Morning Market Brief 7th April. 2021

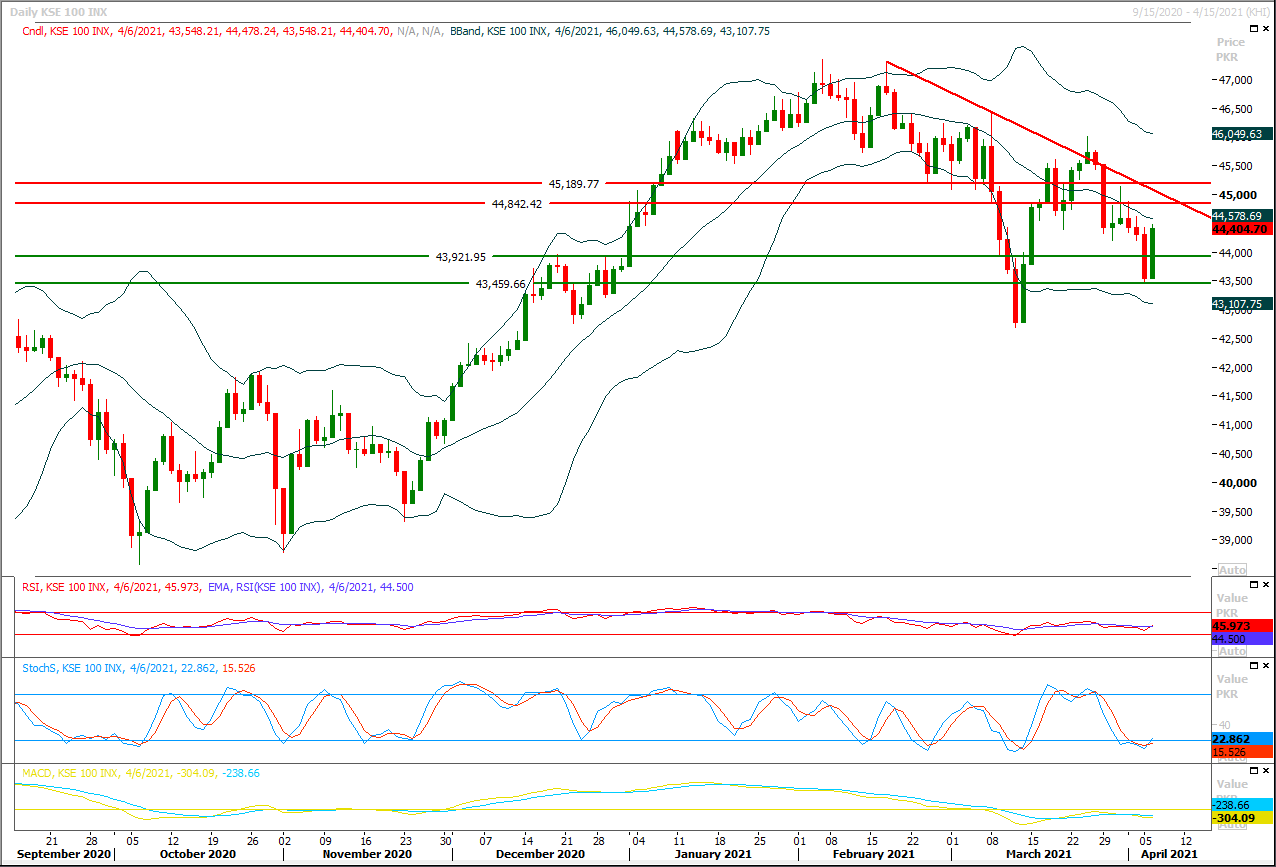

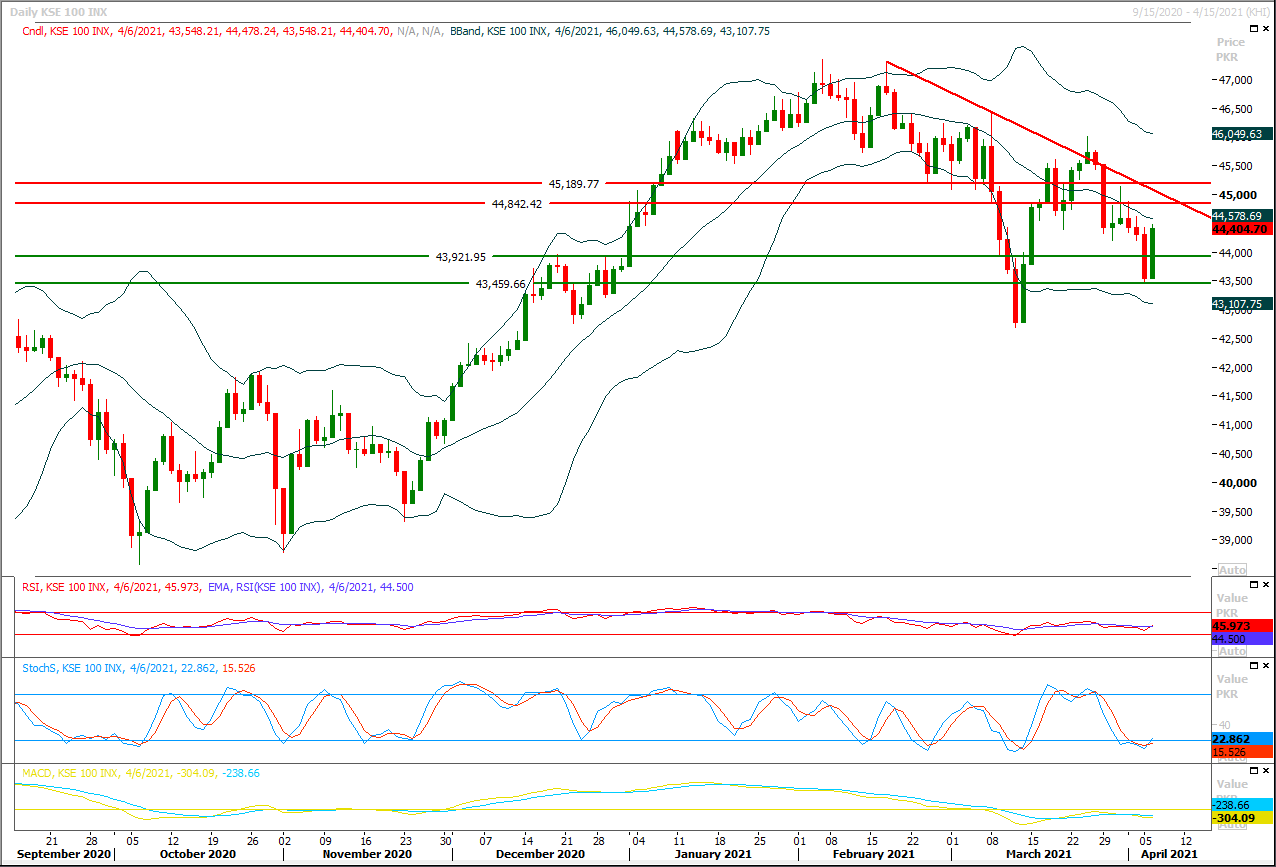

Technical Overview

The Benchmark KSE100 index have bounced back after getting support from 74.6% correction of its last bullish rally and a strong supportive Trend line on daily chart during last trading session and a bullish engulfing formation have been created. Meanwhile index have recovered 61.8% of its last bearish run in just a single day and have succeeded in giving a bullish breakout above two major resistant region till day end yesterday but it's recommended to stay cautious because index needs a confirmation of its bullish engulfing patter by closing above 44,860pts during current trading session otherwise this formation could convert into a cheat pattern therefore it's recommended to post trailing stop losses on existing long positions. It had been tried to change sentiment on PSX floor which was strongly bearish towards bullish side but it needs a strong confirmation. If index would succeed in closing above 44,860pts today then a sharp pull back towards pervious top would be witnessed and index would try to target 45,200pts initially on positive breakout which may extend towards 45,500pts and further. For current trading session index would face initial resistance at 44,860pts which would be followed by 45,085pts-45,200pts region. While on flip side in case of rejection from its resistant regions current pull back would be considered a cheat pattern and index would once more try to extend its previous low towards 42,700pts and 41,400pts. It's recommended to stay cautious because index have confirmed its bearish behavior by closing below 43,500pts therefore it can slide any time if would not be supported by health volumes.

Regional Markets

Asia shares set for sluggish start after Wall Street retreats from record highs

Asia equities are set for a sluggish open on Wednesday after Wall Street pulled back from record highs reached in previous sessions, as investors eye the upcoming earnings season for more signs of a recovery following a series of strong U.S. economic data.“We’ve had a few big up days in a row and I think markets are looking to a take a little bit of a pause here,” said Charlie Ripley, vice president of portfolio management at Allianz Investment Management in Minnesota. “From an economic data perspective, we didn’t get too much information except for the jobs opening report and market pricing is reflecting that.” Japan’s Nikkei 225 futures fell 0.1%, while Australian S&P/ASX 200 futures rose 0.04%. The International Monetary Fund raised its global growth forecast to 6% this year from 5.5%, reflecting a rapidly brightening outlook for the U.S. economy.

Read More...

Business News

Consultative meeting on progress made on Pak-Uzbek PTA held

Advisor to the Prime Minister on Commerce and Investment, Abdul Razak Dawood held a consultative meeting on the progress made on the Pakistan-Uzbekistan Preferential Trade Agreement (PTA). Secretary Commerce and other officials of the Ministry of Commerce (MOC) were present during the meeting. The secretary, Trade Development Authority of Pakistan (TDAP) joined the meeting via video link. The advisor was briefed that Uzbekistan has shared its Request List for Tariff Reduction and MOC is in the process of finalising Pakistan’s Request List in consultation with public and private sector stakeholders. He was informed that the input of private sector, concerned ministries and departments has been obtained via detailed consultations in last three months. The advisor directed the MOC to have a final round of consultation with the private sector stakeholders, companies trading with Uzbekistan, various chambers and associations to review the ground situation before finalising Pakistan’s Request Lists.

Read More...

Govt needs to fix longstanding electricity issues in GB, say webinar speakers

The federal government needs to fix what speakers at a webinar on Tuesday said was a long-standing issue of lack of electricity in Gilgit-Baltistan. An English daily’s GB correspondent Jamil Nagri said at the webinar “Tourism in Pakistan – Challenges and the Way Forward” that the region often got just between two to four hours of electricity during the day, and that this was also the situation in the region’s harsh winter. He also said that there were serious connectivity and internet-related issues in the region which needed to be fixed by the government. Nagri said that the there was a general lack of infrastructure and connectivity in the region and the government had to act to improve it. He also cited the lack of air and road connectivity with the rest of the country. “The KKH (Karakoram Highway) is the lifeline of GB and whenever it gets blocked thousands of people are stranded, including foreign tourists.

Read More...

IMF projects Pakistan’s growth rate at 1.5pc for current financial year

The International Monetary Fund (IMF) has projected Pakistan’s GDP growth rate at 1.5 per cent in the ongoing financial year. The growth rate would increase to 4 per cent in next fiscal year. Pakistan’s growth had contracted by 0.4 per cent in the year 2019-20, the IMF has stated in its report World Economic Outlook. The IMF is seeing a subdued recovery in Pakistan with growth expected at 1.5% this year, driven by industry & construction. The path of the pandemic and the ability of the authorities to provide policy support will be important for that outcome. The IMF has estimated inflation rate in Pakistan at 8.7 per cent in ongoing fiscal year as compared to 10.7 per cent in previous year.

Read More...

Exports increase by 7.12pc in three quarters, 30.44pc in March

The exports from the country increased by 7.12 percent during the first three quarters of the current fiscal year (2020-21) as compared to the corresponding period of last year, Pakistan Bureau of Statistics (PBS) reported. The exports from the country during July-March (2020-21) were recorded at $18.685 billion against the exports of $17.443 billion during July-March (2019-20), according to the latest PBS data. The imports during the period under review also increased by 13.57 percent by growing from $34.791 billion last year to $39.512 billion during the first three quarters of current fiscal year. Based on the figures, the country’s trade deficit increased by 20.05 percent during the first three quarters as compared to the corresponding period of last year.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3