Morning Market Brief 18th Dec. 2020

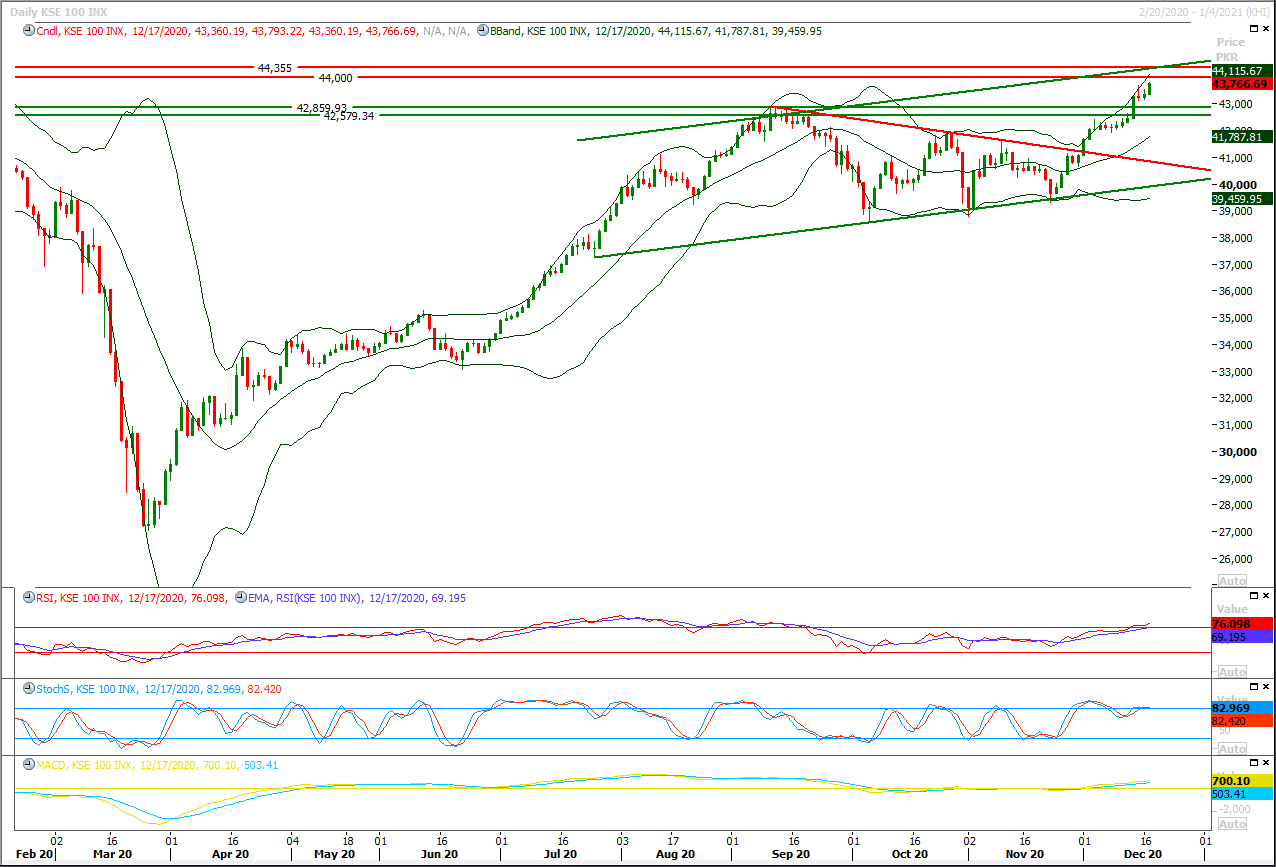

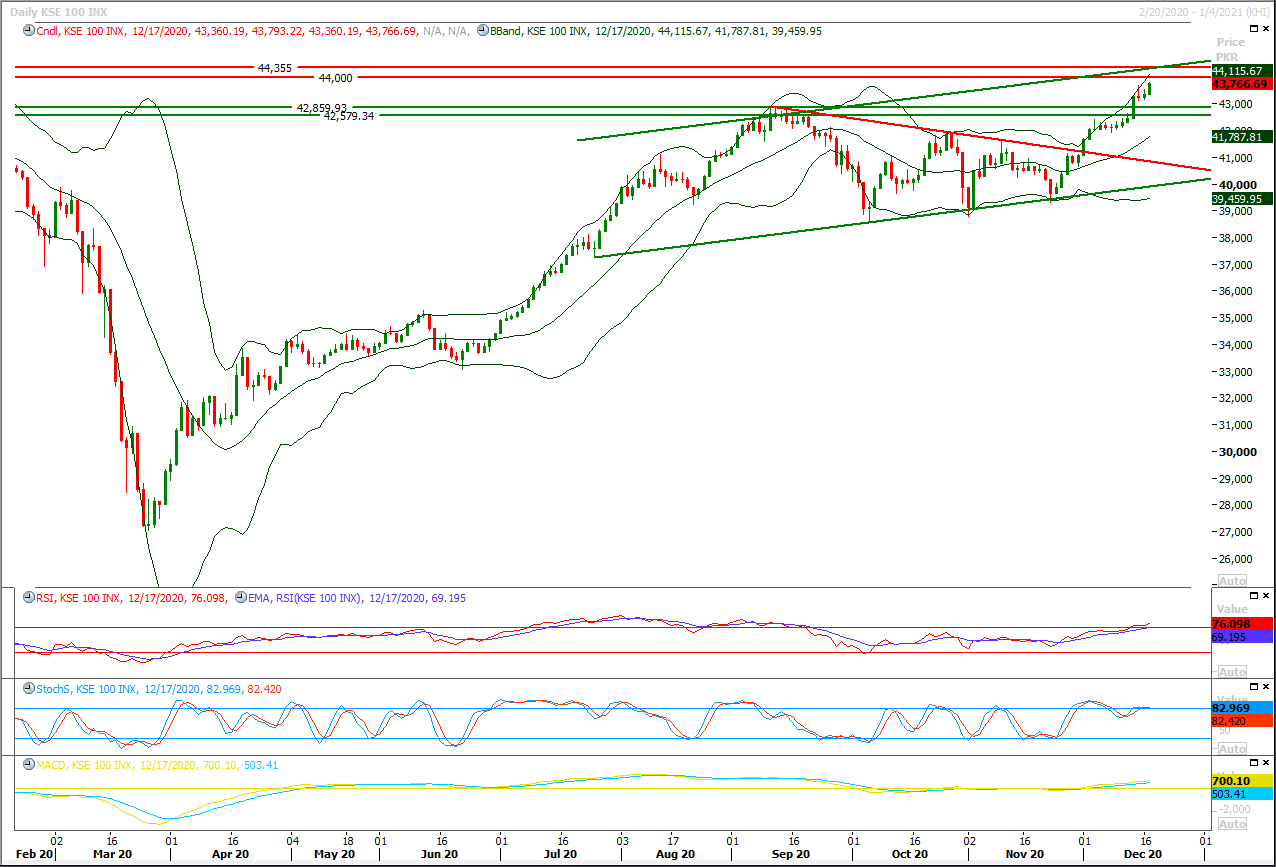

Technical Overview

The Benchmark KSE100 is moving in a bullish price channel on daily chart and had succeeded in closing above its major resistant region of 43,000pts during this week, mean while it had succeeded in penetration above its secondary resistant region of 43,700pts during last trading session. As of now hourly and daily momentum indicators are exhausting and a slight correction would be healthier to strengthen current bullish momentum. Overall sentiment have been changed towards bullish side but uncertainty would prevail until index would not succeed in closing above 44,200pts and closing above 44,200pts would call for 45,000pts and 45,500pts. But it's recommended to stay cautious because 61.8% of its last bullish correction would complete at 44,750pts therefore index remain in uncertain zone until it would not succeed in closing above this region, meanwhile there are still chances that index could start correction of its recent bullish rally anytime therefore it's recommended to post trailing stop loss on existing long positions and prefer day trading instead of short or mid-term until index could not normalize its bullish sentiment. While on flipside index have supportive region at 43,250pts and 42,800pts where strong horizontal supportive regions would try to support index against selling pressure.

Regional Markets

Asian stocks defy broader global rally, Brexit worries emerge

Asian stock fell slightly on Friday, failing to catch a broader global rally as the investor mood in the region shifted to broader caution about the economic outlook and as post-Brexit worries weighed.Australian S&P/ASX 200 lost 0.46% in early trading. Japan’s Nikkei 225 fell 0.01%. E-mini futures for the S&P 500 rose 0.01%. As the year draws to a close, markets have been swinging between broader optimism about COVID-19 vaccines and a global economic recovery and concerns about still rising infections. “We are in an environment now where bad news is good news because it means more stimulus,” said Sharon Zollner, chief economist at ANZ Research.

Read More...

Business News

Competition in gas supply prerequisite for better service, cheaper rates

The stakeholders were on the same page regarding the competitive gas market in Ogra’s hearing, saying that competition in the supply of gas is a pre-requisite for better service and cheaper rates. During a public hearing conducted by Ogra, it was noted that Energas and Tabeer Energy had applied to seek licence of sale and market of LNG. Both the applicants are also setting up LNG terminals in the private sector on their own risk. In hearing, the regulator raised several queries regarding documents of agreements from Energas which this is seeking a licence for sale and marketing of RLNG. The regulator questioned over contracts with LNG suppliers, customers, capacity allocation, the timeframe of imports, and volume of gas. Energas officials said that it would utilise the capacity of Pakistan LNG Limited (PLL) in April.

Read More...

Key features of govt’s markup subsidy schemes highlighted

State Bank of Pakistan on Thursday organised an awareness session on “SBP Concessionary Finance and Markup Subsidy Schemes” at the Lahore Chamber of Commerce & Industry. SBP Chief Manager Javaid Iqbal Marath and LCCI Senior Vice President Nasir Hameed Khan jointly chaired the session that was attended by Regional Sales Manager Home Finance of Faysal Bank Syed Mazhar Arslan and Regional Sales Manager Home Finance of JS Bank Khawaja Noman Ahmed and experts from different sectors of economy. The SBP officials threw light on various aspects of the Concessionary Finance and Markup Subsidy Schemes saying that in line with its vision of providing affordable housing to the masses, government has announced Markup Subsidy Facility for the construction and purchase of new houses.

Read More...

State Life Insurance Corporation, Bank Alfalah ink agreement

State Life Insurance Corporation of Pakistan and Bank Alfalah have signed an agreement to facilitate the State Life’s policyholders where they can easily deposit their due policy premiums and loan installments in any branch of the bank throughout the country. For the time being, this facility is available in Karachi and entire Baluchistan: soon it will be available in the entire country. State Life is the leading insurer in the country that extends the benefits of life insurance to all sections of society, especially to the more flourishing segments of the society spread in towns & villages throughout Pakistan. Its aim is to widen the area of operation of life insurance and making it available to as large a section of the population as possible.

Read More...

Engro Fertilizers becomes only company from Pakistan to win APEA

Engro Fertilizers Limited has been honoured with the prestigious Corporate Excellence Award at the Asia Pacific Enterprise Awards (APEA) 2020. Out of 16 nominations from all over Asia for Corporate Excellence Award in the manufacturing industry, Engro Fertilizers was selected as the first and the only company winner of the prestigious award from Pakistan. The award was presented to Engro Fertilizers after an in-depth analysis of the company’s business excellence, responsible business ethics, promising growth patterns and superior human resource management systems, that set it apart from other competitors.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3