Morning Market Brief 18th Nov. 2020

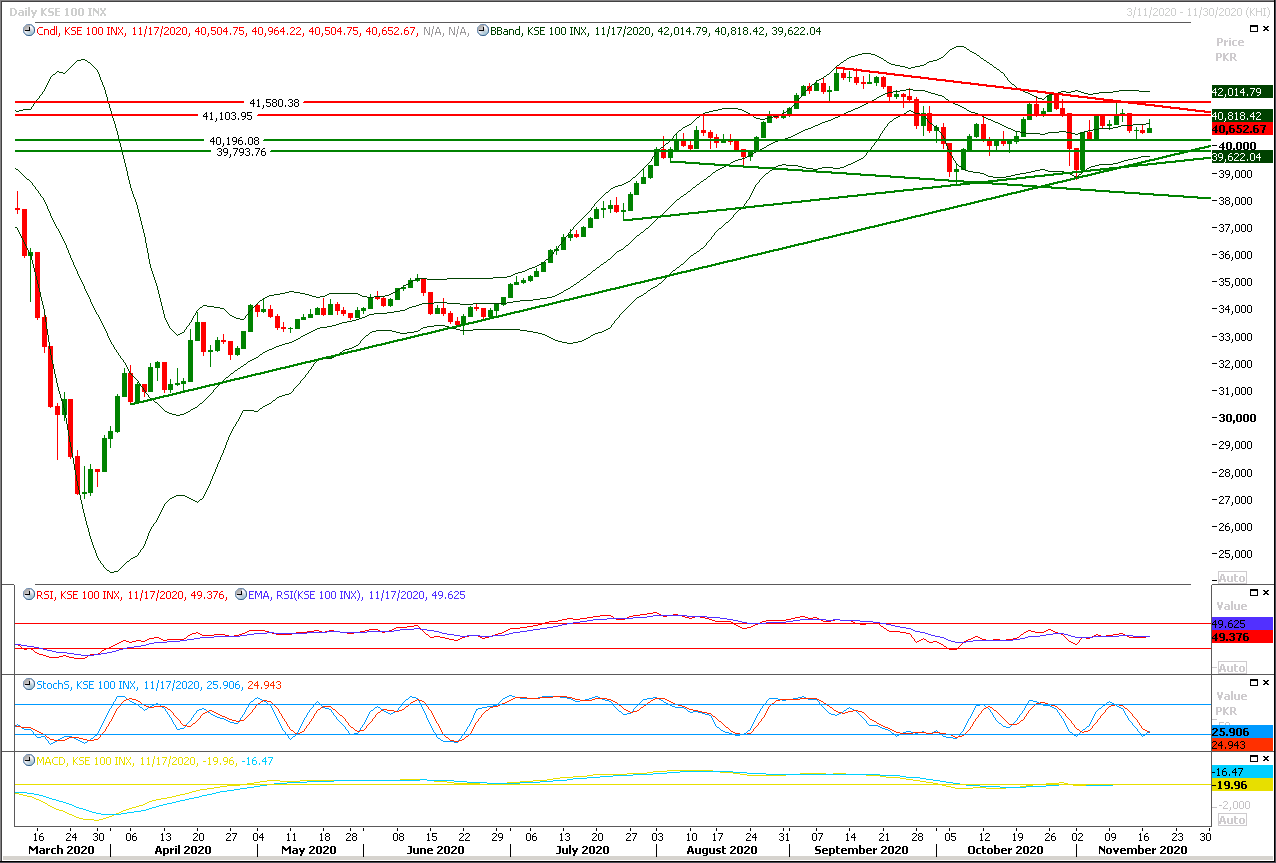

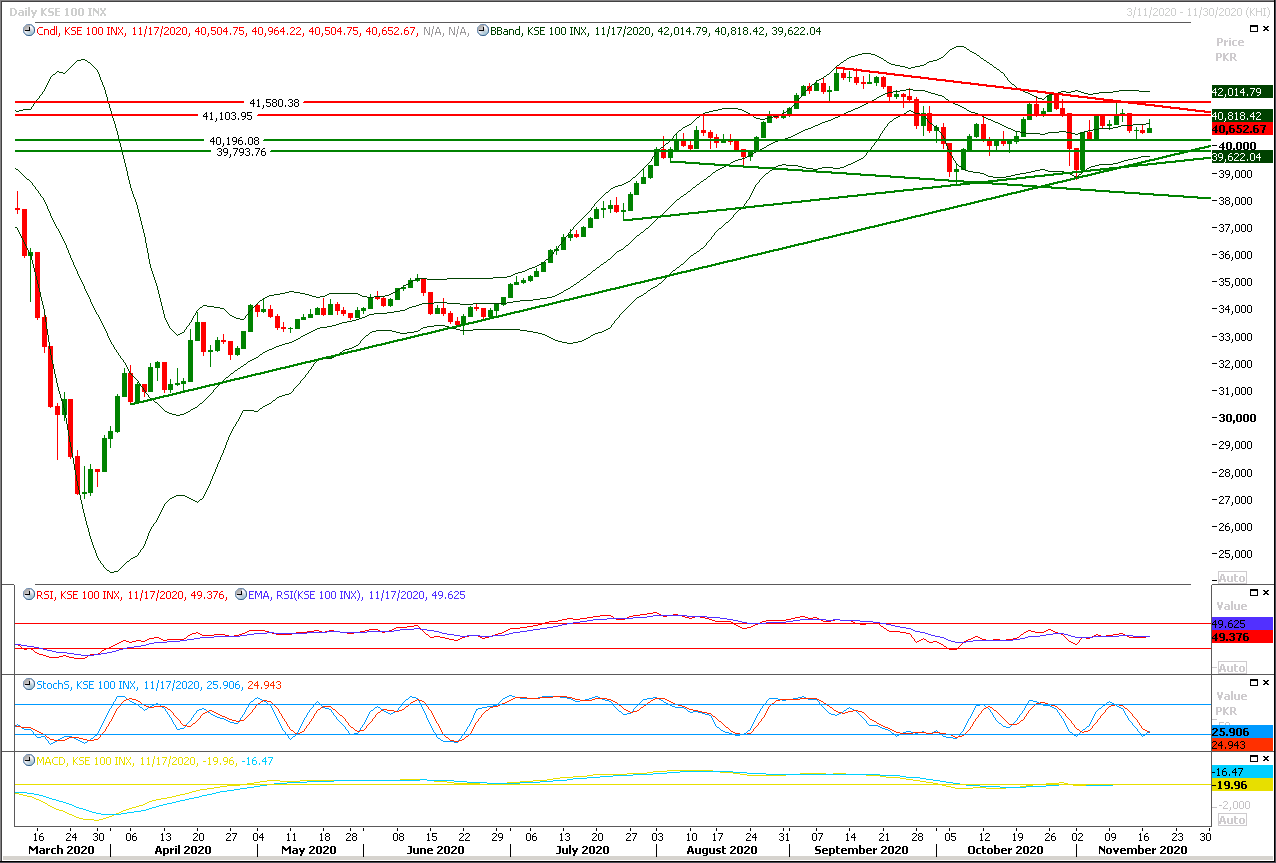

Technical Overview

The Benchmark KSE100 index is being caged in a very tight range since last week and have faced rejection once again during last trading session from its resistant region. As of now it can be said that index is moving downward after completing its bearish corrections because it had started moving downward after facing rejection from 50% correction of its last bearish rally. For current trading session it's expected that index would remain under pressure therefore selling on strength could be beneficial. Today index would face initial resistance at 40,800pts which would be followed by 41,000pts and 41,200pts in case of bullish spike while on bearish side it would try to establish ground above 40,470pts initially and breakout below that region would call for 40,300pts-40,200pts region. While daily closing below 40,200pts would change market direction for short term basis therefore it's recommended to post strict stop loss on existing long positions.

Regional Markets

World shares slip after U.S. retail sales dampen vaccine euphoria

Global shares stepped back on Wednesday as soft U.S. retail sales fuelled worries that rising coronavirus cases could stifle a still fragile economic recovery, dampening the euphoria from vaccine trial breakthroughs.U.S. S&P500 futures shed 0.3% in Asian trade on Wednesday, a day after S&P500 index lost 0.48%, while Europe’s Euro Stoxx 50 futures eased 0.2%. Japan’s Nikkei dropped 0.76%, while MSCI’s broadest index of Asia-Pacific shares outside Japan was little changed, drawing support from better handling of the pandemic in much of the region. “Given the rapid gains over the last 10 days or so, a correction was inevitable,” said Hirokazu Kabeya, chief global strategist at Daiwa Securities.

Read More...

Business News

NA body concerned over high prices of vehicles, misuse of gift schemes

National Assembly Standing Committee on Industries and Production on Tuesday showed concerns over the higher prices of vehicles in the country and misuse of gift schemes for import of vehicles. The meeting of the Standing Committee on Industries and Production of the National Assembly was held under the chairmanship of Sajid Hussain Turi, MNA. Muhammad Hammad Azhar, Federal Minister for Industries and Production, briefed the Committee about the electric cars policy in connection with Automotive Development Policy (ADP).

Read More...

Dawood visits Afghanistan to boost trade, investment cooperation

Adviser to Prime Minister on Commerce and Investment, Abdul Razak Dawood led an official delegation to Afghanistan from November 16-17, 2020, for discussions on bilateral trade, Afghanistan-Pakistan Transit Trade Agreement (APTTA), Preferential Trade Agreement (PTA) and investment-related matters between the two countries. The visit was preceded by last month’s visit by Afghanistan’s acting Minister of Industry and Commerce, Nisar Ahmad Ghoriani, to Pakistan where he conveyed the special invitation of the Afghan President to visit Kabul this month. Apart from the Adviser to PM on Commerce, the delegation includes high-level officials from the Ministries of Commerce and Maritime, Federal Board of Revenue (Customs) and State Bank of Pakistan.

Read More...

LCCI demands opening of marriage halls

The Lahore Chamber of Commerce and Industry on Tuesday urged the government to review marriage halls closure decision to save more than 50 industries and jobs of millions of workers. Addressing a press conference at LCCI, stakeholders said that closure of marriage halls would not only be a big blow to this industry but would also put the employment of millions of workers on stake. Government must reconsider the decision to shut marriage halls from November 20th, said LCCI President Mian Tariq Misbah, Senior Vice President Muhammad Nasir Hameed Khan, Vice President Tahir Manzoor Ch, Chairman Rice Exporters Association of Pakistan (REAP) Faisal Jahangir and Patron In-Chief Punjab Marriage Halls Association & President Lahore Marriage Halls Association.

Read More...

Taxpayers asked to file tax returns before Dec 8

Federal Board of Revenue (FBR) has again reminded the taxpayers to file their annual income tax returns before the last date i.e 8th December, 2020. FBR has further clarified that according to Section-114 of Income Tax Ordinance-2001 whoever owns immoveable property with a land area of five hundred square yards or more or owns a motor vehicle having engine capacity above 1000cc is liable to file annual income tax returns. Further, holder of commercial or industrial connection of electricity, where the amount of annual bill exceeds rupees five hundred thousand or an individual whose income from business exceeds rupees three hundred thousand is also required to furnish return of income.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3