Morning Market Brief 3rd Nov. 2020

Technical Overview

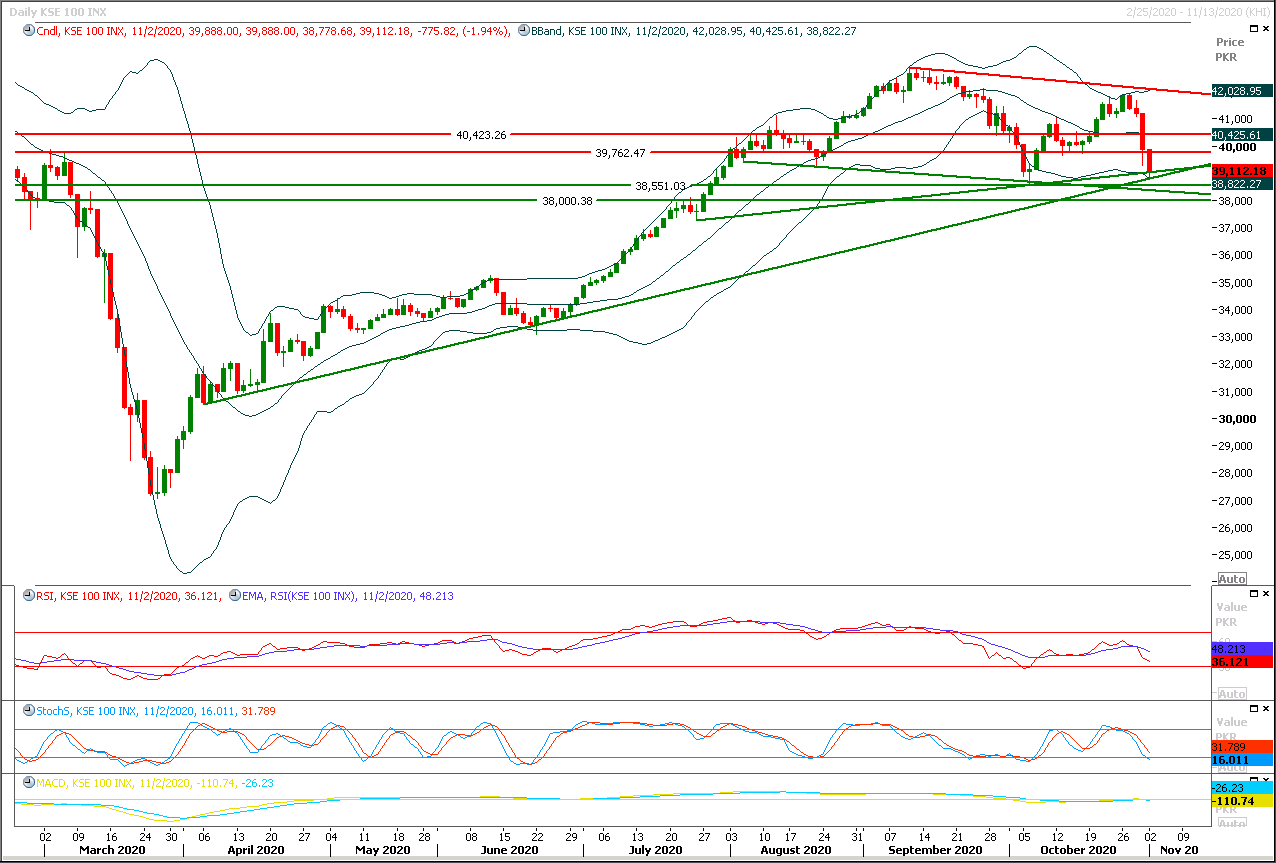

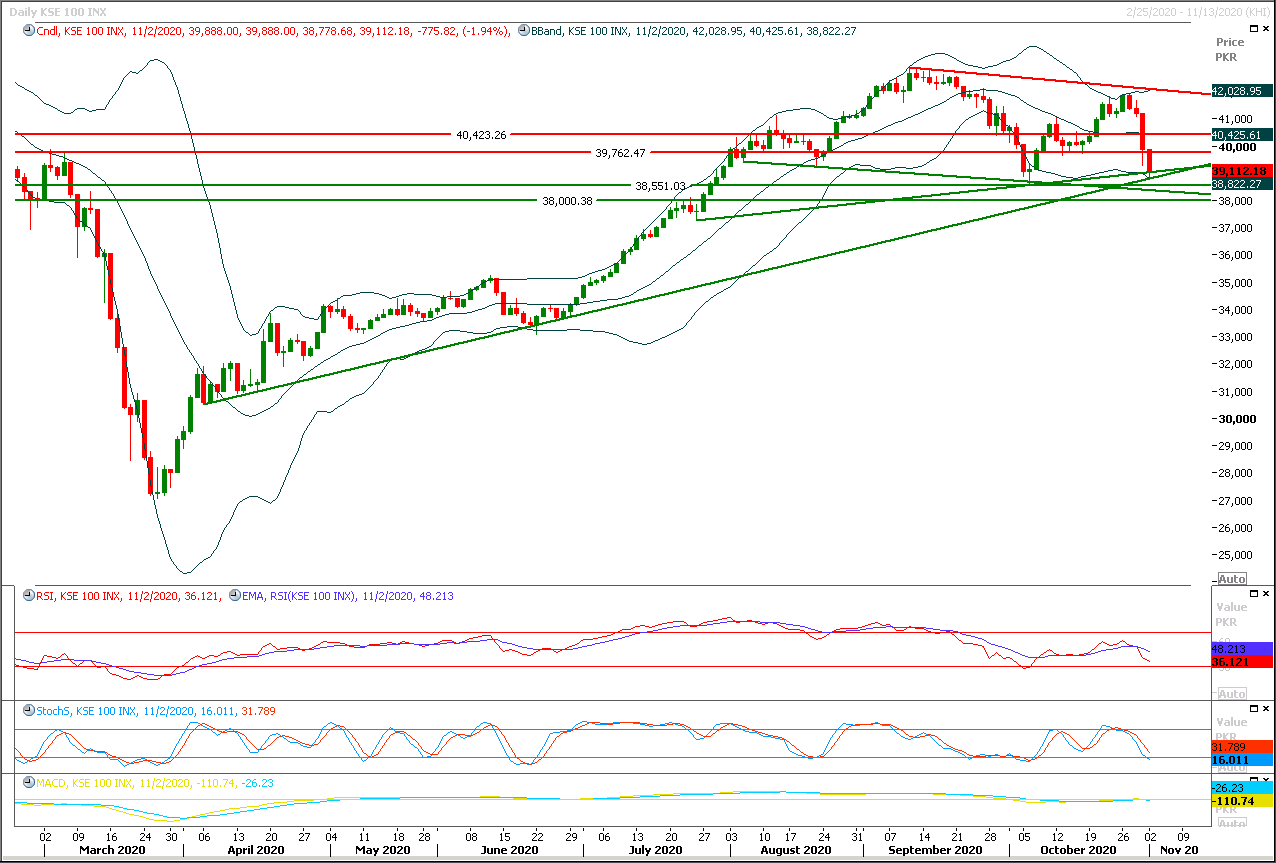

The Benchmark KSE100 index have strong supportive regions ahead where it would try to find some ground against current bearish pressure, initially it would try to find support from a strong horizontal supportive region in 38,500pts region which fall on a daily double bottom which would be followed by another strong support at 38,200pts region which falls on neckline of a daily head & shoulder formation therefore it's recommended to start buying on dip for day trading and if index would succeed in taking a dip between 38,800pts-38,500pts region than that would be most attractive buying region with strict stop loss of 38,200pts otherwise buying in chunks on dip would be beneficial for day trading. It's recommended to post strict stop loss on new buying because if index would succeed in sliding below 38,200pts then a new bearish regime would start and it would not provide chance for a safe exit to bulls. While on its way toward bullish reversal index would face initial resistance at 39,500pts and breakout of that region would call for 39,860pts and 40,000pts. Currently sentiment would remain bearish until it would not succeed in closing above 40,500pts therefore it's recommended to post trailing stop loss on new long positions.

Regional Markets

Asian shares hold firm, shrug off U.S. election jitters

Asian shares looked set to climb on Tuesday as investors shrugged off U.S. election jitters and took hope in strong factory output data in China, Europe and the United States, although the dollar and gold firmed on political uncertainty. Australia's ASX 200 .AXJO jumped 1.17% in early trading, while Hong Kong's Hang Seng index futures .HSIc1 rose 0.28%.S&P 500 futures Esc1 climbed 0.31%, extending gains on Wall Street overnight, and Japan's Nikkei 225 futures NKc1 added 0.41%. The run of upbeat economic data helped oil prices. U.S. Brent crude futures LCOc1 was steady at $39.24. Factory output data released on Monday showed surprising resilience in manufacturing activity in large parts of the world.

Read More...

Business News

SC enhances GIDC recovery period to 60 months

By a majority of two to one, the Supreme Court on Monday rejected a set of petitions seeking review of its Aug 13 verdict relating to Infrastructure Development Cess (GIDC), but asked the federal government to recover the remaining outstanding cess of over Rs400 billion from industries and commercial entities in 60 months instead of 24 instalments. A three-judge SC bench consisting of Justice Mushir Alam, Justice Faisal Arab and Justice Syed Mansoor Ali Shah had taken up the review petitions moved by different textile, cotton and sugar mills, ceramics companies, chemicals units, CNG filing stations, match factories, cement companies and aluminum industries with a plea to revisit the court’s earlier decision on GIDC.

Read More...

Amid hike in commodities prices, inflation recorded at 8.91pc in October

Inflation has recorded at 8.91 per cent in the month of October mainly due to increase in prices of commodities in last month. Inflation measured through Consumer Price Index (CPI) has recorded at 8.91 per cent in October this year over the same period of last year, according to the latest data of Pakistan Bureau of Statistics (PBS). It has shown slight decline as compared to 9.04 per cent in the preceding month (September). Inflation is one of the major challenges for the government, as prices of basic commodities are increasing. The ministry of finance has recently termed inflation as one of the main challenges. The International Monetary Fund (IMF) has estimated Pakistan’s inflation rate in double digits at 10.2 per cent during the current fiscal year.

Read More...

Pakistan’s exports crossed $2 billion in October

Pakistan’s exports have crossed $2 billion in October 2020 despite the contraction in major markets and the uncertainty created by recent resurgence of the COVID-19 pandemic. “Alhamdolillah, our exports have maintained the growth trend in October 2020. Our exports have crossed the 2 billion mark after July 2020 and are back on track to pre-COVID- 19 levels. This is despite the contraction in our major markets due to COVID-19 and the uncertainty created by recent resurgence of the COVID-19 pandemic,” said Advisor to Prime Minister on Commerce and Investment Abdul Razak Dawood on twitter. He congratulated the exporters on crossing $2 billion exports in last month.

Read More...

SBP injects Rs675.9b into market

State Bank of Pakistan on Monday injected Rs 675.9 billion into money market for four days as reverse repo purchase through its open market operation. All 17 bids of Rs 675.9 billion offered were accepted. The rate of return accepted is 7.03 per cent per annum, said SBP release.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3