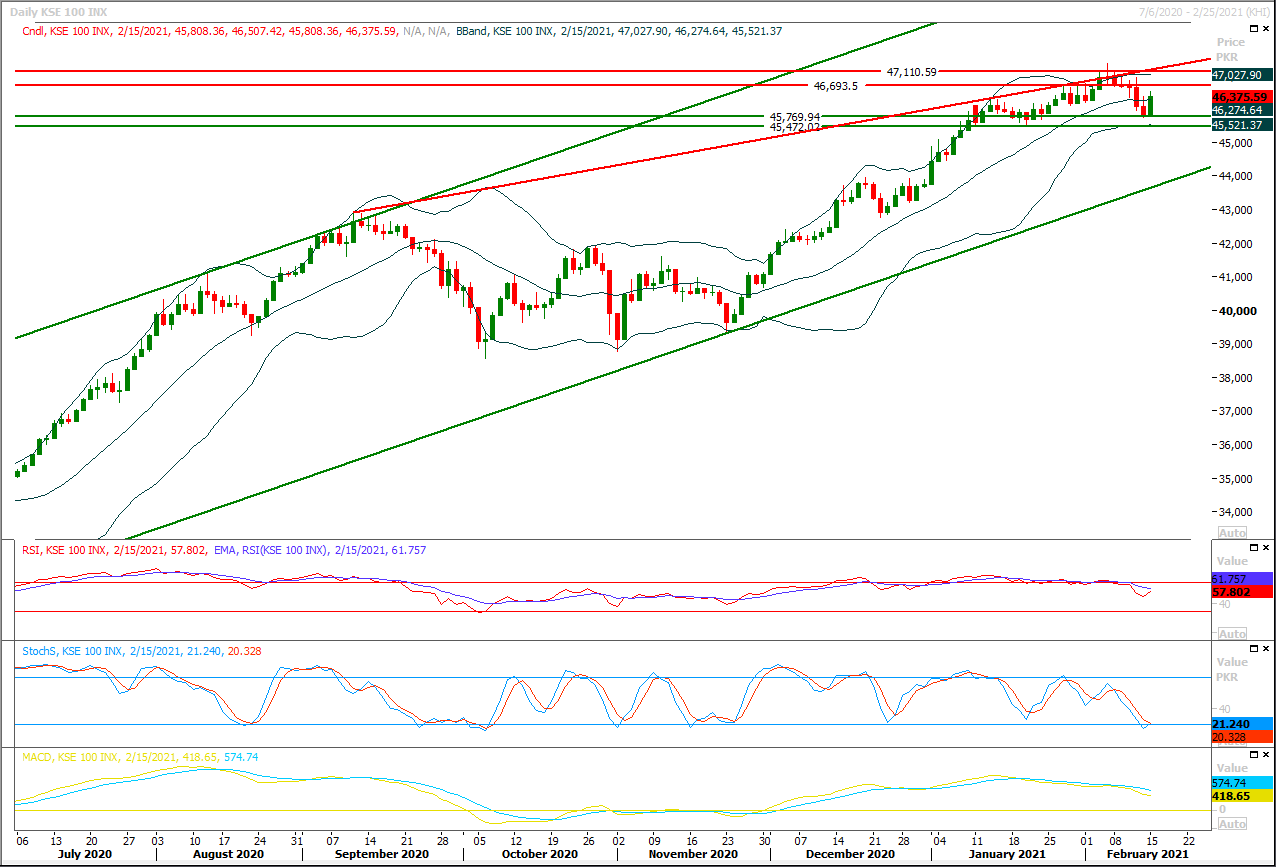

The Benchmark KSE100 index had succeeded in recovering from its supportive regions during last trading session and have closed above its initial resistant region of 46,300pts. As of now it's expected that index would try to continue its pull back and an intraday spike towards 46,700pts could be witnessed where index is being capped by a descending trend line along with a horizontal supportive region therefore it's recommended to stay cautious and start profit taking from existing long positions around this region, bullish breakout above this region would call for 46,900pts and 47,115pts but overall index would remain in uncertain region until it would not succeed in closing above 47,500pts this time. While on flip side in case of pressure or reversal index would try to establish ground above 46,000pts-45,900pts region where its being supported by a horizontal supportive region. Overall a volatile trading session could be witnessed during current trading session therefore it's recommended to stay cautious. Currently daily and weekly momentum indicators are in bearish mode as Stochastic and MAORSI have generated bearish crossovers on both time frames and MACD have started changing its direction towards bearish side but hourly stochastic is showing a pullback sign which indicates that index may take an intraday spike

Regional Markets

Asia sets up global stocks for extended bull run on economic optimism

Asian shares advanced on Tuesday, putting world equities on course to extend their bull run for a 12th consecutive session as optimism about the global economic recovery and expectations of low interest rates drive investments into riskier assets. Oil prices soared to a 13-month high as a deep freeze due to a severe snow storm in the United States not only boosted power demand but also threatened oil production in Texas. MSCI’s broadest index of Asia-Pacific shares outside Japan ticked up 0.45% while Japan’s Nikkei rose 0.4% to a 30-year high. In Hong Kong, the Hang Seng Index surged 1.79% to hit a 32-month high in its first trading session since Thursday following the Lunar New Year holidays. Mainland Chinese markets will remain closed for the holidays until Thursday while Wall Street was also shut on Monday.

Read More...

Business News

Khusro Bakhtyar chairs meeting of National Coordination Committee on Foreign-Funded Projects

Federal Minister for Economic Affairs Makhdum Khusro Bakhtyar on Monday directed the line departments of government of Khyber Pakhtunkhwa for fast track implementation and set timelines for expeditious execution of the foreign-funded projects. The minister made these remarks while chairing the meeting of National Coordination Committee on Foreign-Funded Projects (NCC-FFP) at Ministry of Economic Affairs in Islamabad. The forum reviewed the progress of ongoing thirty projects under the Government of Khyber Pakhtunkhwa portfolio amounting to USD 3.1 billion. The portfolio encompasses transport & communication, energy, rural development, education & training, water and irrigation system in the province. These thirty projects are being implemented with help of development partners like World Bank, Asian Development Bank, USAID, China, UK, Saudi Fund, Germany, and France.

Read More...

Govt likely to eliminate tax exemptions in various sectors in upcoming budget

In a bid to generate more revenues, the government is likely to eliminate tax exemptions in various sectors in the upcoming budget for next fiscal year 2021-22, officials of the Federal Board of Revenue (FBR) said on Monday. “The government will eliminate the tax exemptions in next budget to increase the tax collection,” said Muhammad Javed Ghani, Chairman FBR, in Senate Standing Committee on Finance and Revenue, which met under the chair of Senator Farook H Naik. Chairman FBR said that preparations of next annual budget are underway. The government would finalize the budget proposals by end of March, he added. Talking about tax exemptions, Javed Ghani said that government would continue tax exemptions on food items, medicines and others essential items. The government would provide relief to the common people and would take measures to generate employment opportunities in the budget.

Read More...

CDWP clears five projects worth Rs58.5 billion

Central Development Working Party (CDWP) Monday cleared five projects worth Rs 58.5 billion including Gwadar-Lesbella Livelihood Support Project Phase-II. The CDWP meeting, presided over by Deputy Chairman Planning Commission Mohammad Jehanzeb Khan, cleared two development projects with a cumulative estimated cost of Rs 5 billion and recommended three projects worth Rs 53.50 billion to the Executive Committee of the National Economic Council (ECNEC) for further consideration. Senior officials from Planning Commission and Federal Ministries/Divisions also participated in the meeting while representatives from provincial governments participated through video conference. Projects related to agriculture & food, governance, transport & communications were presented in the meeting.

Read More...

Inflow of workers’ remittances increases 24pc in 7 months

The inflow of workers’ remittances into the country witnessed 19 percent increase in January 2021, as compared to same month of the previous year. The remittances remained above $2 billion for 8th straight month as during the corresponding month, the inflow was recorded at $2.3 billion as compared to the inflow of $1.907 billion in January 2020. On average, the remittances surged by 24 percent during July-January (2020-21) from $13.28 billion in Jul-Jan (2019-20) to $16.476 billion in same period of the current fiscal year, according to data released by State Bank of Pakistan on Monday. The country wise detail shows that the highest inflows came from Saudi Arabia as Pakistan received $553 million during the month as compared to $531.6 million in January 2020 and $624 million in December 2020.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3