Morning Market Brief 23rd Oct. 2020

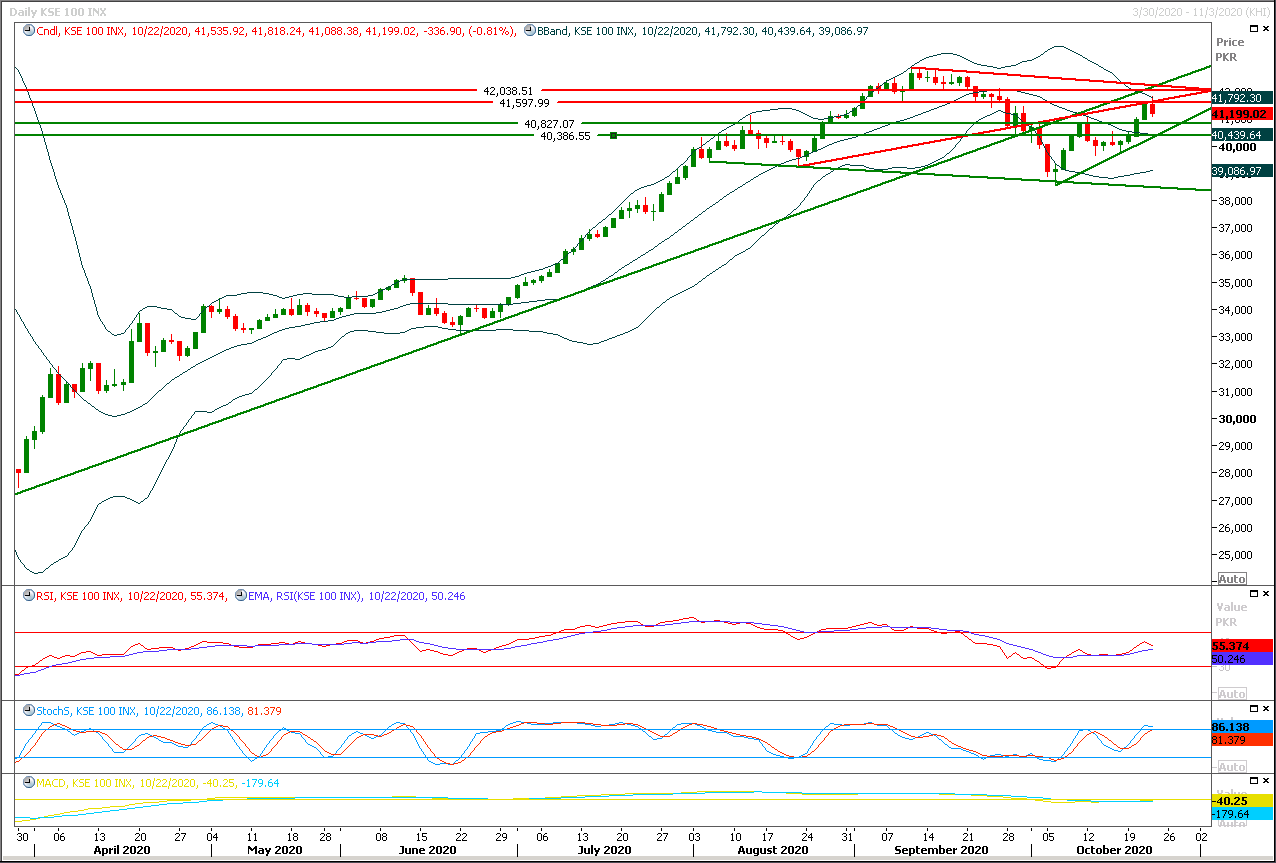

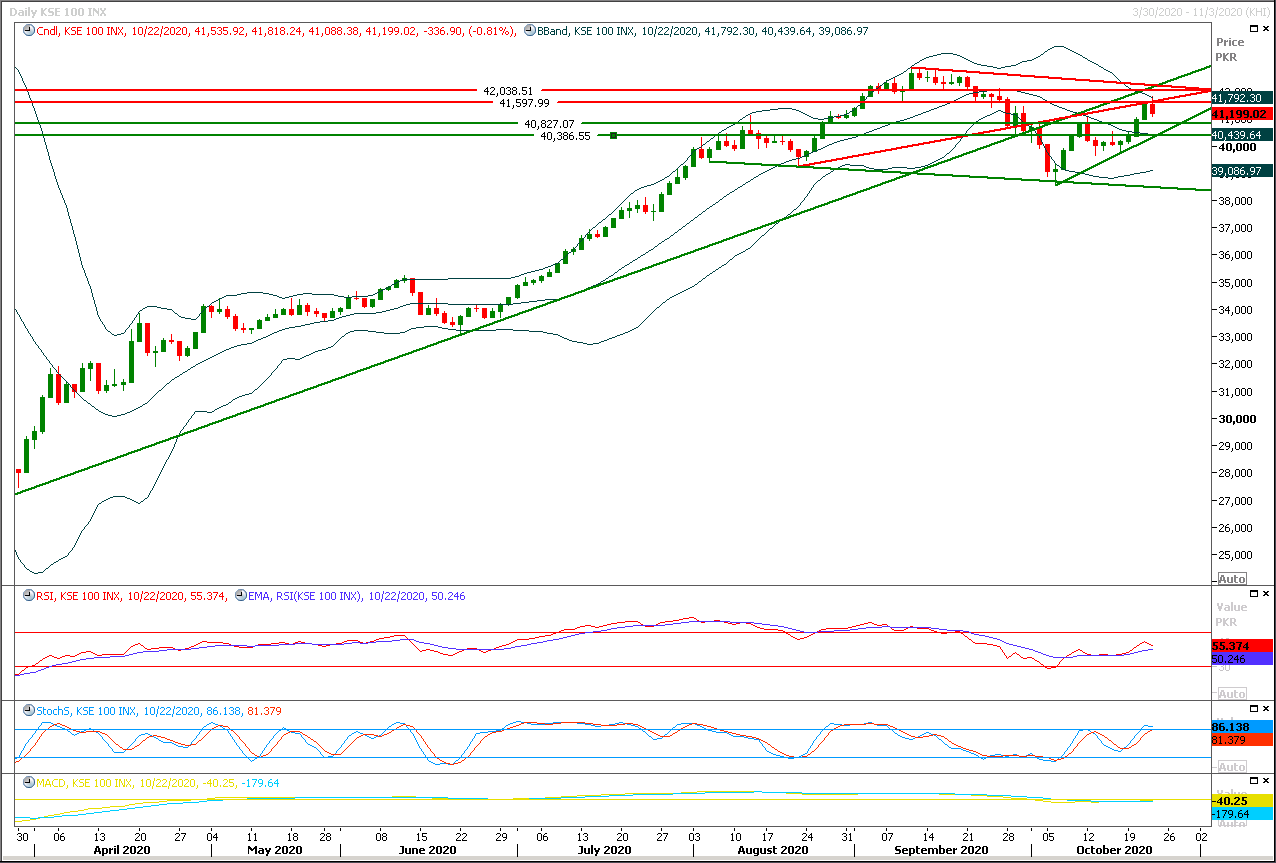

Technical Overview

The Benchmark KSE100 index had start correction after facing rejection from a strong resistant trend line and completion of 84.12% expansion of its last bullish correction. Meanwhile a daily dark cloud formation have taken place on daily chart which would try to push index for a further dip towards 41,000pts or 40,860pts-40,700pts region initially but a sharp recovery could be witnessed before day end therefore buying on dip with strict stop loss of 40,500pts could be beneficial for day trading. In case index would not succeed in recovering after retesting its supportive region then a major upset would take place which may push index below 40,500pts in coming days. While on flip side index would face initial resistance at 41,500pts which would be followed by 41,700pts 42,000pts where strong resistant regions would try to cap bullish momentum. Daily momentum indicators are trying to change their direction towards bearish side and daily closing below 41,000pts would confirm reversal for a short time but it's expected that index would succeed in maintaining its positive momentum by closing with a positive recovery to complete weekly bullish engulfing pattern because hourly momentum indicators are ready for a bullish spike after a slight dip.

Regional Markets

Asian stocks set for slight gains after Wall Street ends higher

Asian stocks were set for cautious gains on Friday after positive U.S. economic data and signs of progress in stimulus talks in Washington lifted Wall Street benchmarks. In early Asian trade, futures for Japan’s Nikkei 225 index were up 0.3%. Australia’s S&P ASX 200 and MSCI’s gauge of stocks across the globe were roughly flat. Hong Kong’s Hang Seng index futures were down 0.11%. U.S. lawmakers were still trying to hammer out a roughly $2 trillion stimulus deal late on Thursday, with U.S. House Speaker Nancy Pelosi saying that she and Treasury Secretary Steven Mnuchin had not spoken during the day. U.S. economic data surprised to the upside, as jobless claims fell more than expected and existing home sales exceeded estimates to more than a 14-year high. The Dow Jones Industrial Average rose 0.54%, and the S&P 500 gained 0.52%. The tech-heavy Nasdaq Composite bumped up 0.19%.

Read More...

Business News

Hafeez chairs FBR Policy Board meeting

Adviser to the Prime Minister on Finance Dr. Abdul Hafeez Shaikh chaired the 3rd meeting of the FBR Policy Board at the FBR Headquarters. After the approval of the minutes of the previous meeting, the members proceeded with the discussion on the proposed ToRs of the Policy Board; prepared by the Minister for Industries and Production, Hammad Azhar and Mr. Abdullah Yousaf, FBR former Chairman. The Subcommittee presented the proposed ToRs before Policy Board for discussion. The members of the Board gave their valuable input to fine tune the same. There was extensive discussion on the task assigned to another sub-committee which included Mr. Hammad Azhar and Faiz ullah Kamoka for designing a mechanism of data sharing between FBR and NADRA. During the meeting, the Chair also inquired on the progress of clearance of containers on the Torkham Borders.

Read More...

NAB approves 11 references against various people, including Nawaz Sharif

National Accountability Bureau has approved 11 corruption references against various people, including former Prime Minister Nawaz Sharif, his principle secretary Fawad Hassan Fawad, PML-N leader Ahsan Iqbal and others. The approval was granted during NAB's executive board meeting, which met in Islamabad today with Chairman Javed Iqbal in the chair. Nawaz Sharif, foreign secretary Aizaz Ahmed Chaudhry, and ex-director general of Intelligence Bureau Khalid Sultan have been accused of inflicting a loss of around two billion rupees on national exchequer on procuring 73 security vehicles, and misuse of power.

Read More...

DDB System fully operational, 7,998 refund claims processed

The automated Duty Drawback (DDB) System, conceived by Ministry of Commerce and jointly implemented by Pakistan Customs, and State Bank of Pakistan (SBP), is now fully operational, as total 7,998 refund claims amounting to around Rs953 million have been processed through the system up to October 20, 2020. This was told in an internal briefing at Ministry of Commerce, chaired by the Advisor to the Prime Minister on Commerce and Investment, Mr. Abdul Razak Dawood, and attended by senior officials of the Ministry.

Read More...

CCP recommends issuing show cause notices to sugar mills, association

The Competition Commission of Pakistan (CCP) in its enquiry report has recommended issuing show cause notices to Pakistan Sugar Mills Association (PSMA) and its member mills after finding them in anti-competitive activities. The CCP has concluded the findings of its enquiry report into the anti-competitive activities in the sugar sector. The CCP has found PSMA and Jehangir Khan Tareen’s owned JDW Sugar Mills in anti-competitive activities. The CCP’s enquiry has found multiple instances where the Pakistan Sugar Mills Association (PSMA) is acting as a front runner for cartelisation in the sugar industry. Evidence gathered during raids on the premises of PSMA and JDW Sugar Mills seems to suggest these anti-competitive activities have continued since 2010.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3