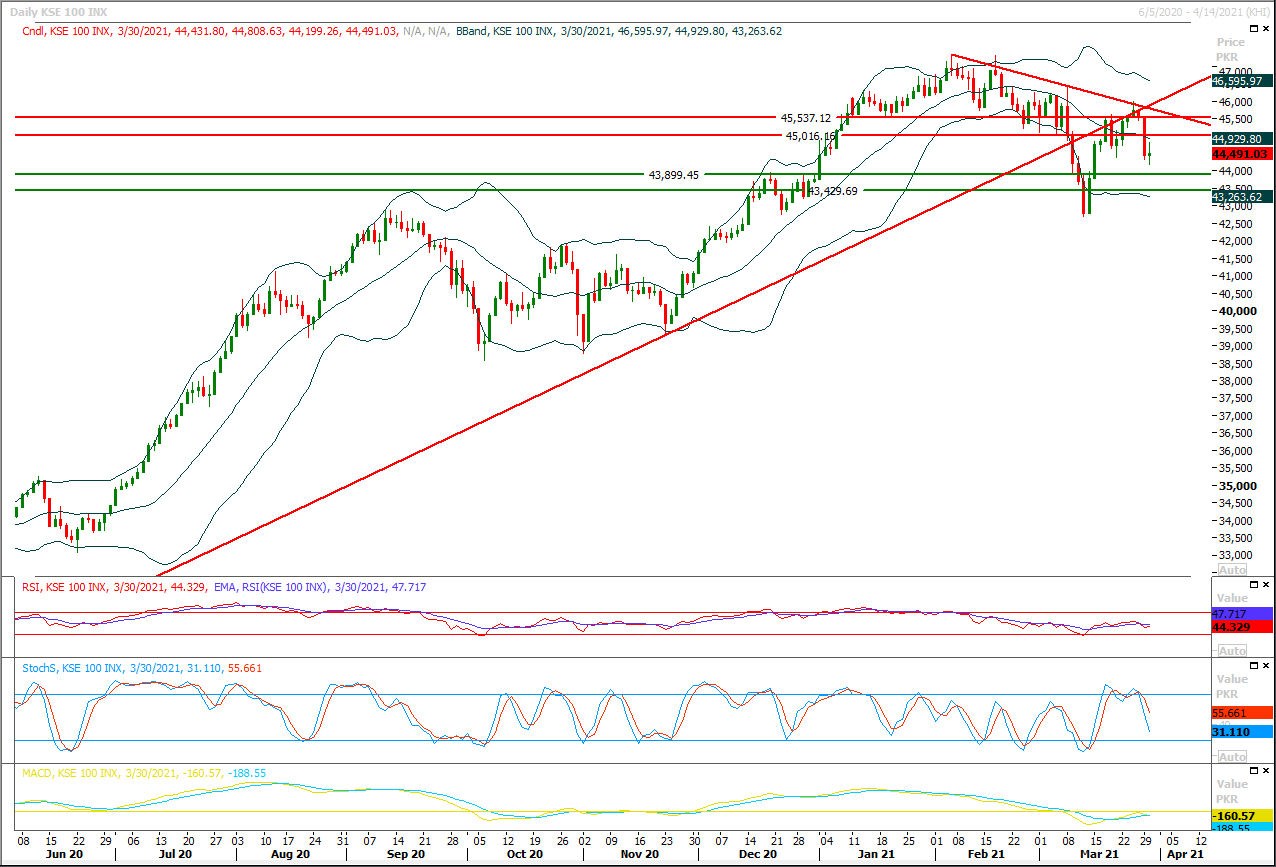

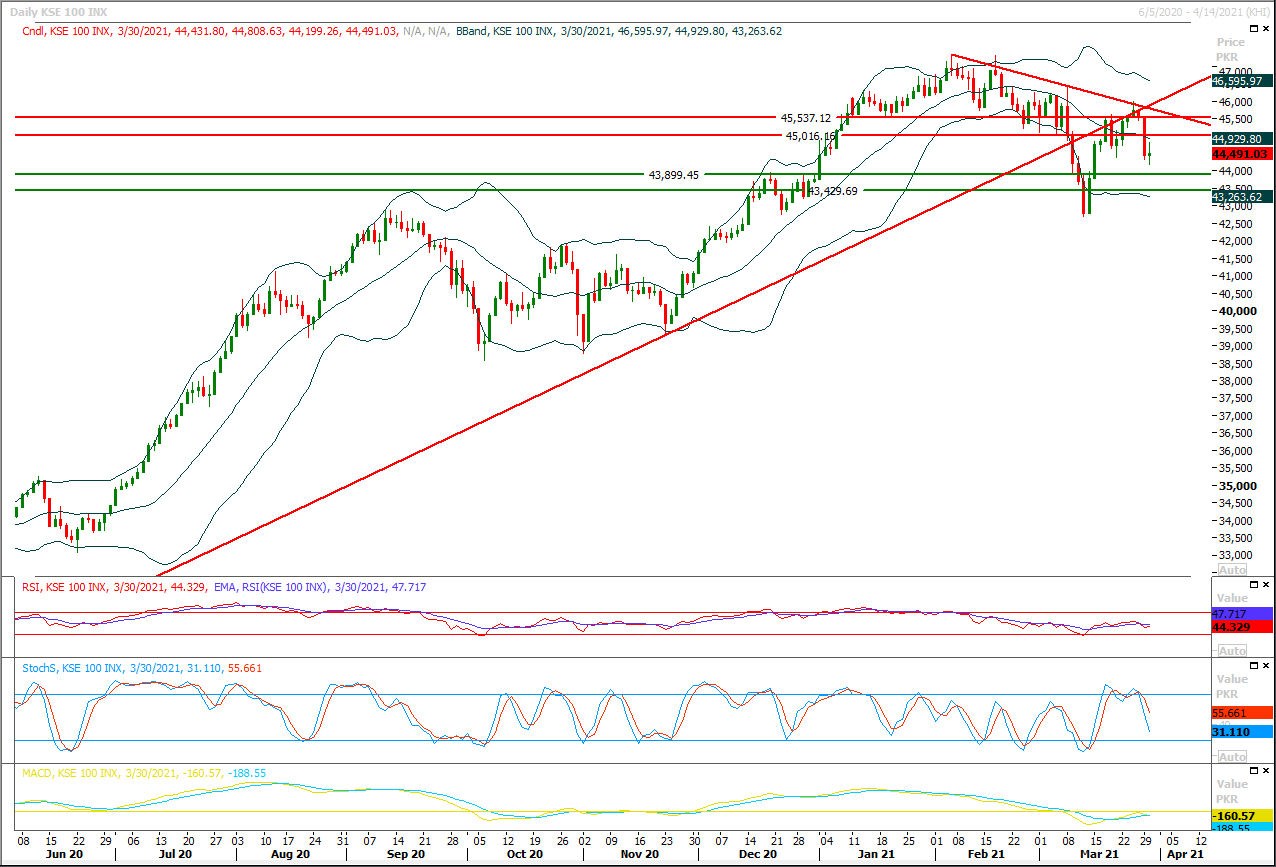

Morning Market Brief 31st Mar. 2021

Technical Overview

The Benchmark KSE100 index had witnessed a volatile trading session yesterday and closed with a doji formation at day end. As of now it's expected that today index would try to start the day with a positive note as hourly stochastic have generated a bullish crossover but later on index would face strong resistances and those would try to push index into negative zone again. It's expected that index would face initial resistance at 44,800pts from its daily double top while breakout above this region would call for 44,900ptts-45,050pts region. While on flipside index would find initial support at 44,200pts which would be followed by 44,000pts and 43,900pts. Being last trading session of the month today's closing matters a lot as index is trading in a very crucial region because today's closing below 44,500pts would format an evening shooting star on monthly chart which would be a negative sign. Meanwhile index may format a morning shooting star on daily chart after yesterday's doji formation but for this purpose index needs to close above 45,100pts at day end today. It's recommended to stay cautious and selling on strength with strict stop loss of 45,200pts could be beneficial for day trading. Overall index is being caged in a very tight range and it can be said that index is caged in correction of correction therefore swing trading also could be beneficial until index either gave bullish breakout of 45,200pts or bearish below 43,900pts.

Regional Markets

Asian stocks poised for first monthly loss since Oct on bond rout

Asian stocks were on track for their first monthly loss since last October though markets were up on Wednesday and the U.S. dollar stood tall as investors focused on growing signs of a sure-footed global economic recovery.MSCI’s broadest index of Asia-Pacific shares outside of Japan climbed for a fourth consecutive day to a one-week high of 682.36 points. The index, last up 0.4%, was still a fair distance away from an all-time peak of 745.89 touched just last month. For the month so far, the index is down 1.6% to be on track for its first loss in five months. It is also poised for its smallest quarterly gain since a 21% fall in March 2020 when the coronavirus pandemic brought the world to a standstill. As many countries rolled out the coronavirus vaccine, investors wagered on a quicker-than-anticipated economic recovery by dumping safe haven bonds, triggering a sudden and massive jump in yields that in-turn spooked equity investors..

Read More...

Business News

ADB approves $300 million loan to build hydropower plant in Pakistan

Pakistan has obtained another loan as this time Asian Development Bank (ADB) has approved a $300 million loan to finance the construction of a 300-megawatt hydropower plant that will increase the share of clean energy in Pakistan and improve the country’s energy security. In last week, the International Monetary Fund (IMF) had approved to release $500 million for Pakistan under extended fund facility. Meanwhile, Pakistan and World Bank had signed agreements worth $1.3 billion for social protection, improving human capital and building resilience in the country. On Tuesday, the ADB approved $300 million loan to finance the construction of a 300-megawatt hydropower plant. All these inflows would help in building the country’s foreign exchange reserves. Pakistan had already taken $7.208 billion loans from external sources in eight months (July to February) of the current fiscal year that helped to improve foreign exchange reserves and exchange rate stability. The amount of borrowing is 59 percent of annual budget estimates of $12,233 million for the entire fiscal year 2020-21.

Read More...

Manufacturers want lower taxes on raw materials import

The manufacturing industry has asked the government to allow the import of raw materials at reduced duties and taxes to enable them to compete with local vending and raw materials monopolies, and help keep the end products prices affordable for consumers. Local recyclers of CRC steel, steel forgings and aluminum have increased prices significantly in the past few months, forcing the industries that use these raw materials to pass on the burden to the consumer. According to details, Aluminum HD-2 prices went up to Rs 350/kg in March this year from Rs 233/kg back in April 2020, showing almost 50 per cent increase. The global prices of Aluminum HD-2 also witnessed an increase of 42.25 per cent, from $ 1526/T in Apr 2020 to $ 2171/T in Mar 2021, but it was much lower than the increase in the local market.

Read More...

Nepra reserves decision on Discos’ petition seeking transfer of Rs96.5 billion to consumers

National Electric Power Regulator Authority (NEPRA) has reserved judgment on the petition of Discos for the transfer of around Rs 96.50 billion to power consumers on account of monthly and quarterly adjustments. Presided over by NEPRA Chairman, Tauseef H. Farooqi, the regulator conducted separate hearings on the XWapda Discos demand for the transfer of burden of Rs 91.367 billion to power consumers on account of adjustments for the first two quarters (July- Sept 2020 and Oct-Dec 2020) of the current fiscal year and around Rs 5 billion under fuel price adjustment for February 2021 for XWapda Discos. If the demand is given approval, it will have an impact of Rs 0.91 per unit on the power consumers. In its petition submitted to NEPRA, XWapda Discos have demanded Rs 44.709 billion for the first quarter of 2020-21(July 2020 to September 2020) and Rs 46.658 billion for the second quarter of 2020-21(October 2020 to December 2020) under quarterly adjustments on account of variation in Power Purchase Price(PPP).

Read More...

Passco establishes 239 centres for wheat procurement

Pakistan Agriculture Storage and Service Corporation (PASSCO) has established 239 procurement centres across the country in order to initiate grain procurement drive for crop season 2021. These centres were established to facilitate the farmers in order to sell their produce on official fixed rates and save them from the exploitation of middle men, said Food Security Commissioner Dr imtiaz Ali Gopang. Talking to APP here on Tuesday, he informed that proposed target for PASSCO for wheat procurement drive 2021 has been set at 1.250 million tons. In this regard, PASSCO has already made all the necessary arrangements like requirements of logistics including supply of bardana (jute bags), gunji kits, fumigants or pesticides and, polyethylene, he added. Target of 1.250 million tons assigned to PASSCO for the wheat crop 2021 has further been sub-allocated to field zones and established different zones to further strengthening and streamlining the procurement campaign,

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3