Morning Market Brief 24th Feb. 2021

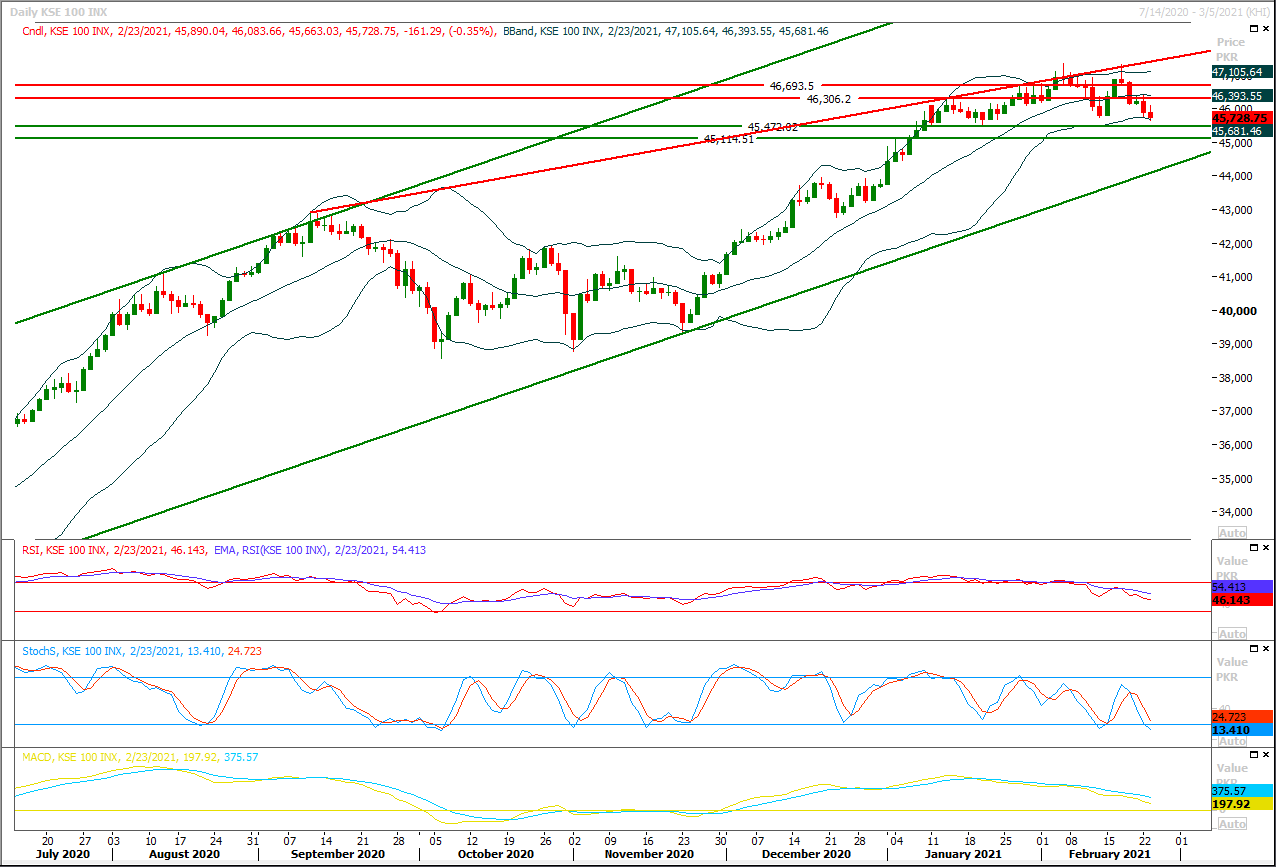

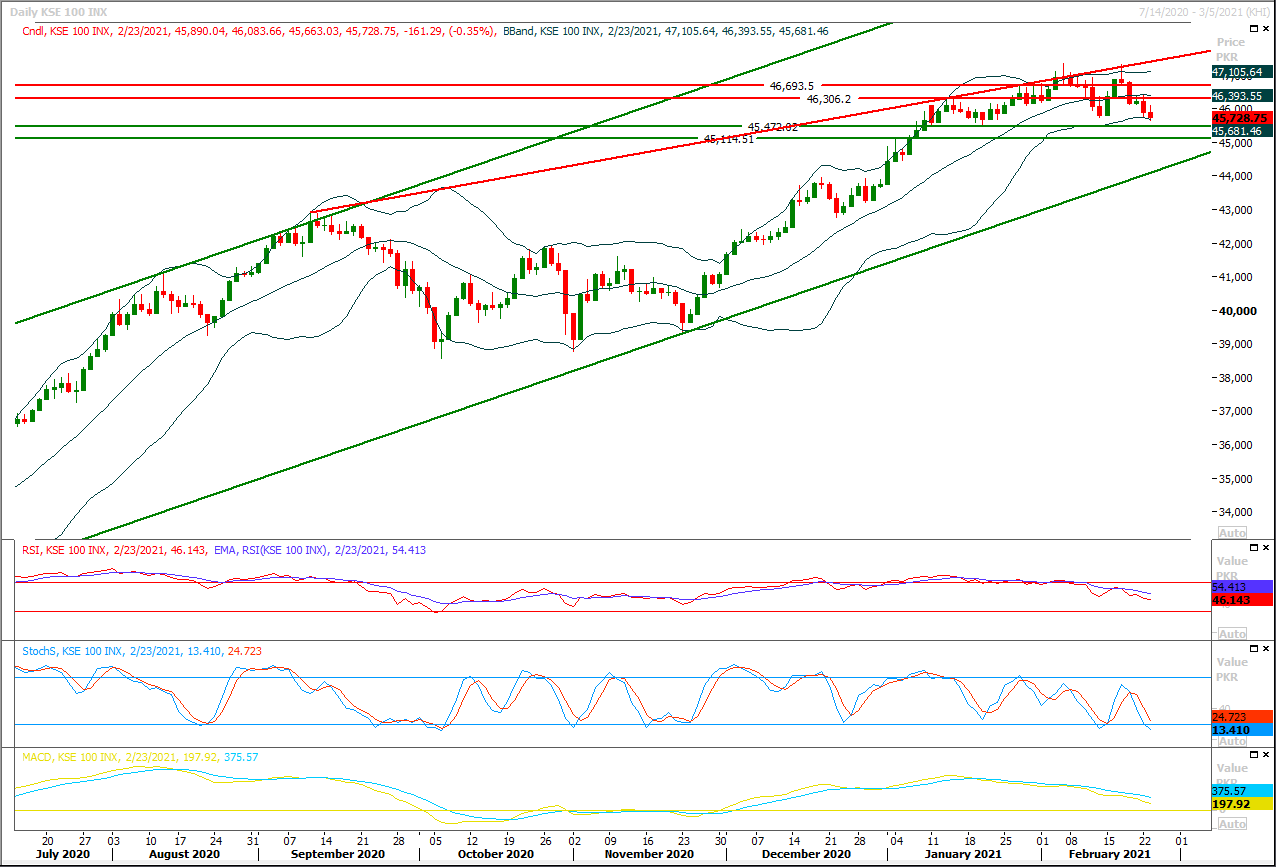

Technical Overview

The Benchmark KSE100 index have continued its bearish journey after facing rejection below its initial resistant region of 46,100pts during last trading session but it's still maintaining above its major supportive region of 45,500pts. Once index would succeed in closing below 45,500pts during this week then selling pressure would start increasing and index would start taking efect of previous weekly bearish engulfing. As of now it's expected that index would remain volatile during current trading session and a zigzag move can be witnessed on hourly chart. Overall some serious pressure would be witnessed on index during the day and initially index would try to establish ground above 45,500pts while breakout below that region would call for 45,350pts and later on it could slide towards 45,100pts if bulls would not succeed in providing fresh buy volumes. While on flip side in case of bullish reversal index would face initial resistance between 45,960pts-46,120pts where its being capped by horizontal resistant regions while in case of breakout above this region would call for next resistant region which fall at 46,350pts overall sentiment would remain bearish until index would not succeed in closing above 46,700pts on daily chart. Hourly, Daily and weekly momentum indicators are in bearish mode and this is first indication of start of a deeper corrective rally therefore it's recommended to post trailing stop loss on existing long positions.

Regional Markets

Oil slips after U.S. crude stocks rise amid deep freeze hit to refiners

Oil prices fell in early trade on Wednesday after industry data showed U.S. crude inventories unexpectedly rose last week as a deep freeze in the southern states curbed demand from refineries that were forced to shut.Crude stockpiles rose by 1 million barrels in the week to Feb. 19, the American Petroleum Institute (API) reported on Tuesday, against estimates for a draw of 5.2 million barrels in a Reuters poll. API data showed refinery crude runs fell by 2.2 million bpd. U.S. West Texas Intermediate (WTI) crude futures were down 55 cents or 0.9% at $61.12 a barrel at 0136 GMT, after slipping 3 cents on Tuesday.

Read More...

Business News

Nepra holds Guddu Thermal Power Plant responsible for blackout

National Electric Power Regulatory Authority (NEPRA) inquiry report, regarding nationwide power breakdown in country, has hold the staff of Guddu Thermal Power Plant responsible for gross negligence which had resulted in the blackout. The inquiry report recommended that the departmental enquiry initiated by Guddu Power Plant management against the delinquent staff regarding the instant breakdown be concluded and management reforms at Guddu for systematic working. The inquiry set up by NEPRA, on nationwide power blackout occurred in January, has also hold the staff of Guddu Power Plant responsible for the gross negligence. National Electric Power Regulatory Authority (NEPRA) had constituted a three member Inquiry Committee to investigate the power blackout which had plunged the entire country into darkness. The committee had submitted it report on February 8, 2021, which was released on Tuesday.

Read More...

Pakistan earns US $224 million from export of travel services in 1st half

Pakistan earned US $224.12 million by providing different travel services in various countries during the first half of current financial year 2020-21. This shows decline of 18.54 percent as compared to US $275.114 million same services were provided during the corresponding period of fiscal year 2019-20, Pakistan Bureau of Statistics (PBS) said. During the period under review, the personal travel services decreased by 17.98 percent, from US $272.224 million last year to US $223.29 million during July-December (2020-21). Among these personal services, the exports of personal expenditure, however, rose by 44.26 percent while the education related expenditure, however, witnessed a decrease of 13.21. In addition, the other personal services also decreased by 18.24 percent, out of which religious and other travel services witnessed decline 94.19 and 18.10 percent respectively.

Read More...

Circular debt to rise despite tariff increase, NA body told

The government on Tuesday told a parliamentary panel that despite the recent 15 per cent increase in consumer tariff, the power sector’s circular debt would go up by Rs436 billion during the current fiscal year to reach Rs2.6 trillion. The meeting of the National Assembly Standing Committee on Finance was presided over by MNA Faizullah, and was given a presentation by the Power Division’s Additional Secretary Waseem Mukhtar. Mr Faizullah pointed out that strangely a position paper provided to the standing committee mentioned an increase of Rs500bn in circular debt during the current year, with the debt set to cross Rs2.8tr by June 30, 2021. This would have serious consequences for the budget.

Read More...

FBR says ‘FASTER Plus system’ expeditious, transparent

FBR’s Inland Revenue (Operations) Member Dr Muhammad Ashfaq has said that the newly-upgraded ‘Fully Automated Sales Tax e-Refund (FASTER) Plus system’ is so expeditious and transparent that now there is no need of sales tax zero rating regime for the exporters. While addressing a meeting of Sialkot exporters, organised by the Pakistan Readymade Garments Manufacturers & Exporters Association, he said that the FBR is paying refunds’ claims of Rs200-250 billion to the exporters every month, as each and every exporter is enlisted in the FASTER Plus system, which is performing very well and involving no human hand. He was accompanied by Sialkot Chief Commissioner Inland Revenue RTO Dr Tariq Mahmood. The meeting was attended by the prominent businessmen and SME representatives of industrial hub of Sialkot.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3