Morning Market Brief 27th April. 2021

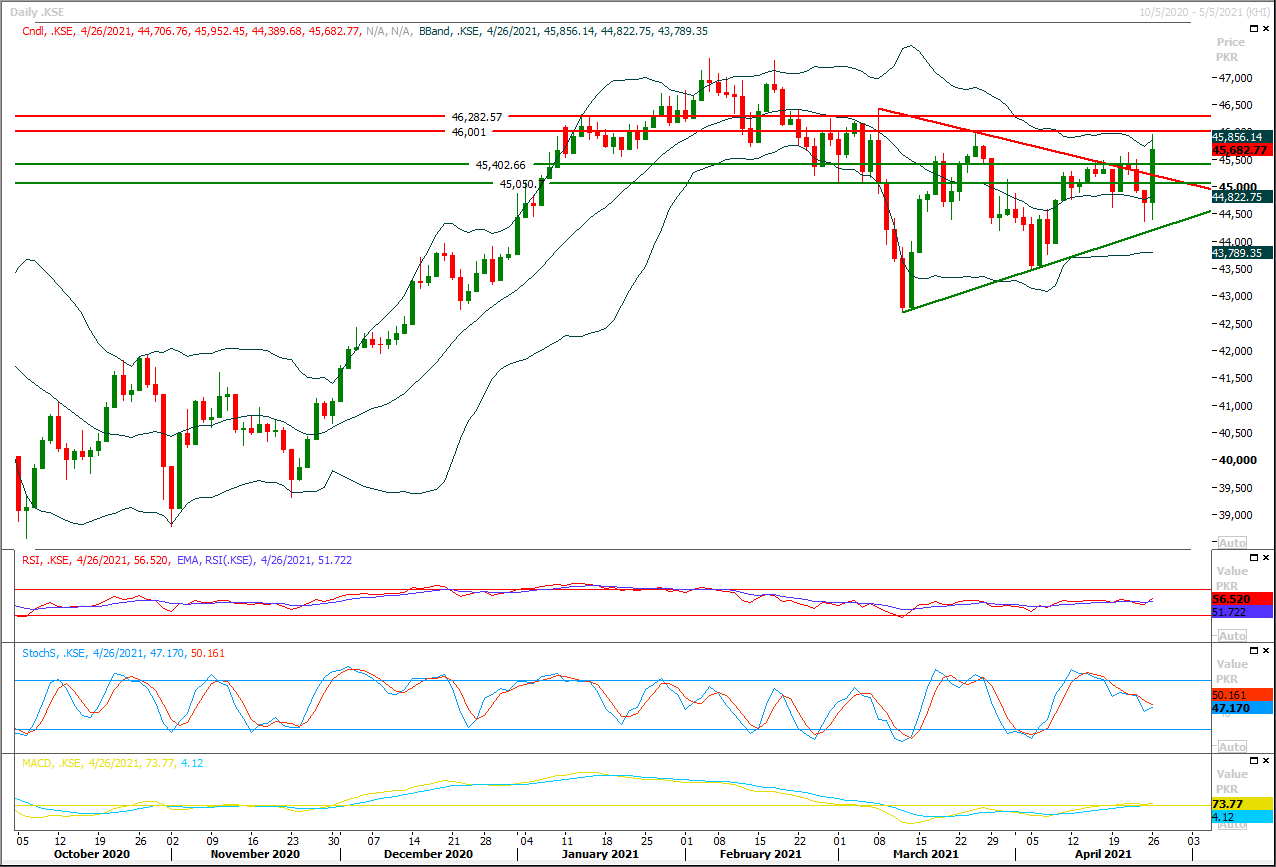

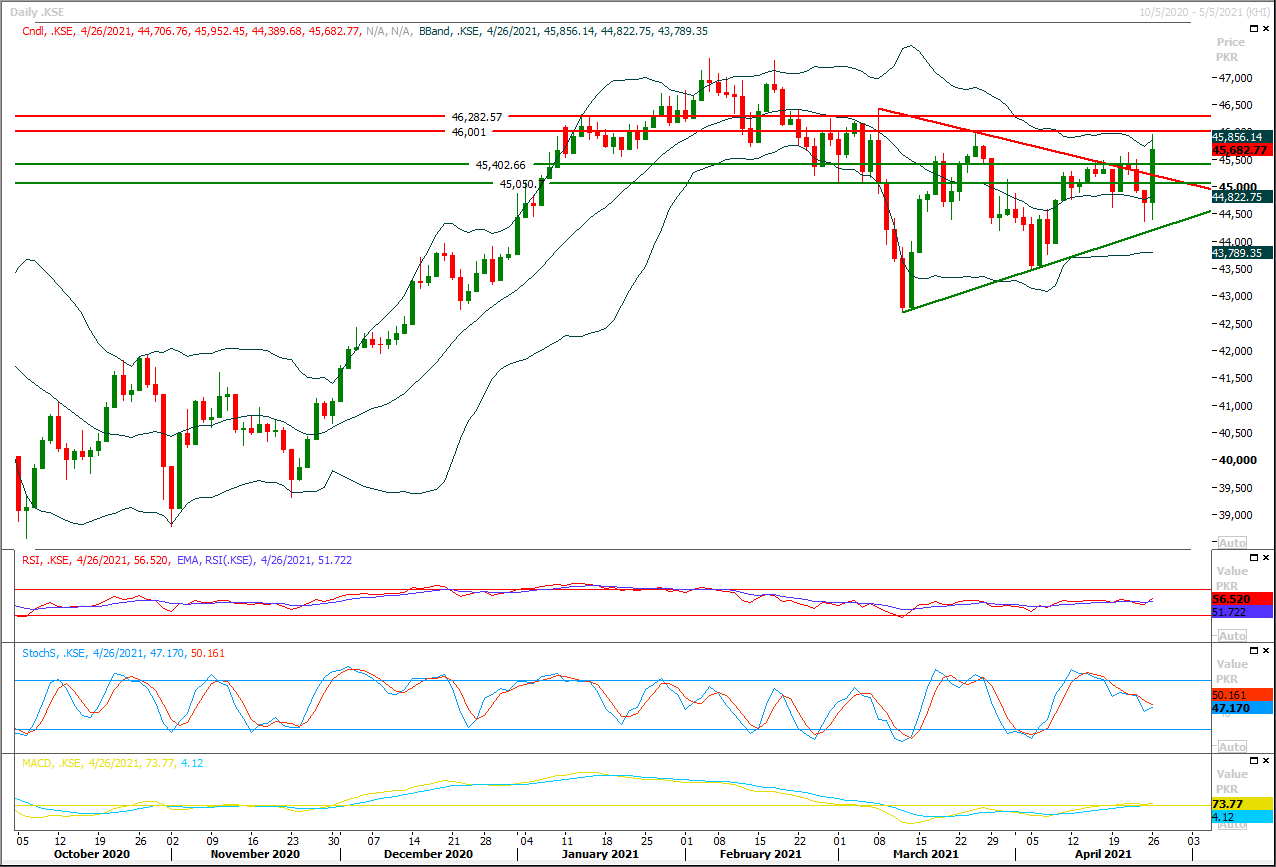

Technical Overview

The Benchmark KSE100 index had tried to penetrate its triangle in bullish direction during last trading session but could not succeed in giving a positive breakout above resistant trend line of said triangle on hourly chart and closed inside this triangle again at day end. As of now it's recommended to stay cautious and post trailing stop loss on existing long positions because if index would not succeed in closing above 46,000pts during current trading session then it may start sliding downward again to retest its supportive regions. For day trading its recommended to adopt swing trading until index succeed in closing above 46,200pts on daily chart, breakout above this region would call for 46,500pts and 46,760pts in coming days. While on flip side in case of rejection from its resistant regions index would find initial support at 45,400pts and bearish breakout below this region would call for 45,200pts and 45,000pts. Hourly momentum indicators have changed their direction towards bullish side but it's recommended to wait for a confirmation of current morning shooting star on daily chart before initiating new long positions for short term trading because if this morning start would convert into a cheat pattern then index may crash badly. Index would need fresh volumes to continue above 46,200pts therefore it's recommended to keep an eye on blue chip scripts volume figures as well for a confirmation.

Regional Markets

Asian shares wobble ahead of Fed outcome and earnings

Asian shares fell and U.S. stock futures were steady on Tuesday as caution ahead of a U.S. Federal Reserve meeting and a slew of corporate earnings offset growing optimism about the global economic recovery from the COVID-19 blow. MSCI's broadest index of Asia-Pacific shares outside Japan eased 0.14%. Australian stocks dropped 0.51%, but shares in China were little changed. Stocks in Tokyo edged 0.11% lower. S&P 500 e-mini stock futures rose 0.07%. Oil rebounded in Asian trading after major oil producers stood by their demand forecasts, but there are still downside risks due to surging COVID-19 cases in India, the world's third-biggest oil importer.

Read More...

Business News

Pakistan’s regional exports down by 5.7pc

Pakistan’s exports to its nine regional countries plunged over 5.7 per cent in the nine months of the current fiscal year due to the impact of Covid-19, data of the State Bank of Pakistan showed on Monday. The country’s exports to these countries — Afghanistan, China, Bangladesh, Sri Lanka, India, Iran, Nepal, Bhutan and the Maldives — account for a small amount of $2.788 billion, which is just 14.91pc of Pakistan’s total global exports of $18.688bn in 9MFY21. China tops the list of countries in terms of Pakistan’s exports to its neighbours, leaving other populous countries India and Bangladesh behind. Pakistan carried out its border trade with the farther neighbour Nepal, Sri Lanka, Bhutan, Bangladesh and Maldives via sea only. On the other hand, the country’s trade deficit with the region narrowed slightly during the period under review as imports from these countries also dipped.

Read More...

Pak-Iran goods train service suspended

The goods train service between Pakistan and Iran was suspended after a freight train carrying sulphur derailed in the Padag area of Chagai district on Monday. A Pakistan Railways officer based in Dalbandin told Dawn that six bogies of the freight train, which was on its way from Zahedan to Quetta, derailed near Yadgar Close Station owing to the bad railway track. He said several-foot-long track was damaged due to the incident. However, no one was injured in the incident. According to sources in Pakistan Railways, a derailment incident always takes place in the summer season which makes the condition of ageing railway tracks more dilapidated.

Read More...

116 audit paras cleared without PAC perusal

The Establishment Division with the support of audit and finance officials got cleared 116 out of 129 audit objections during meetings of the Departmental Audit Committee (DAC), hence leaving only 13 paras for perusal of the Public Accounts Committee (PAC). According to the documents available with Dawn, during an internal audit of the accounts of the Establishment Division for the year 2019-20, the auditors have raised 129 audit objections of multi-billion rupees irregularities in the financial affairs of the division. These audit paras related to unjustified pay and allowances to re-instate sacked employees, their posting to various departments, unauthorised grants of honorarium, irregular expenditure on entertainment, unauthorised payment of inadmissible allowance, unauthorised use of 1800cc cars, overpayment of additional charge, unauthorised payment of late sitting allowance, overpayment of deputation allowance, less deduction of income tax, irregular payment of rent, irregular allotment of accommodation to non-entitled employees, unnecessary hiring of private property for office accommodation, unnecessary purchase of library books, irregular expenditure of journeys, etc.

Read More...

Automatic provincial power dues’ adjustments against NFC Award proposed

The Federal government is considering a proposal under which the amounts owed by provinces and / or their departments to the power sector shall be automatically adjusted from the share allocated to the respective province in National Finance Commission Award. The proposed National Electricity Policy 2021 has recommended that the agreed upon amounts owed by provinces and / or their departments to the power sector, shall be automatically adjusted from the share allocated to the respective province in accordance with the Article 160 of the Constitution and departmental budgets, documents of the NEP 2021 available with The Nation reveals.The Cabinet Committee on Energy (CCoE) had last week recommended the proposed National Electricity Policy 2021 for presentation to the Federal Cabinet.According the proposed National Electricity Policy 2021, financial sustainability of the power sector is premised on the recovery of full cost of service, to the extent feasible, through an efficient tariff structure, which ensures sufficient liquidity in the sector.The NEP 2021 has recommended the automatic adjustments of provincial power dues from the NFC share allocated to the respective province in accordance with the Article 160 of the Constitution.Article-160 of the constitution 1973 provide for the constitution of National Finance commission consisting of the Minister of Finance of the federal government, the ministers of Finance of the provincial governments and such other persons as may be appointed by the President after consultation with the Governors of the provinces. The NFC decides about the award which determines the shares of the federal government and provinces in taxes for five years.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3