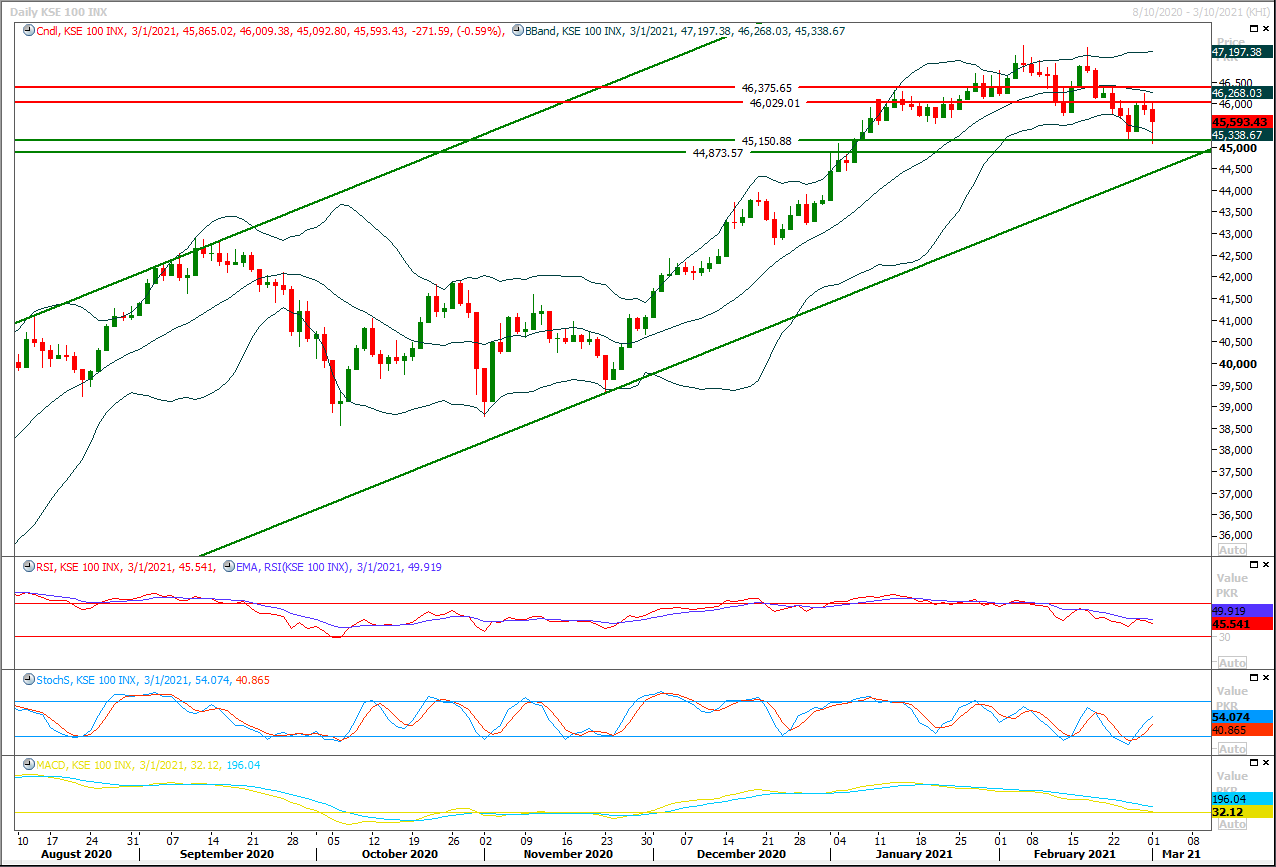

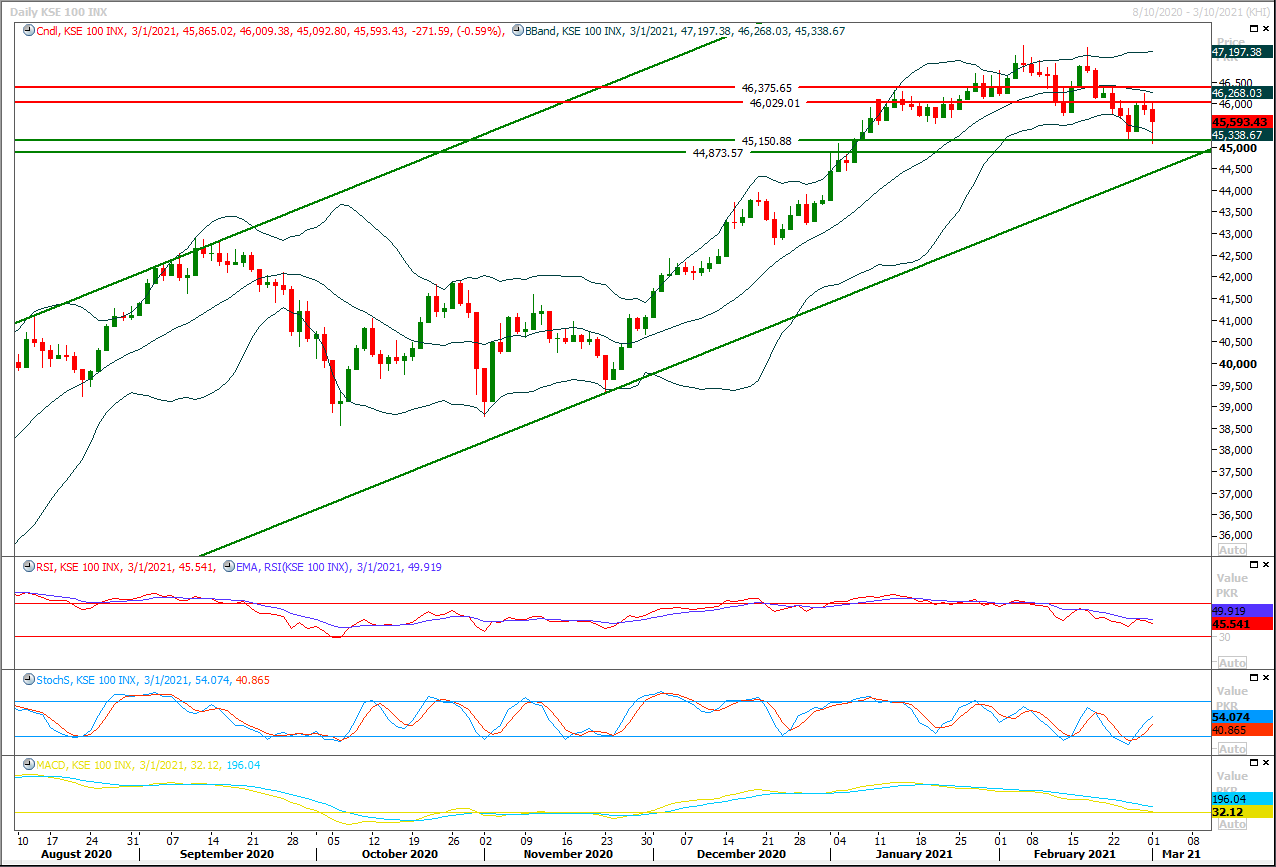

The Benchmark KSE100 index have succeeded in avoiding an evening shooting star on daily chart but a hammer have been formatted on daily chart which is also a symbol of uncertainty and could convert yesterday's pull back into a cheat pattern therefore it's recommended to stay cautious and post trailing stop loss on long positions. Currently index would face initial resistance at 45,750pts while breakout above this region would call for 45,900pts-46,064pts region. It's expected that a volatile session would be witnessed during current trading session and index could face rejection from its resistant regions which may result in a decline till day end. In case of rejection from its resistant regions index would target its supportive regions at 45,300pts and 45,000pts while breakout below 45,000pts would call for 44,500pts in coming days. Index is moving downward in a zig zag way which indicates that a final dip may take place if index would not succeed in recovering above its resistant regions.

Regional Markets

Oil extends losses on worry over possible supply increase from OPECy

Oil prices fell more than 1% on Tuesday, extending losses that began last week, as investors unwound long positions on concern that OPEC may agree to increase global supply in a meeting this week and Chinese demand may be slipping. Brent crude dropped 78 cents, or 1.2%, to $62.91 a barrel by 0138 GMT, after losing 1.1% the previous day. U.S. West Texas Intermediate (WTI) crude slid 74 cents, or 1.2%, to $59.90 a barrel, having lost 1.4% on Monday. Investors are worried the Organization of the Petroleum Exporting Countries and its allies, a group known as OPEC+, will boost oil output, said Hiroyuki Kikukawa, general manager of research at Nissan Securities.

Read More...

Business News

Govt puts half-year fiscal deficit at 3.1pc of GDP

Highlighting certain risks to fiscal sustainability, the federal government has reported its half-year (July-December) fiscal deficit at 3.1 per cent of GDP, or the highest-ever figure of Rs1.393 trillion in absolute terms. In its mid-year Budget Review Report submitted to the parliament as required under the Public Finance Act, 2019, the Ministry of Finance on Monday claimed credit for higher revenues, controlled expenditures amid fiscal consolidation measures but conceded that there were “certain risks to fiscal sustainability”. Going forward, the fiscal position would depend on the domestic and international evolution of the Covid-19 pandemic, the ministry said, adding that faster-than-anticipated economic revival was also likely to increase demand for inputs.

Read More...

Exports cross $2 billion mark for fifth consecutive month

For the fifth consecutive month, Pakistan’s exports have crossed $2 billion mark in February that would help in maintaining foreign exchange reserves. “Ministry of Commerce would like to share that, Alhamdolillah, for 5th consecutive month, our exports have crossed the USD 2 billion mark,” said Adviser to the Prime Minister on Commerce and Investment Abdul Razak Dawood on Twitter on Monday. He further said that country’s exports for February this year stood at $2.044 billion as compared to $2.140 billion in same period of the previous year (Feb-2020), showing a decline of 4.5 per cent. Adviser also shared the eight months exports figures. Pakistan’s exports in first eight months (July to February) of the current fiscal year have increased by 4.2 per cent to $16.3 billion as against $15.64 billion in the corresponding period of the previous year.

Read More...

FBR hold tax awareness session in Rawalpindi college

In continuation of holding Tax Awareness Educational Sessions in different educational institutes under Directorate of Federal Government Educational Institutions Cantt Garrison, Ministry of Defense, Federal Board of Revenue (FBR) held a session in F.G Post Graduate College for Women, Kashmir Road, Rawalpindi. Different activities for the students were arranged in the Tax Awareness Educational Session which greatly helped the students to understand the tax structure and importance of tax payment responsibility. The officers of FATE Wing made the students to understand tax system in a very easy to understand manner. Secretary FATE, Sonia Anwar Rana in her presentation informed about the structure of FBR, types of taxes and benefits of tax returns filing. The students were informed about Tax Asaan App as well. A quiz competition was also arranged to gauge the understanding of the students on the subject after the session.

Read More...

Punjab Revenue Authority collects Rs10.1 billion in Feb

Punjab Revenue Authority (PRA) collected Rs 10.1 billion during the month of February 2021, compared to Rs.9.2 billion in February 2020, the Authority’s spokesperson confirmed this to the media here Monday. She added that this was first time that Authority had crossed the ten billion rupees mark in the month of February. PRA’s total collection for the first eight months of the financial year 2020-21, according to the provisional figures, is Rs.96.3 billion compared to Rs.71.5 billion in the same period of the last financial year, which represents a growth of 35 per cent, she elaborated. Once the figures are finalized, she said, the collection is expected to improve further. This growth proved that the economy was doing well despite the second wave of COVID-19. She mentioned, “As the financial year draws to a close, the collection is likely to improve further as the economy continues to bounce back from the effects of the pandemic.”

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.