Morning Market Brief 19th April. 2021

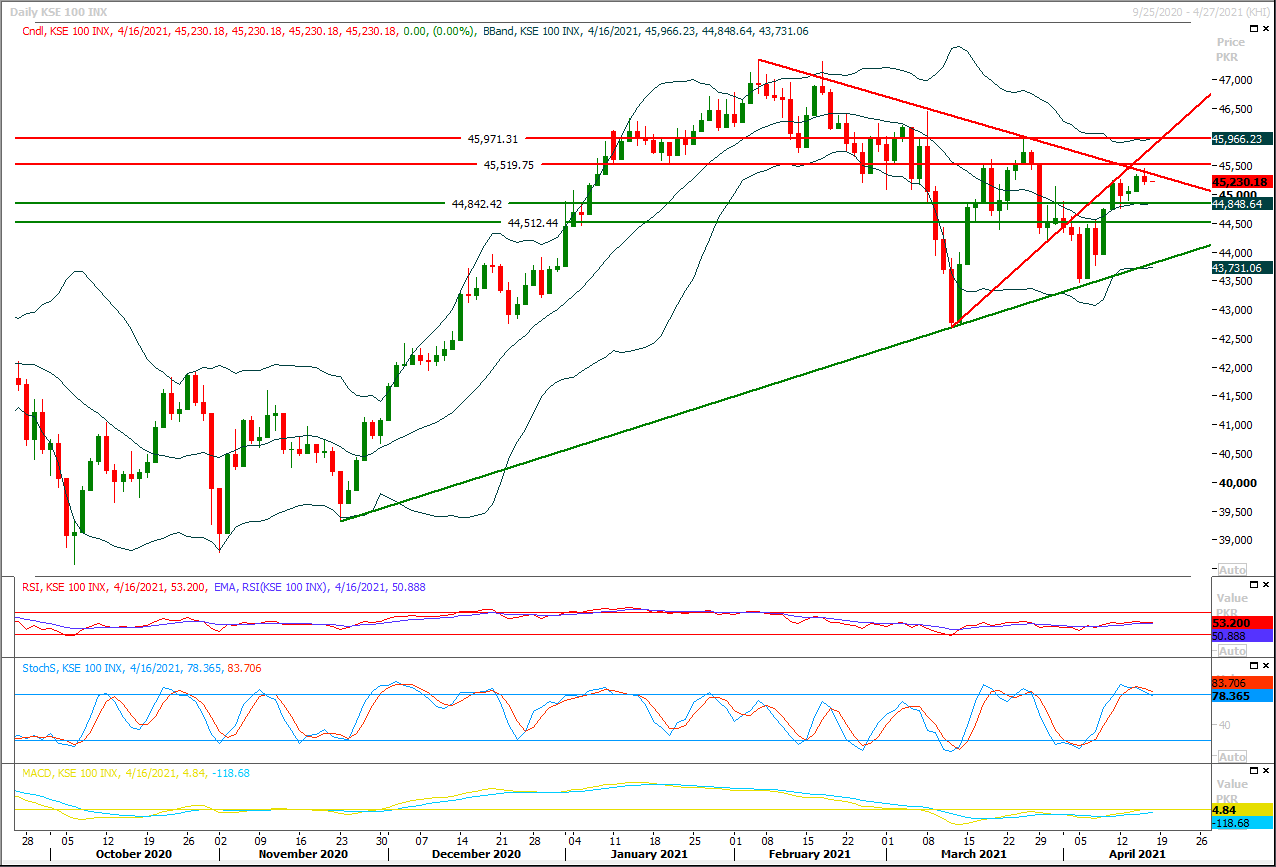

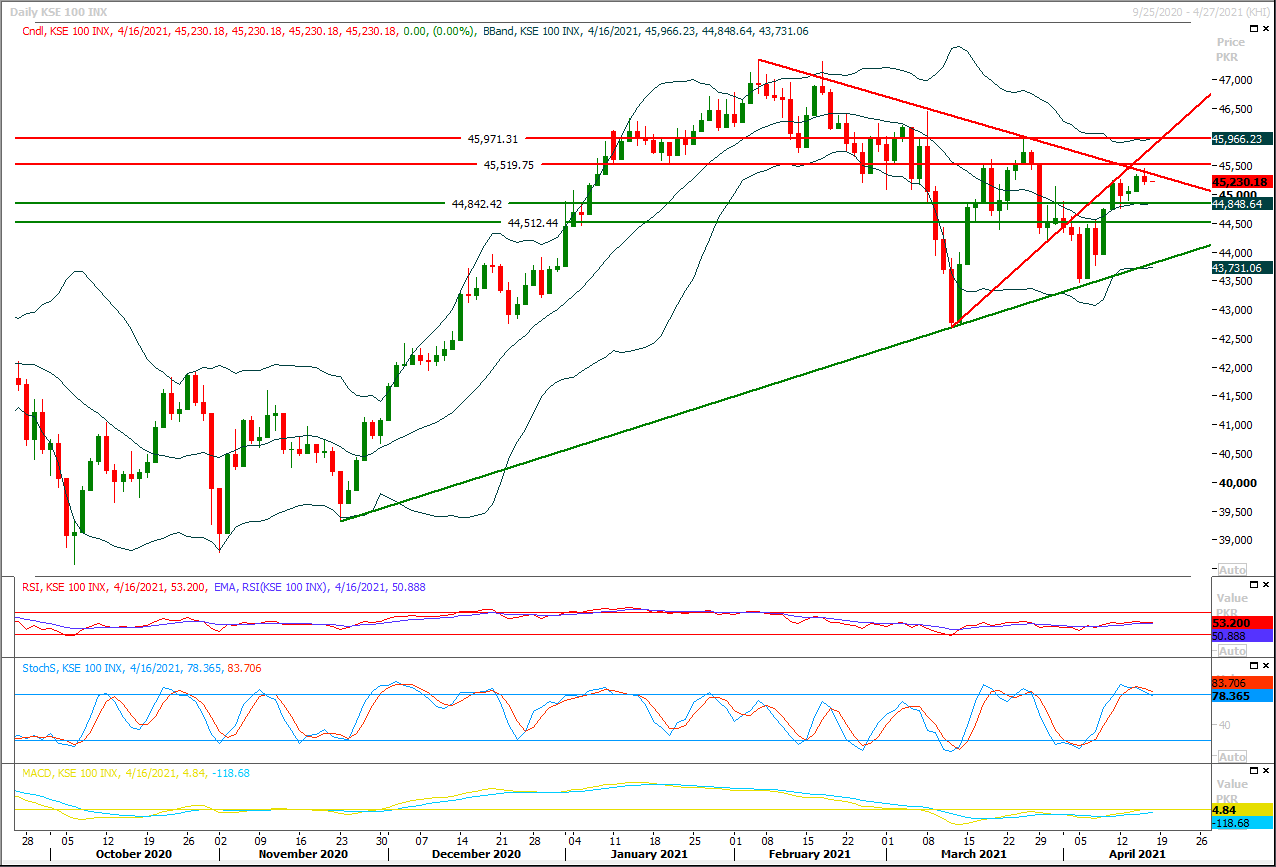

Technical Overview

The Benchmark KSE100 index had faced rejection from a strong horizontal resistant region along with its 74.6% correction level during last trading session but still succeeded in maintaining above its initial supportive region of 45,200pts at day end. As of now index have major resistant regions ahead at 45,380pts and 45,600pts. Initially it's expected that index would try to open with a negative gap and would continue its bearish sentiment towards 44,800pts. While in case of pull back it would face resistance from 45,380pts where 74.6% correction of its last bearish rally would complete but breakout above this region would call for 45,500pts-45,615pts region. It's recommended to stay cautious because hourly and daily stochastic are ready for bearish crossovers and if index would face rejection from above mentioned resistant regions then some serious selling pressure would try to push index in downward direction. On bearish side index would find initial supportive region at 45,000pts which would be followed by 44,860pts-44,700pts region. It's recommended to post trailing stop loss on existing long positions because if index would start sliding downward from this region then short term sentiment would reverse toward bearish side. Overall index would remain range bound until it would not either succeed in closing above 46,200pts or below 44,500pts.

Regional Markets

Asian shares near 1-1/2 week highs, Bitcoin recoups losses

Asian shares hovered near 1-1/2 week highs on Monday helped by expectations monetary policy will remain accommodative the world over, while COVID-19 vaccine rollouts help ease fears of another dangerous wave of coronavirus infections. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) was last at 695.59, within striking distance of Friday's high of 696.48 - a level not seen since Apr. 7. The index jumped 1.2% last week and is up 5% so far this year, on track for its third straight yearly gain. "The extremely supportive monetary and fiscal policy setting continues to provide a fertile environment for risk assets," said Rodrigo Catril, senior forex strategist at National Australia Bank.

Read More...

Business News

Punjab govt launches crackdown against sugar hoarders

The Punjab government has launched a crackdown against hoarders of sugar in an attempt to end its shortage in and around the provincial capital. Sugar disappeared from the shelves of retail shops after the government fixed its sale price at Rs85 kg notwithstanding the purchase price days before Ramazan set in. Those not complying with the official rates were fined and even arrested. “To avert humiliation and penalties, I decided to remove sugar from the shop as I cannot afford to sell it at Rs85 per kg after purchasing the same from the wholesale market at Rs100 per kg,” said Ajmal, a retailer in a northern Lahore neighbourhood.

Read More...

NTDC completes 4 more 500 kV Transmission Line Circuits

In pursuits of early completion of its projects, the National Transmission & Dispatch Company Limited (NTDC) has completed four more 500 kV transmission line circuits for evacuation of electricity from power plants located in southern parts of the country. The transmission line circuits have been connected with HVDC Converter Station at Matiari, said a press release issued on Sunday. In this regard, a virtual ceremony of energisation of transmission lines circuits was held at Wapda House Lahore. NTDC Managing Director Engr Dr. Khawaja Riffat Hassan, Deputy Managing Directors, General Managers, Chief Engineers and other officers participated in the ceremony. While elaborating the details of completed transmission line projects, the NTDC spokesman has said that two 500 kV transmission line circuits for direct connection from 1320 MW Port Qasim coal fired power plant to HVDC Matiari converter station has been energised. While other two 500 kV transmission line circuits for looping in/out with existing 500 kV Jamshoro-Dadu Circuit-I have been energised and connected with HVDC Matiari converter station at Hyderabad.

Read More...

FBR discusses $400m tax automation programme with World Bank Share:

Federal Board of Revenue (FBR) Chairman, Asim Ahmed has discussed $ 400 million program for domestic resource mobilisation through the automation of tax collection processes with the Work Bank. The World Bank Country Director for Pakistan, Najy Benhassine called on Chairman FBR Asim Ahmad for an introductory meeting, following his recent appointment as the FBR chairman, said a press release issued by FBR here. Both the heads discussed the World Bank sponsored reforms program ‘Pakistan Raises Revenue’, which is a $ 400 million program for automation of tax collection processes and the simplification of tax compliance procedures. The chairman gave an update on the progress of the reforms agenda covering 10 Disbursement Linked Indicators (DLIs) and also shared concerns regarding the difficulties being encountered in progress on reform interventions involving data sharing with provinces and the Sindh High Court stay on the Track and Trace process. Member Reforms, Ambreen Iftikhar, and Raymond Muhulla, World Bank’s Team Lead on ‘Pakistan Raises Revenue’ were also present in the meeting.

Read More...

KE urges govt to release Rs300 billion for additional 450MW power supply

The Power Purchase Agreement for the supply of additional 450 MW of electricity to K-Electric is facing delay as the KE has asked the federal government to pay for the supply of additional 450 mw from national grid from tariff differential subsidy of around Rs 300 billion owed by the government of Pakistan (GoP). For the PPA between National Transmission and Dispatch Company (NTDC) and K-Electric for the supply of additional 450 MW, the mechanism for payment has not yet agreed as the KE has said that they will not pay to NTDC/CPPA and instead requested the federal government for continuation of mechanism for set-off of power purchase cost with tariff differential subsidy, an official source told The Nation here Sunday. In order to plug the supply demand gap of the KE and to overcome the power outages in Karachi in summer, the federal government has agreed to provide an additional 450MWs of electricity from the National Transmission and Dispatch Company (NTDC) to KE.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3