Morning Market Brief 28th Oct. 2020

Technical Overview

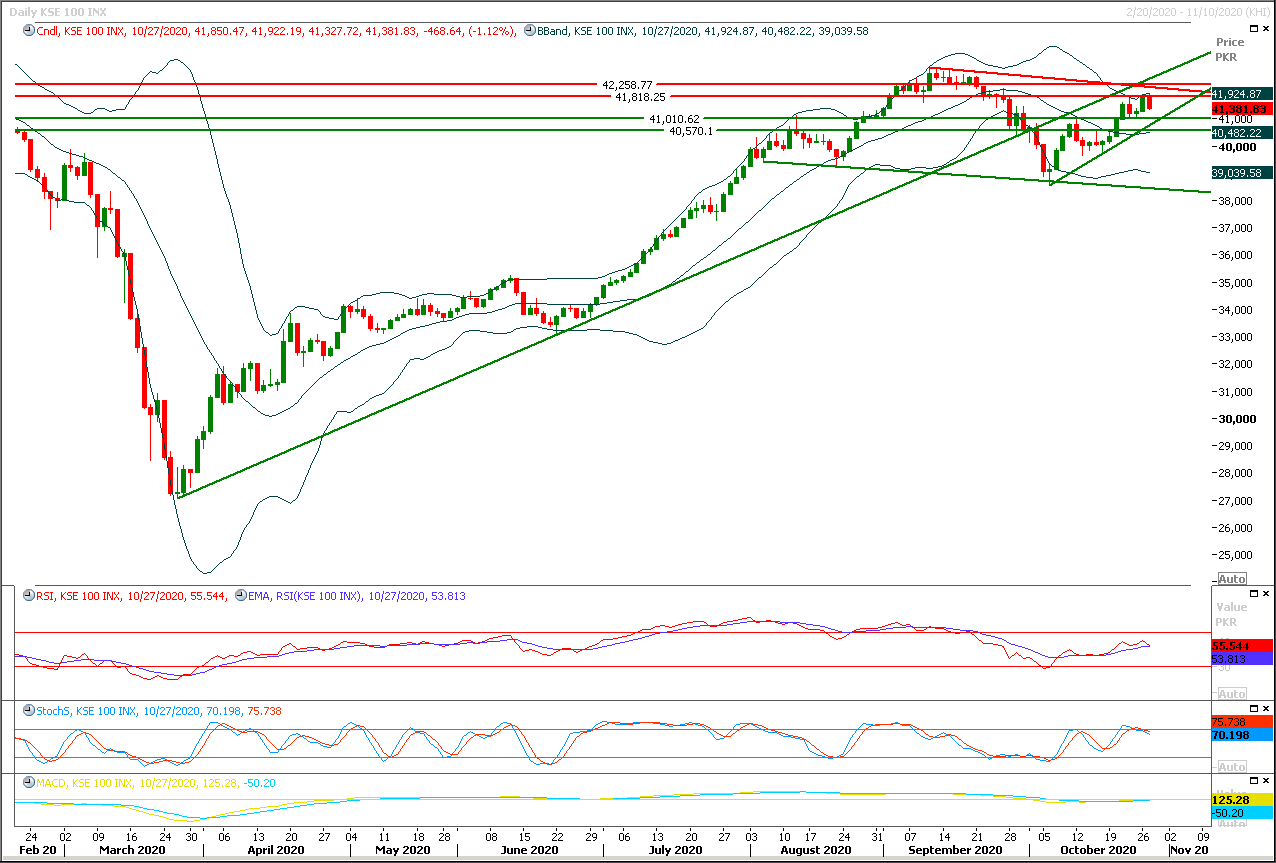

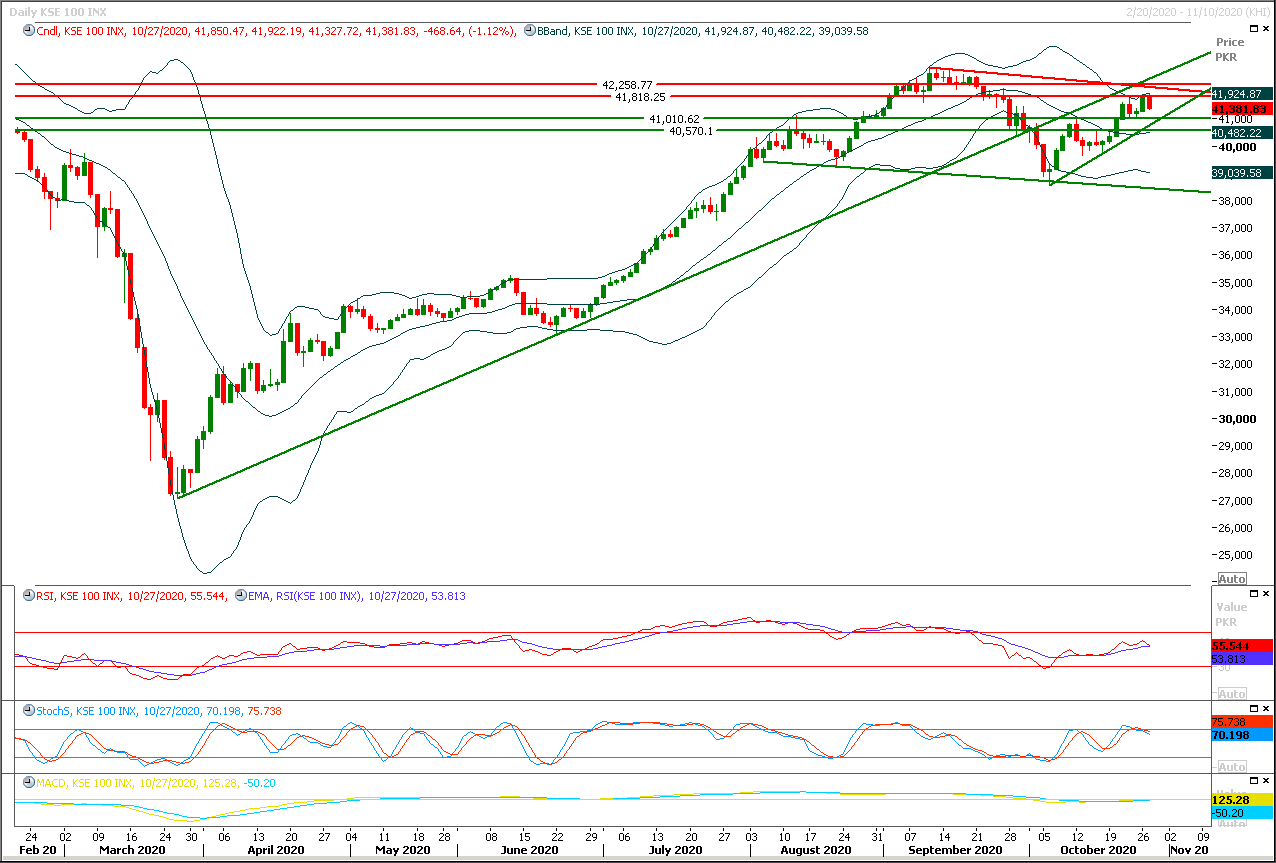

The Benchmark KSE100 index have formatted a dark cloud pattern on daily chart after facing rejection from a strong horizontal resistant region and in response of previous morning shooting star which have neutralized impact of morning star and confirmed formation of cheat pattern during last trading session. As of now it's expected that index would continue its bearish journey towards 41,000pts while breakout below that region would call for 40,800pts-40,700pts region. For day trading selling on strength could be beneficial because hourly momentum indicators are strongly bearish and these would try to push index for an intraday dip. While on flip side in case of reversal index would face initial resistance between 41,500pts-41,600pts region which would be followed by a strong resistant region at 41,800pts. While daily closing below 41,000pts would change the sentiment for short term basis which may result in correction of its last bullish rally.

Regional Markets

Asian shares seen lower on coronavirus

Asian markets looked set for another weaker open on Wednesday as worries about a surge in coronavirus cases and dwindling hopes for a U.S. stimulus package kept investors gloomy. Australia's ASX 200 .AXJO opened down about 0.43%, while Japan's Nikkei 225 futures were down 0.36%. The Nikkei 225 index .N225 closed down 0.04% on Tuesday. The futures contract was down 0.62% from that close. Hong Kong's Hang Seng index futures .HSI.HSIc1 were up 0.4%. MSCI's gauge of stocks across the globe .MIWD00000PUS was down 0.27%.U.S. markets slipped as Trump acknowledged an economic relief package would likely come after the Nov. 3 election. In addition, new data showed U.S. consumer confidence dipping in October, although orders of key capital goods hit a six-year high. The Dow Jones Industrial Average .DJI fell 222.19 points, or 0.8% and the S&P 500 .SPX lost 10.29 points, or 0.30%. The Nasdaq Composite .IXIC added 72.41 points, or 0.64%.

Read More...

Business News

Global lockdowns may hit exports in coming months: Govt

The government has feared that Pakistan’s exports may affect in the months to come with the world returning to lockdowns, amid Covid-19 resurgence. “With the world returning to lockdowns, amid Covid-19 resurgence, the demand for our exports may also be affected. I appeal to the exporters to be vigilant and aggressive so that they may be able to sustain their presence in the global markets,” said Advisor to the Prime Minister on Commerce and Investment Abdul Razak Dawood on twitter. He further said that Covid-19 is an unprecedented crisis in the recent human history with far-reaching implications to the global economy.

Read More...

Amid possible COVID-19 second wave, Pakistan fears economic halt

The ministry of finance on Tuesday has noted that fears and risk factors are appearing due to the possible second wave of COVID-19 after economic recovery was seen in first quarter (July to Sep) of the current fiscal year (FY2021). “Economic recovery has been observed from the start of the new fiscal year. Most importantly the decrease in number of coronavirus cases and the resumption of economic activities have contributed in dampening the negative impact of health crisis on the economy. Economic recovery was seen in Q1 FY2021 and it is expected that this trend will continue but fears and risk factors are appearing due to the possible second wave of COVID,” the ministry of finance said in its monthly Economic Update and Outlook October 2020.

Read More...

World Bank downgrades tax project

The Pakistan Tehreek-e-Insaf (PTI) government’s risky $400 million venture to fix the ailing tax system meets the fate predicted by many before its inception, as the World Bank has downgraded the project due to slower-than-expected progress. There has been widespread opposition to the $400 million project, including by Federal Board of Revenue (FBR) former chairman Shabbar Zaidi, as tax reforms cannot be done by signing off on expensive foreign loans.

Read More...

SECP approves technology-based crowd funding platform

The Securities and Exchange Commission of Pakistan (SECP) has granted approval to the first technology-based crowd funding platform for commencement of live testing and experimentation under first cohort of its technology driven initiative – Regulatory Sandbox. Crowd funding platform is an online digital platform that allows start-ups and Small and Medium enterprises to fund their capital requirement from investors in return for securities. Crowd Funding Platform would conduct requisite due diligence on the behalf of the investors and only eligible issuers that meets certain threshold criteria would be allowed to pitch the issue through the crowd funding platform and raise funds from investors.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3