Morning Market Brief 7th Dec. 2020

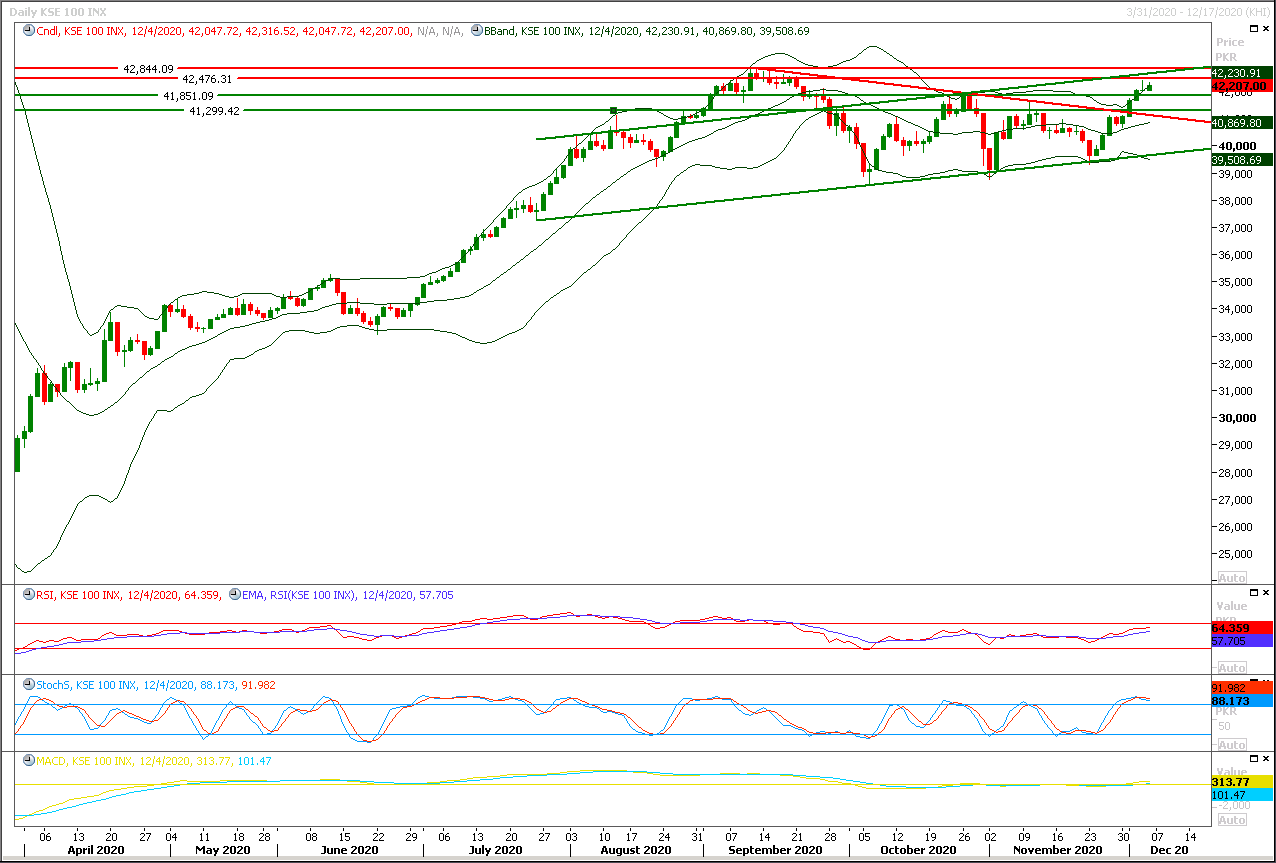

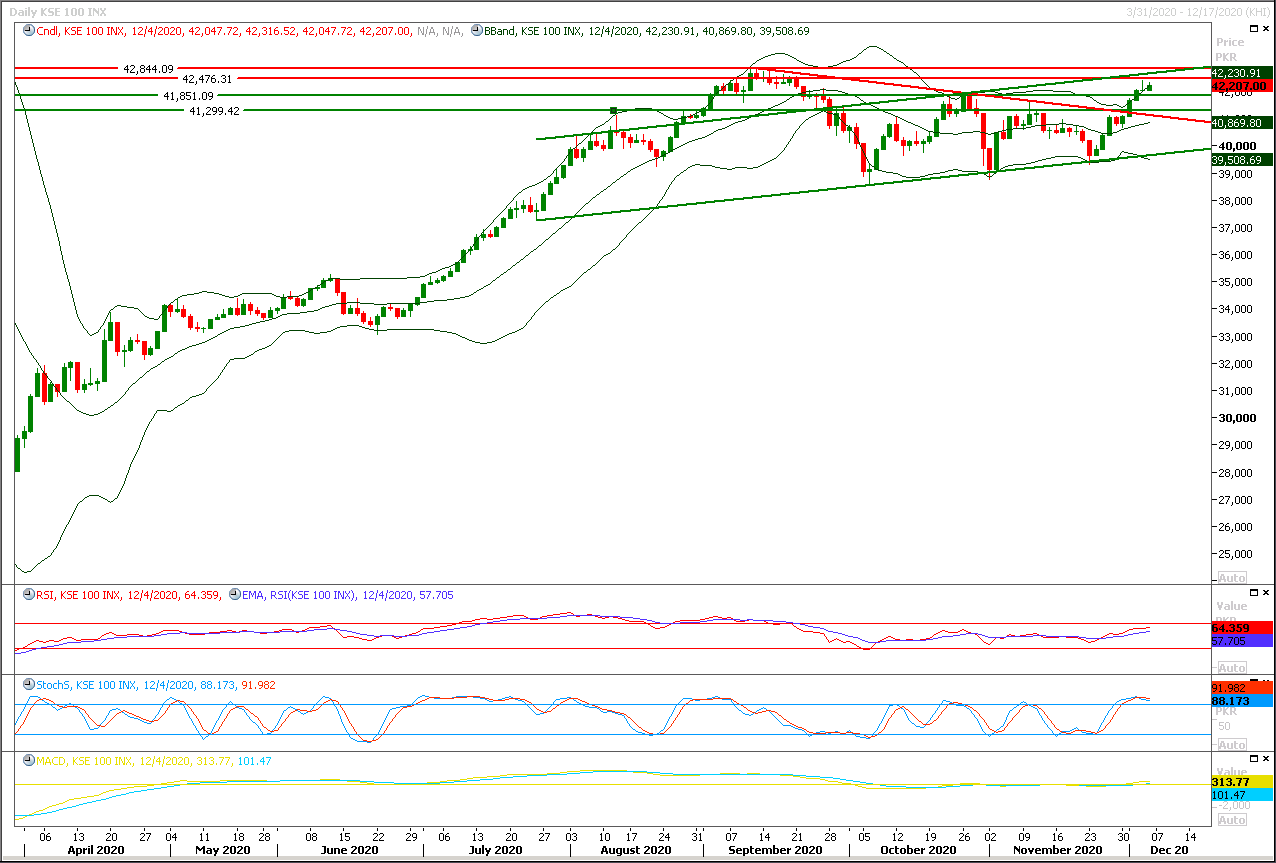

Technical Overview

The Benchmark KSE100 index is moving in an upward price channel after bullish breakout of its previous daily triangle and right now it’s heading towards resistant tend line of that channel which falls on 42,650pts. As of now it’s expected that index would try to continue its bullish journey during current trading session but some kind of volatility can be witnessed if index would face rejection from its resistant regions. Mean while hourly momentum indicators have changed their direction towards bearish side which indicates that index could take a slight dip on intraday basis, daily stochastic also have changed its direction towards bearish side which is going to increase uncertainty among investors. In case of rejection from its resistant regions index would try to find support at 41,850pts where a strong horizontal supportive region would try to provide ground against bearish pressure while breakout of this region would push index further downward towards 41,500pts and 41,350pts. It’s recommended to stay cautious and trade with strict stop loss on both sides because index have reached its major resistant region which falls between 42,500pts to 42,880pts where it would face resistance from its weekly double top. Breakout of this region would be considered most important because it falls on a monthly triple top. Swing trading could be beneficial until index would not succeed in either closing above 43,500pts or below 41,500pts on daily chart.

Regional Markets

Asian shares slip from all-time highs; oil falls on virus case surge

Asian shares retreated from a record peak on Monday after a Reuters report the United States was preparing to impose sanctions on some Chinese officials highlighted geopolitical tensions, while oil prices fell on surging virus cases.MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.3% following four straight sessions of gains. It is still up about 16% so far this year, the best since a 33% jump in 2017. China’s blue-chip index dropped 0.6% while Hong Kong’s Hang Seng was down 1.2%. Japan’s Nikkei declined 0.3% while Australian shares were up 0.5%. E-Mini futures for the S&P 500 were down 0.1% after starting higher.

Read More...

Business News

Exporters suggest PM to declare Sialkot as ‘Value-added City’

The Pakistan Readymade Garments Manufacturers & Exporters Association on Sunday proposed the Prime Minister Imran Khan declare Sialkot as a Value-added City, as it is a hub of SME sector, contributing $2.5 billion foreign exchange by adding a multi-fold value addition in garments, sports goods, surgical goods, musical devices, cutlery, leather garments, gloves, handmade badges and military uniforms. Sialkot is the only city in Asia where its business community has built its airport and now it is going to launch a private airline-‘Airsial’, this will help spur export growth from this city.

Read More...

838,770 tonnes of rice valuing $ 499.485m exported

About 838,770 metric tonnes of rice valuing $499.485 million exported during first four months of the current financial year as compared the exports of 1,176,228 metric tonnes worth $ 633.797 million of the corresponding period of last year. According to the data of Pakistan Bureau of Statistics, rice exports from the country during the period from July-October, 2020-21 decreased by 21.19 per cent as compared to the exports of the same period of last year. During the period under review about 170,729 metric tonnes of Basmati rice worth $168.745 million exported as against the exports of 283,458 metric tonnes valuing 259.099 million of the same period of last year. The exports of basmati rice during the period under review reduced by 34.87per cent as compared the exports of the same period of last year, the data revelled.

Read More...

FBR, PRA pushing industry to pay double tax

The Friends of Business and Economic Reforms (FEBR) on Sunday called for harmonization between Federal Board of Revenue (FBR) and Punjab Revenue Authority (PRA) intending to avoid double taxation, as both tax collecting agencies have started sending notices to the industry to collect the same tax. FEBR President Kashif Anwar said that the FBR and the PRA simultaneously have been pushing the manufacturers to submit ‘toll manufacturing sales tax’ and ‘workers welfare fund’. So, the manufacturers, who have been squeezed between the federal as well as the provincial tax collecting agencies, decided to move the court to avoid the undue burden of double taxation.

Read More...

Around 8,543,761 BBL oil, 64,967 MMCF gas produced from Karak fields in 11 months

Exploration and Production (E&P) companies have produced around 8,543,761.66 Barrel (BBL) oil and 64,967.32 Million Cubic Feet (MMCF) gas from five fields of Karak district of Khyber Pakhtunkhwa from July 2019 to May 2020. During the 11 months, the companies extracted 4,893,536 BBL oil and 27,783.97 MMCF gas from the Nashpa field, 142,953.95 BBL oil and 8,273.38 MMCF gas from Manzalai field, 570,420.42 BBL oil 4,322.14 MMCF gas from Makori Deep field, 2,931,241.39 BBL oil 24,507.79 MMCF gas from Makori East field and 5,609.90 BBL oil 80.04 MMCF gas, according to an official document available with APP. Since 1977, as many as 35 wells had so far been drilled in the Karak district mainly by three E&P companies including Oil and Gas Development Company Limited, MOL and TEX, out of which 11 were exploratory, 24 appraisal and development wells.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3