Morning Market Brief 24th Nov. 2020

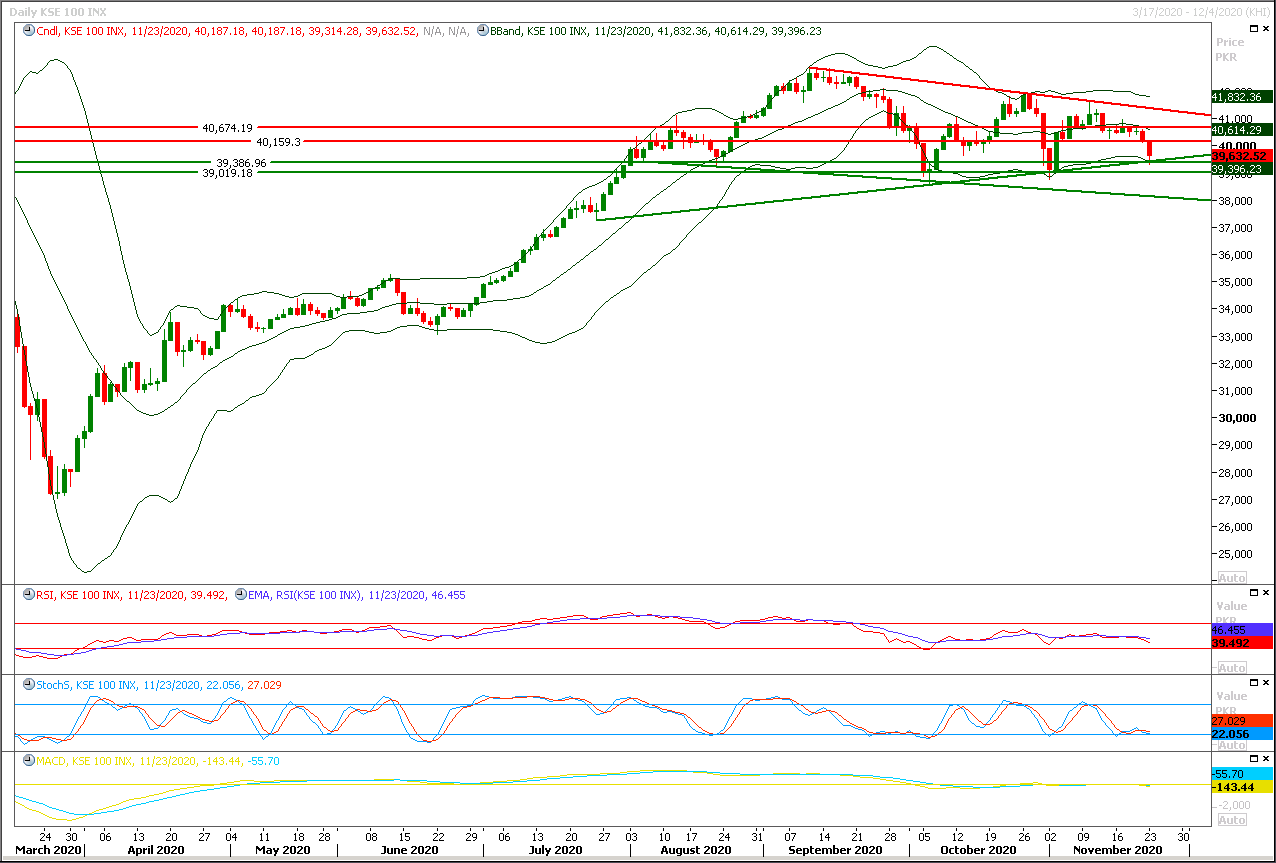

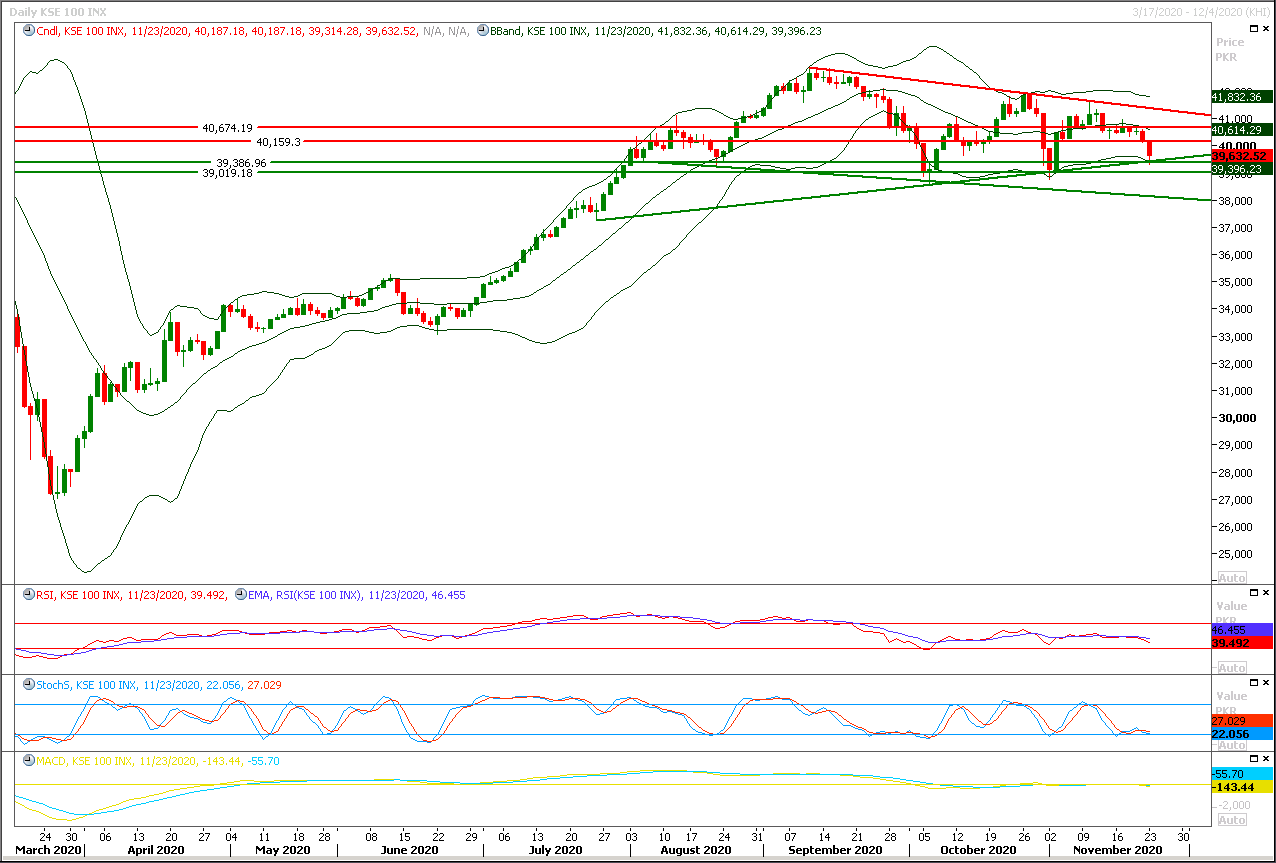

Technical Overview

The Benchmark KSE100 index have started a pull back after getting support from rising trend line along with a strong horizontal supportive region during last trading session. As of now it's expected that index would continue its pull back today as well and it would try to bounce back towards 39,860pts and 40,150pts where it would face strong resistances from horizontal resistant regions. For day trading its recommended to start buying with strict stop loss of 39,200pts. Currently daily and weekly momentum indicators are still moving on bearish side but hourly momentum indicators have started a sharp pull back by creating bullish crossovers therefore it's expected that index would try to bounce back to retest supportive trend line of its previous triangle on hourly chart. Overall index would remain under pressure until it would not succeed in closing above 40,500pts on daily chart and momentum would change towards bullish side until it would not succeed in closing above 41,860pts therefore swing trading could be beneficial between 39,200pts to 41,500pts and breakout of either side would push index for 1,000pts-1,500pts in respective direction.

Regional Markets

Stocks rise as Biden transition, vaccine progress lift confidence

Asian shares climbed on Tuesday as news U.S. President-elect Joe Biden was given the go-ahead to begin his White House transition added to an already brighter mood from progress made on COVID-19 vaccine and the prospects for a speedy global economic revival.The upbeat backdrop helped MSCI’s broadest index of Asia-Pacific shares outside Japan advance 0.15%. Australia’s S&P/ASX 200 was 1.1% stronger, touching its highest level in almost nine months, with energy stocks leading the pack. Japan’s Nikkei jumped 2.48% while Seoul’s Kospi was 0.74% higher. Chinese blue-chips and Hong Kong’s Hang Seng were however outliers, edging down 0.75% and 0.08%.

Read More...

Business News

Centre stresses provinces to take practical measures to control food prices

The federal government on Monday has emphasised that the provincial governments and all other concerned authorities take immediate proactive measures to control increase in prices. The National Price Monitoring Committee (NPMC) reviewed the price trend of the essential commodities namely wheat flour, sugar, tomatoes, onions, vegetable ghee, potatoes and chicken on weekly basis. Adviser to the Prime Minister on Finance and Revenue Dr. Abdul Hafeez Shaikh chaired a meeting of National Price Monitoring Committee (NPMC). The Finance Secretary while presenting the price trend of essential commodities informed that according to latest SPI released by PBS, there is decline in the prices of wheat flour, sugar, onions while the prices of tomatoes, potatoes and chicken have slightly increased.

Read More...

Weekly inflation goes up 0.24 pc

Sensitive Price Indicator (SPI) based weekly inflation for the week ended on November 19, for the combined consumption group, witnessed increase of 0.24 per cent as compared to the previous week. The SPI for the week under review in the above mentioned group was recorded at 143.05 points against 142.71 points registered in the previous week, according to the latest data of Pakistan Bureau of Statistics (PBS). As compared to the corresponding week of last year, the SPI for the combined consumption group in the week under review witnessed an increase of 7.7 per cent. The weekly SPI with base year 2015-16=100 is covering 17 urban centres and 51 essential items for all expenditure groups.

Read More...

ICCI expresses disappointment for maintaining interest rate

The Islamabad Chamber of Commerce and Industry (ICCI) on Monday has expressed disappointment over State Bank of Pakistan (SBP)’s decision for maintaining interest rate at seven per cent. ICCI President Sardar Yasir Ilyas Khan said that keeping in view the challenges being created by the COVID-19 pandemic, the business community of the country was expecting further cut in the policy interest rate to bring it down to below 5% that would have helped the businesses in achieving better growth and expansion. However, the SBP has maintained the interest rate at 7% in the new bi-monthly monetary policy, which has disappointed the business community.

Read More...

SBP maintains policy rate at 7pc

The State Bank of Pakistan (SBP) Monday decided to maintain the policy rate at 7 per cent, as SBP press release said. The SBP’s Monetary Policy Committee (MPC) its meeting noted that since its last meeting in September, the domestic recovery had gradually gained traction, in line with expectations for growth of slightly above 2 per cent in the Fiscal Year 2020-21, and the business sentiment also improved further. Nevertheless, there were risks to the outlook, it added. The committee observed that the recent rise in COVID cases in Pakistan and many other countries presented considerable downside risks.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3