Morning Market Brief 16th Mar. 2021

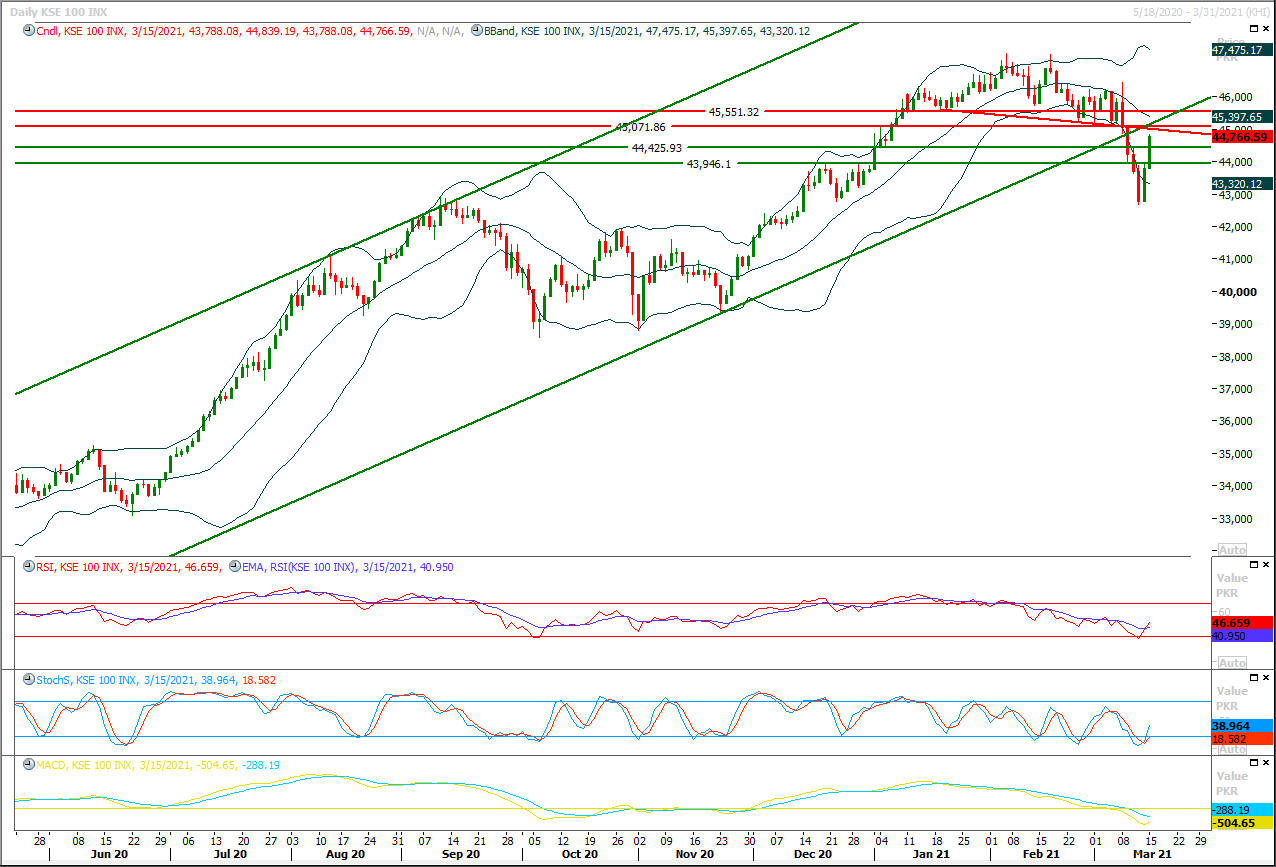

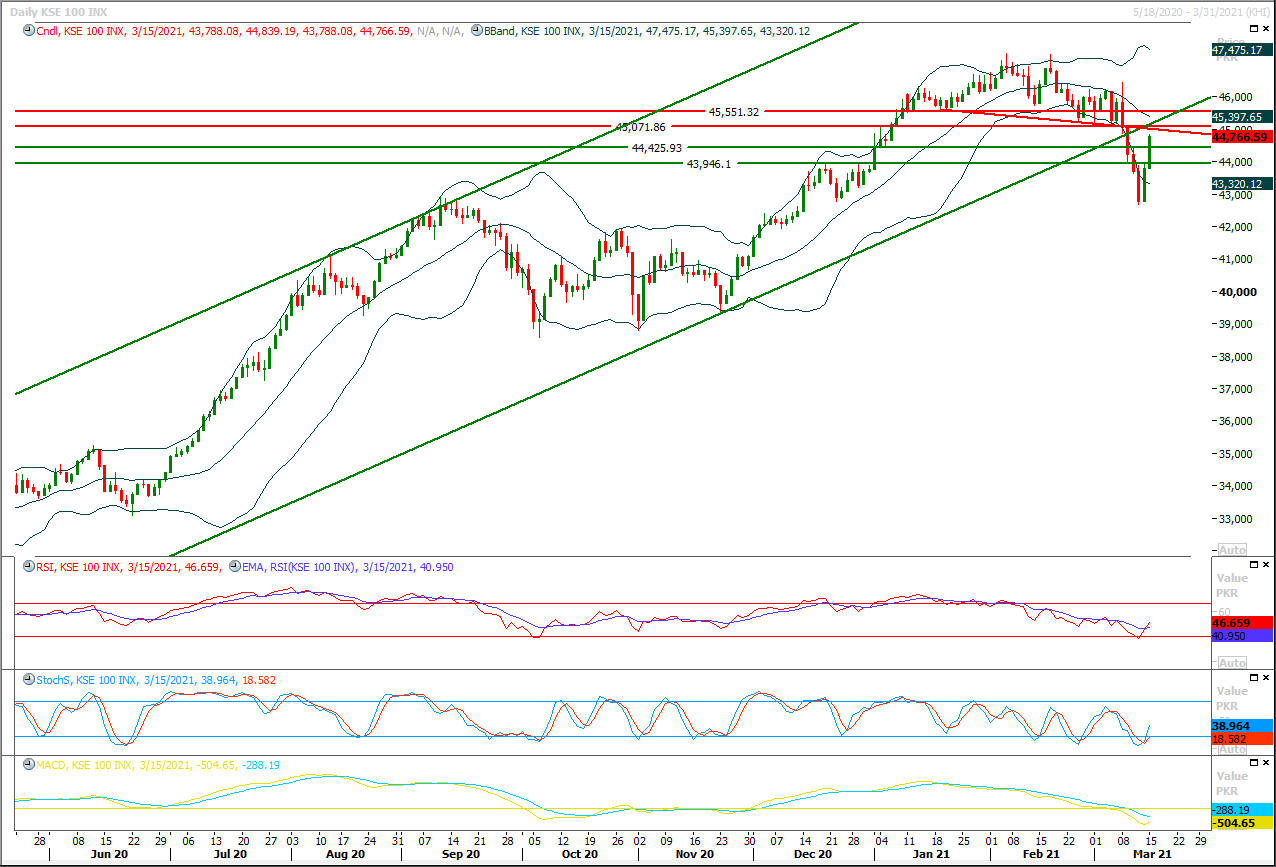

Technical Overview

The Benchmark KSE100 index have confirmed its bullish engulfing pattern on daily chart during last trading session and have succeeded in closing above its initial resistant region of 44,500pts. As of now it's being capped by strong resistant objects on its way towards its previous bullish price channel. For current trading session it's expected that index would face initial resistance at 45,000pts where its being capped by a descending trend line which falls at 61.8% correction level of its recent bearish rally and 50% of its total fall since 17th Feb. 2021 therefore its recommended to stay cautious because in case of rejection from its resistant regions index may start sliding for expansion of current pull back. While bullish breakout of 45,000pts would call for 45,150pts-45,300pts region where index would face resistance from a horizontal resistant line along with supportive trend line of its previous bullish price channel. Overall index would remain in uncertain region until it would not succeed in closing above 45,500pts. On flip side in case rejection index would try to establish ground initially above 44,4250pts and breakout below that region would call for 44,000pts and 43,800pts. Daily stochastic and MAORSI have changed their direction towards bullish side but weekly MACD is still bearish therefore it's recommended to post trailing stop loss on existing long positions. Current pull back would be considered a B wave if index would not succeed in closing above 45,500pts on daily chart in coming days which may lead towards overall correction of bullish run which started from 27,046pts last year.

Regional Markets

Asian markets set to rise on strong U.S. equities

Asian stocks were set to open higher on Tuesday after Wall Street’s main indexes closed at record highs and investors awaited comments from the U.S. central bank’s meeting later this week.The S&P 500 and Dow Jones Industrial Average both surged on gains in travel stocks as mass vaccinations in the United States and congressional approval of a $1.9 trillion aid bill fueled investor optimism. Japan’s Nikkei 225 futures added 0.10%. Hong Kong’s Hang Seng index futures rose 0.55%. E-mini futures for the S&P 500 fell 0.16%. Australia’s S&P/ASX 200 index rose 0.24% in early trading. MSCI’s gauge of stocks across the globe gained 0.04%.

Read More...

Business News

CCP issues show-cause notices to four companies

The Competition Commission of Pakistan (CCP) has issued show-cause notices to four companies for prima facie violation of Section 10 of the Competition Act, 2010. A show cause notice was issued to Unilever Pakistan Limited for prima facie violation of Section 10. Reckitt Benckiser Pakistan Limited sent a formal complaint that Unilever Pakistan Limited was distributing false/misleading information by making absolute claims regarding its products, Lifebuoy Soap, and hand wash. The enquiry report concluded that Unilever Pakistan Limited was harming other undertakings’ business interests and misleading consumers by making absolute claims regarding the abovementioned products. Some of the claims were: “100% guaranteed protection from germs”, “World’s No. 1 germs protection soap”, and “99.9% germ protection in 10 seconds.”

Read More...

PM starts olive cultivation campaign

Prime Minister Imran Khan on Monday said that large-scale olive cultivation would prove to be the best investment for the country in terms of earning valuable foreign exchange and ensuring food security. Launching the countrywide olive cultivation drive in Nowshera district, the prime minister said the country had immense potential in cultivation of olive trees owing to its suitable topography and climate from north to south. He said that water-scarce areas such as Suleiman Mountains near Waziristan, Balochistan’s plains and Punjab’s diverse terrain offered environment for low-irrigation olive farming.The prime minister said that olive fruit produced edible oil of high nutritional value, which could also be used to meet local demand besides its export.

Read More...

Capital businessmen urge govt to allow trading at weekends

The business community of the federal capital on Monday has called upon the government to immediately withdraw the new Covid-19 restrictions, imposed on the businesses to save from further losses. Addressing a press conference here on Monday, the businessmen have showed resentment over the National Command Operation Centre (NOCC)’s new guidelines for imposing restrictions on businesses to control the increasing cases of Covid-19 in the country. The traders expressed concerns over the new guidelines of NCOC for further restrictions, due to which the ICT Administration has issued a new notification to close all commercial activities, establishments, markets and amusement parks on Saturday and Sunday except for essential services. Sardar Yasir Ilyas Khan, President, Islamabad Chamber of Commerce and Industry (ICCI) said that this decision would badly hit the businesses that were already struggling for revival due to previous lockdowns.

Read More...

Plan to transfer Rs1060b burden to power consumers to cut circular debt

The government is planning to transfer the burden of Rs 1060 billion to the power consumers during next 27 months (March 2021-June 2023) to reduce the circular debt (CD) under the Circular Debt Management Plan 2021 (CDMP-21). Under the Circular Debt Management Plan (CDMP) it is proposed that Rs 194 billion will be collected through quarterly adjustments, while Rs 866 billion will be collecting through increasing/ rebasing in power tariff which will be used to reduce the CD, official source told The Nation. The Cabinet Committee on Energy discussed the summary of comprehensive CDMP-2021 which covers the three years period from FY2020-21 to FY2022-23 and describes the mechanisms and initiatives to address the issue and suggests an action plan to control the flow of Circular Debt with a monitoring matrix.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3