Morning Market Brief 1st April. 2021

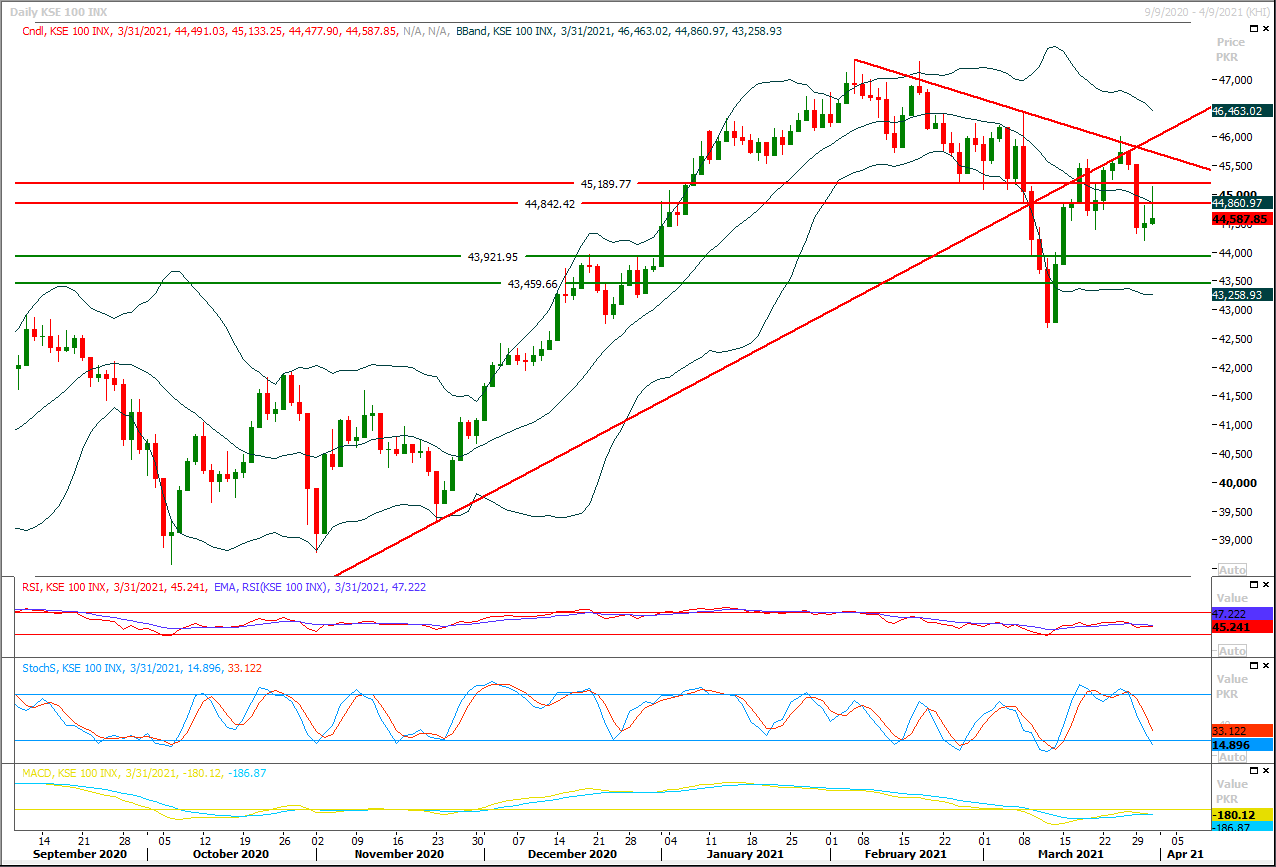

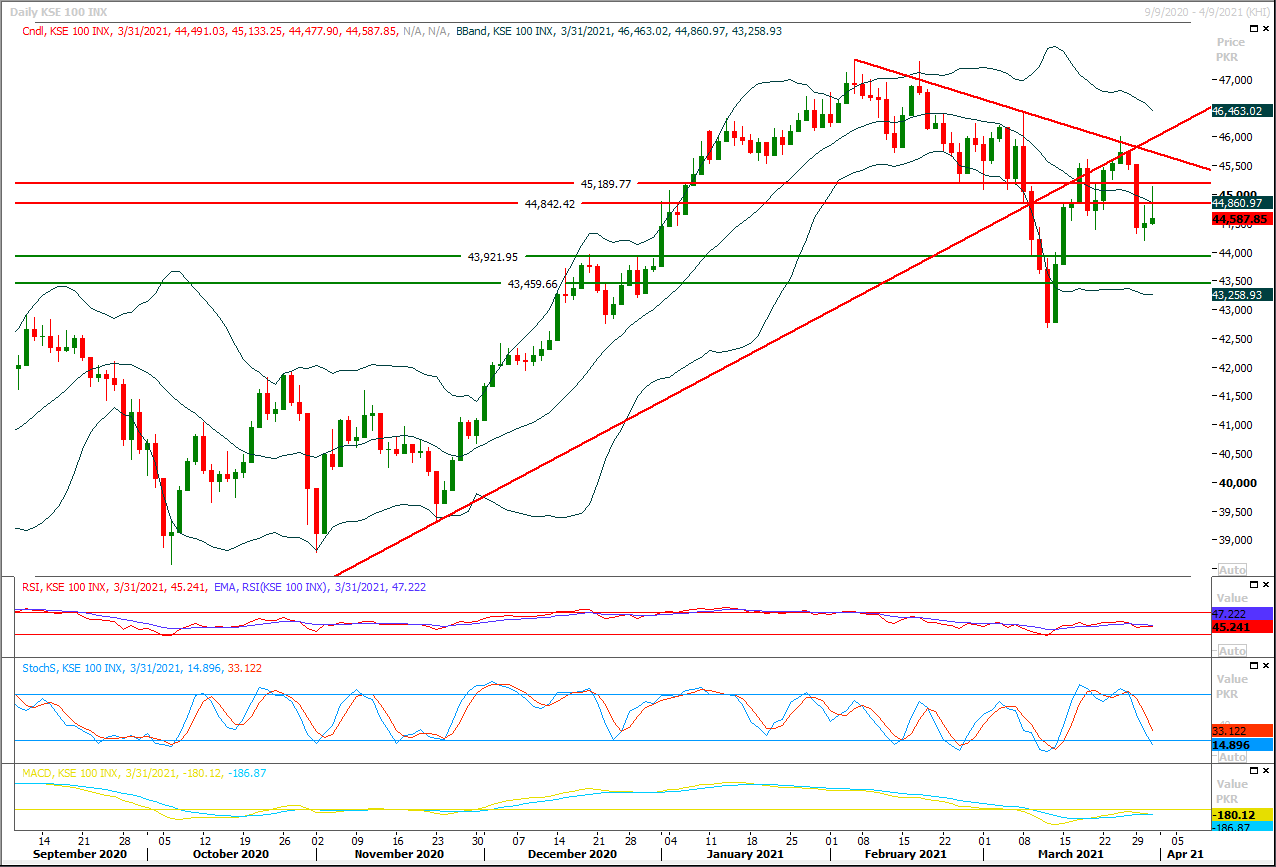

Technical Overview

The Benchmark KSE100 index had faced rejection again from a strong resistant region during last trading session and have formatted a hammer on daily chart, meanwhile it's not becoming able to recover above its bearish corrections since last week. As of now it's being supported by a rising trend line on hourly chart but hourly momentum indicators have changed their direction towards bearish side therefore its recommended to stay cautious because if index would not succeed in maintaining above 44,200pts then it may slide further towards 43,900pts. It seems that index is in expansion mode of its last bearish correction because monthly closing have left index in an uncertain region. While on flip side in case of pull back index would face initial resistance at 44,900pts and breakout above this region would call for 45,100pts-45,250pts region. Overall sentiment would remain uncertain and index would face selling pressure until it would not succeed in closing above 45,200pts on daily chart. Chance of a morning shooting star are still intact till day end today and this would take place if index would succeed in closing above 45,000pt. It's recommended to adopt swing trading until index either succeed in closing above 45,200pts or below 43,900pts.

Regional Markets

Stocks edge up as Biden spending plan boosts U.S. outlook

Stocks crept higher on Thursday following their weakest quarter in a year, while higher Treasury yields supported the dollar, as investors parsed the details of a $2 trillion U.S. government spending plan and hoped for strong jobs data later in the week.MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.6% after a modest drop on Wednesday. Japan’s Nikkei rose 1.3% as a survey showed big manufacturers’ mood bouncing back to pre-pandemic levels. Ten-year U.S. Treasuries, which had suffered their biggest selloff in a dozen years last quarter, remained under pressure and yields crept as high as 1.753%, while the dollar stood just shy of a one-year peak on the yen at 110.685. On the heels of a $1.9 trillion pandemic relief package, President Joe Biden on Wednesday outlined a broad plan to re-make the world’s biggest economy including spending on roads, railways, broadband, clean energy and semiconductor manufacture.

Read More...

Business News

ICCI urges FBR to defer tax collection from businesses during Covid-19

President, Islamabad Chamber of Commerce, and Industry (ICCI) Sardar Yasir Ilyas Khan on Wednesday lauded the decision of Federal Board of Revenue (FBR) for extending the deadline to furnish the taxpayer profile up to June 30. It would reduce pressures on taxpayers by giving them more time for preparation of their profiles, he said in a statement. However, he urged that FBR to simplify the taxpayer profile as it required extensive information including mandatory submission of bank account detail, business premises detail and utility connections detail that would be a very cumbersome exercise for the taxpayers and would consume a lot of their time in its completion. Sardar Yasir Ilyas Khan said that the business community has been demanding of the FBR since long for developing a simplified and easy taxation system to enhance tax compliance as the current complicated tax system was a major hurdle for many potential taxpayers to come into the tax net.

Read More...

Hammad hints at reviewing IMF programme, SBP bill

A day after launching $2.5 billion international bond and receiving $500 million tranche from the International Monetary Fund, newly appointed Finance Minister Hammad Azhar on Wednesday hinted at reviewing the IMF programme and the controversial State Bank of Pakistan amendment bill 2021. “We are taking the SBP law to parliament with an open mind and are ready to adopt recommendations for its improvement,” he said at his maiden news conference as finance minister. The minister said the SBP amendment bill had been prepared in line with international best practices and introduced in parliament. He said the matter was sensationalised as if the country’s sovereignty had been breached, adding that the central bank was also given autonomy in the past that was being consolidated through the fresh bill.

Read More...

CASA power project to be completed early, Tajikistan assured

Pakistan on Wednesday assured Tajikistan of making utmost efforts for an early completion of the CASA-1000 project. Foreign Minister Shah Mahmood Qureshi at a joint press conference with his Tajik counterpart Sirajuddin Mehruddin said Pakistan believes that Central Asia-South Asia (CASA-1000) project will not only benefit the two countries, but the entire region. Launched in 2016, the under-construction CASA-1000 power project will allow the export of surplus hydroelectricity from Tajikistan and Kyrgyzstan to Afghanistan and Pakistan. Mr Qureshi said that CASA-1000 project would improve electricity access, integrate and expand markets to increase trade and find sustainable solutions to water resources management.

Read More...

Germany to provide €7.50 million to boost Pakistan’s textile industry

Pakistan’s Ministry of Commerce and Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, Germany signed an Implementation Agreement to support two projects and one is on “improvement of Labor, Social and Environmental Standards in Pakistan’s Textile Industry (TextILES)”. The implementation agreement was signed in pursuance of Memorandum of Understanding (MoU) earlier signed between Economic Affairs Division (EAD) on behalf of Islamic Republic of Pakistan and Federal Republic of Germany on December 23, 2020 in which Government of Germany agreed to support two projects and one is on “improvement of Labor, Social and Environmental Standards in Pakistan’s Textile Industry (TextILES)”. Under this program, the Federal Republic of Germany would provide GIZ up-to Euro 7,500,000 as German contribution for period of three years.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3