Morning Market Brief 30th Nov. 2020

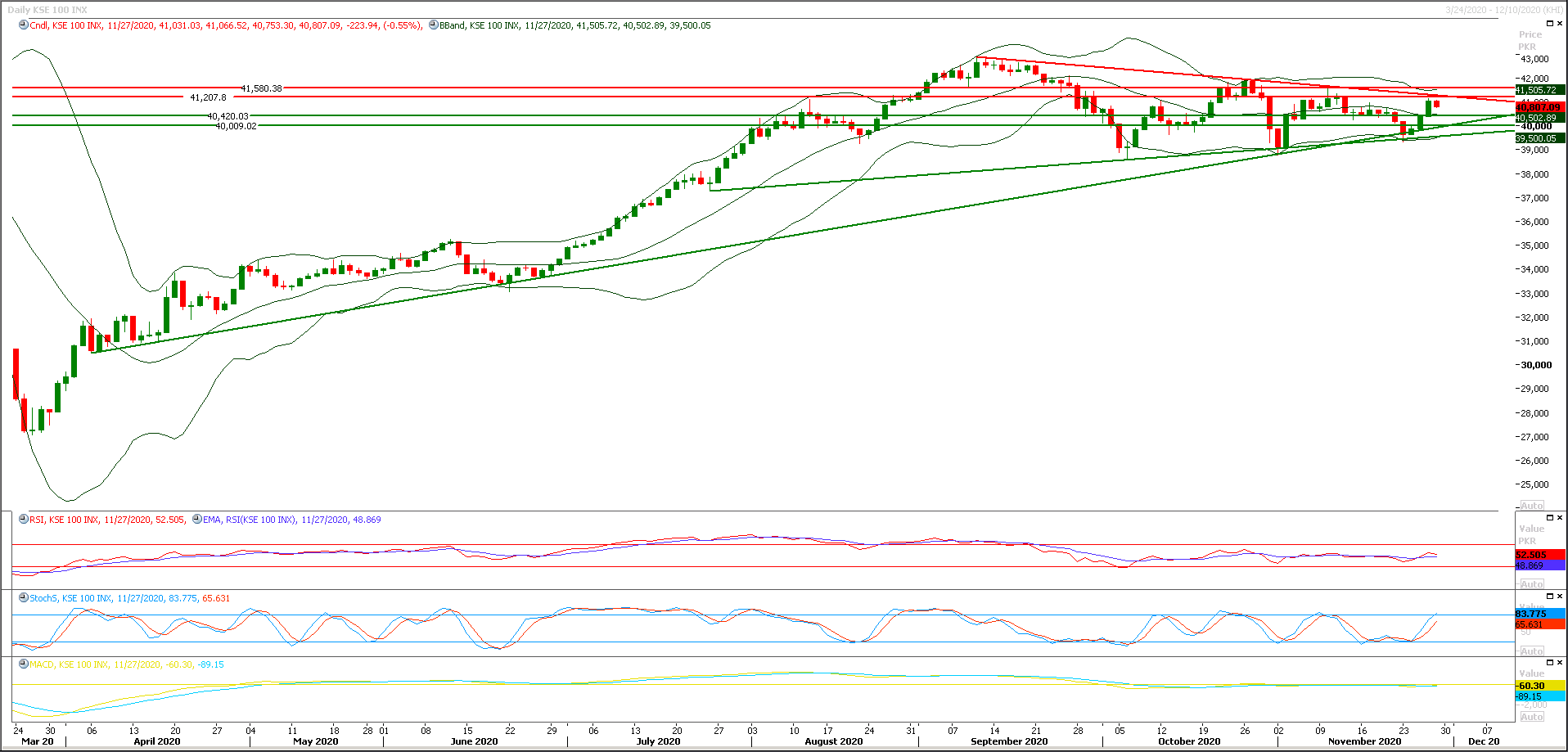

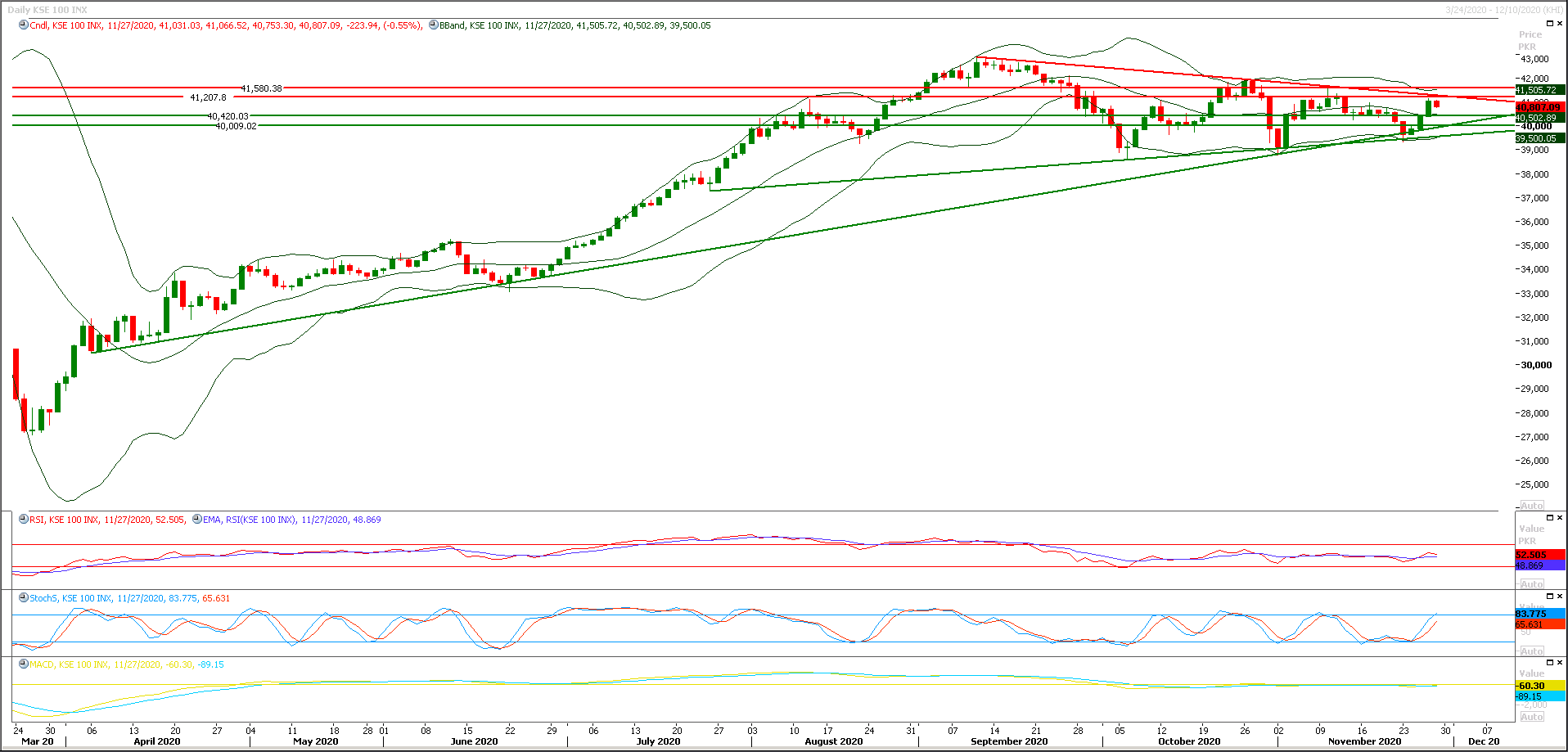

Technical Overview

The Benchmark KSE100 index is trying to format a bullish price channel on hourly chart but it had faced rejection from resistant trend line of its triangle on hourly chart during last trading session and for current trading session same region would try to react as major resistant region, therefore it's recommended to stay cautious. As of now it's expected that index would remain volatile during current trading session and swing trading between 40,500pts to 41,200pts could be beneficial. Initially index would remain under pressure but later on it would try to retest its resistant regions at 41,000pts and breakout above this region would call for 41,150pts-41,200pts region. While in case of bearish pressure index would try to find support from a strong horizontal supportive region at 40,500pts while breakout below that region would face some panic selling which may lead index towards 40,200pts. Daily momentum indicators are in bullish mode but hourly indicators have changed their direction towards bearish side and these would try to push index for an intraday dip which may be recovered before day end.

Regional Markets

Shares take a breather after stellar month, China data upbeat

World shares paused to assess a record-busting month on Monday as the prospect of a vaccine-driven economic recovery next year and yet more free money from central banks eclipsed concerns about the coronavirus pandemic in the near-term. Many European bourses are boasting their best month ever with France up 21% and Italy almost 26%. The MSCI measure of world stocks is up 13% for November so far, while the S&P 500 has climbed 11% to all-time peaks. Early Monday, MSCI’s broadest index of Asia-Pacific shares outside Japan held steady, to be up more than 11% for the month in its best performance since late 2011. Japan’s Nikkei firmed 0.1%, bringing its gains for the month to 16% for the largest rise since 1994.

Read More...

Business News

Country borrowed $3.18 billion from external sources in four months

-Pakistan borrowed $3.18 billion from external sources during first four months (July to October) of the current fiscal year to maintain its foreign exchange reserves. The borrowing from external sources remained lower due to the Covid-19, which had slowed down the pace of the development projects in the country. The borrowing in four months is only 26 percent of the total budgeted external loans of $12.233 billion for the entire fiscal year. In the month of October, the government had borrowed $327.79 million external inflows from multiple financing sources including $231.66 million from foreign commercial banks, according to the official of ministry of Economic Affairs.

Read More...

Businessmen demand drop in policy rate

Pakistan Industrial and Traders Association Front (PIAF) has asked government to drop the policy rate and termed it essential to make Pakistani export sector as well as the local industry competitive, as the interest rates in regional are still lower than Pakistan. In a joint statement PIAF Chairman Mian Nauman Kabir and Vice Chairman Javed Siddiqi said that after the corona devastation, Pakistan should take advantage of those export orders cancelled by the other regional countries. For this, the government will have to reduce production cost of the industries to avail this offer by the international buyers.

Read More...

Export of sports goods falls 14.29pc in 4 months

The exports of sports goods from the country witnessed decrease of 14.29 per cent during the first four months of the ongoing financial year (2020-21) against the exports of corresponding period of last year. The country exported sports goods worth $87.069 m during July-October (2020-21) against the exports of $101.590 m during July-October (2019-20), showing negative growth of 14.29 per cent, according to the latest data released by Pakistan Bureau of Statistics (PBS) here on Wednesday. During the period under review, the export of footballs decreased by 25.44 per cent from $57.383 m last year to $42.782 m during current year while the exports of gloves also declined by 16.36 per cent from $27.692 m to $23.161 million. However, the exports of all other sports good witnessed an increase of 27.92 per cent by going up from $16.515 m to $ 21.126 m during the period under review.

Read More...

Pakistan offers attractive business, investment opportunities for Chinese, ASEAN investors

Pakistan Ambassador to China Moin-ul-Haque has urged the business and investment community of China and ASEAN countries to tap into the vast and virgin market of Pakistan, particularly with regard to the several Special Economic Zones (SEZs) being set up under the transformative China Pakistan Economic Corridor (CPEC). In this regard, he highlighted Pakistan’s special relations and comprehensive strategic partnership with China and the deep-rooted and wide-ranging links with ASEAN countries. He made these remarks in his welcoming address during the Trade and Investment Promotion Conference, organized by Pakistan Mission in Nanning, the capital city of Guangxi-Zhuang Autonomous Region of China on the sidelines of the ongoing 17th China-ASEAN Expo (CAEXPO).

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3