Morning Market Brief 8th Dec. 2020

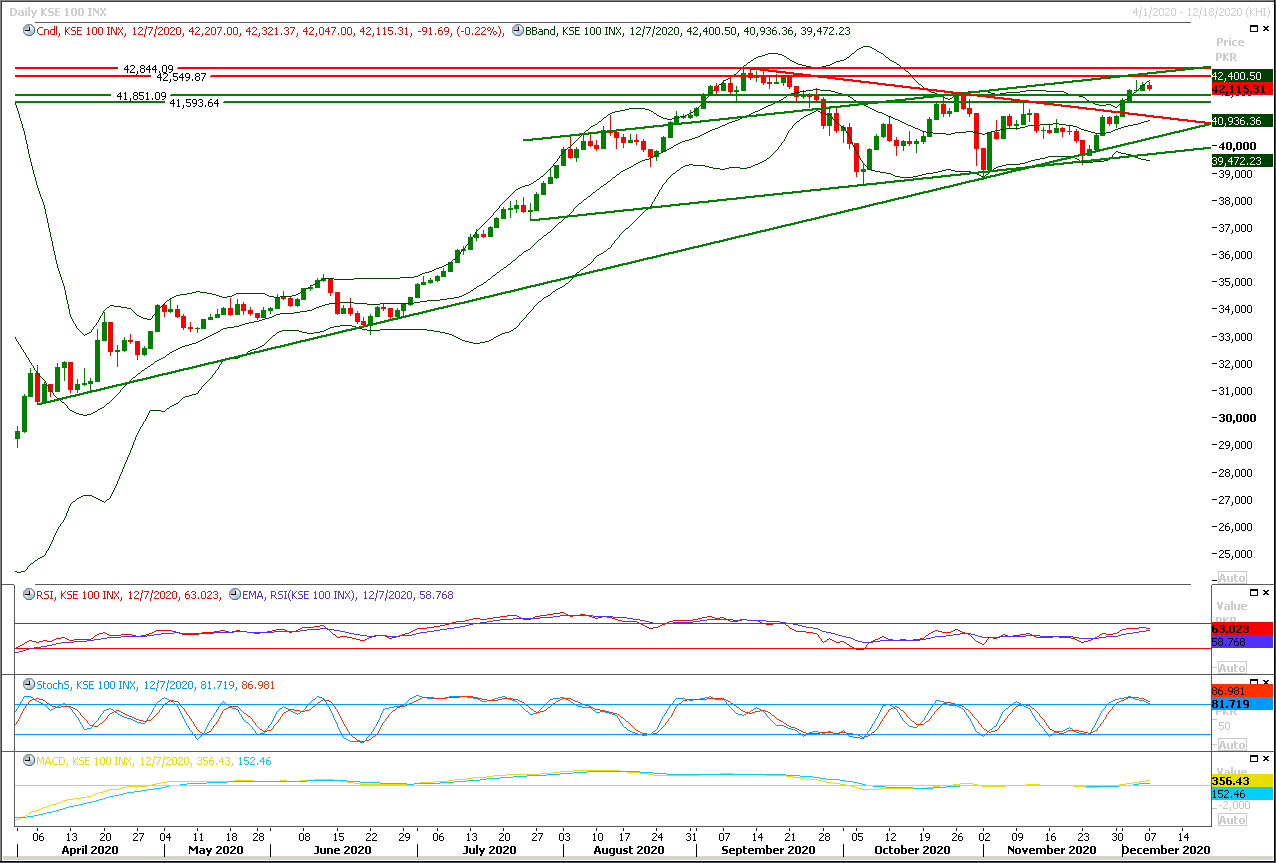

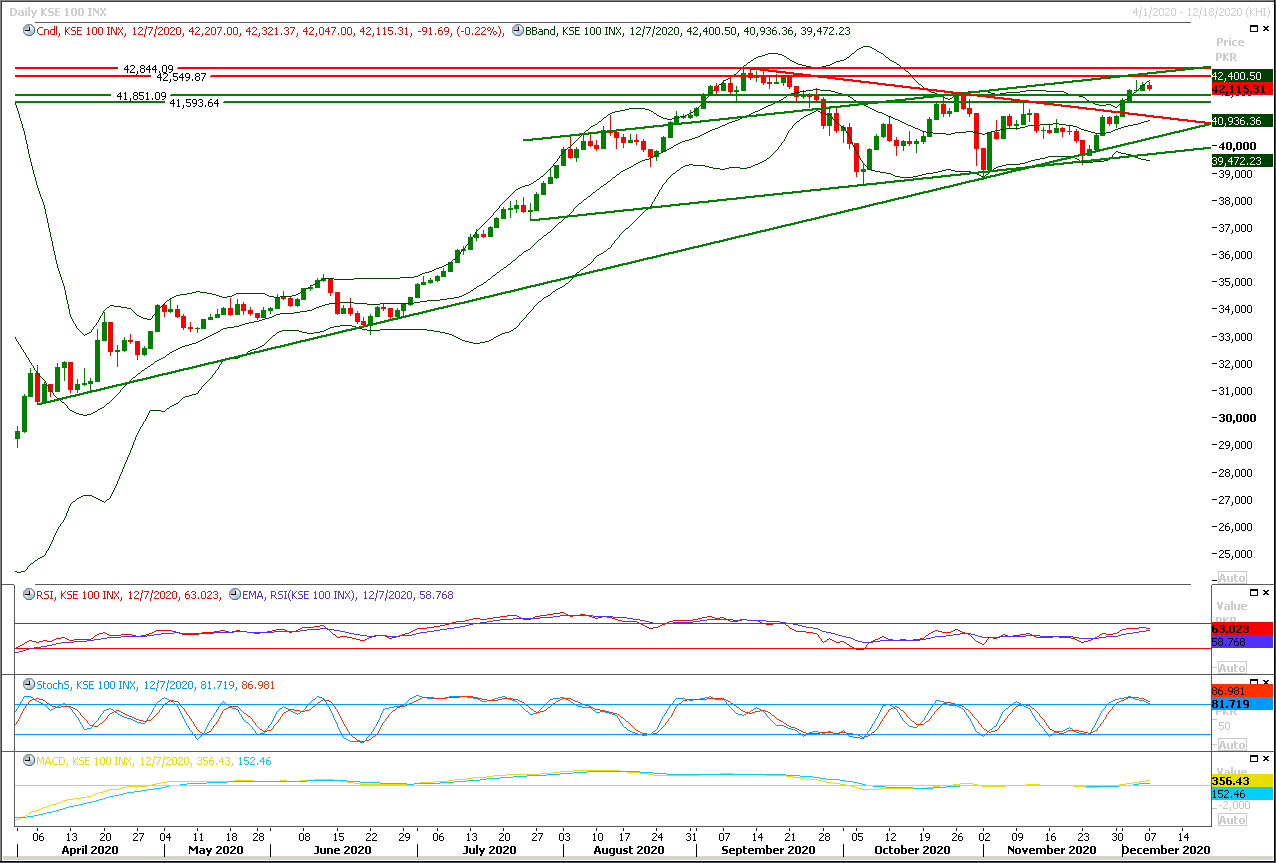

Technical Overview

The Benchmark KSE100 index is facing rejection from resistant trend line of bullish price channel since last three days and now it’s expected that it would take a slight dip during current trading session for resting of resistant trend line of its previous triangle. For day trading it’s recommended to start selling on strength with strict stop loss of 42,500pts while on short term basis index would remain bullish until it would not succeed in sling below 41,000pts on daily chart. Initially it’s expected that index would try to show some volatility in first half of the day but later on it would face bearish pressure which may lead index towards 41,850pts where it would try to establish ground above a strong horizontal supportive region but breakout below that region on hourly chart would push index further downward till 41,500pts.While on flip side in case of bullish pull back index would face initial resistance at 42,350pts which would be followed by 42,500pts and 42,860pts. Hourly momentum indicators are under pressure and these would try to lead index in negative zone while daily stochastic already have generated a bearish crossover which indicates that these would put pressure on index during current trading session.

Regional Markets

Asian stocks under pressure as pandemic concerns outweigh stimulus hopes

Asian stocks came under pressure on Tuesday as investors struggled to balance hopes for more economic stimulus and vaccines with anxiety over a surge in COVID-19 infections.MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.25%. Australia’s S&P/ASX 200 inched up 0.23% as gold miners rose on strong bullion prices, though gains were capped by losses in energy stocks triggered by an overnight slump in oil prices. Japan’s Nikkei 225 narrowed its losses from early trade, down 0.27%, as Prime Minister Yoshihide Suga unveiled 73.6 trillion yen ($708 billion) in fresh economic stimulus measures, signalling his resolve to pull the country out of its coronavirus crisis-induced slump.

Read More...

Business News

Pakistan stresses to boost regional free trade agreements among Carec countries

Pakistan on Monday has highlighted that to expand trade between the Central Asia Regional Economic Cooperation countries (CAREC) programme, Transit Trade Agreements (TTAs) amongst member countries leading to the Regional Free Trade Agreements (RFTAs) may be considered. Federal Minister for Economic Affairs Makhdum Khusro Bakhtyar participated in the 19th Ministerial Conference of Central Asia Regional Economic Cooperation (CAREC) virtually held on 7th December 2020. President of Afghanistan Mr Mohammad Ashraf Ghani while delivering his special message, especially appreciated the Prime Minister Imran Khan’s recent visit to Kabul. He termed the PM Imran Khan’s visit an important milestone in strengthening bilateral ties and enhancing prospects for regional cooperation and integration.

Read More...

National Culinary Team new members conferred with prestigious belts

The newly selected members of National Culinary Team of Pakistan (NCTP) were conferred with prestigious belts by Mr Ahmad Shafiq at COTHM New Garden Town Campus. Notably, the members were selected during the annual trials. The candidates who managed to make up to the finals include Shehroz Babar, Naveed Akhtar, Hadia Tariq, Maham Tanveer Hussain and Muhammad Haseeb Zahid. The National Culinary Team of Pakistan will participate in international culinary competitions around the globe and will play a vital role in promoting the soft image of Pakistan internationally. Representation at international forums through such ventures will reinforce identity as proud people of substance.

Read More...

China keen to work with Pakistan in field of energy, power projects under CPEC

The Chinese Ambassador, Nong Rong, has Monday said that China is keen to work with Pakistan in field of energy including power projects under China Pakistan Economic Corridor (CPEC). The newly appointed Ambassador of China to Pakistan, H.E Nong Rong has expressed these views in a meeting with Federal Minister for Energy Omar Ayub Khan. Omar Ayub Khan welcomed the Chinese Ambassador in his office. Chairman CPEC Authority Gen. (R) Asim Saleem Bajwa and Special Assistant to Prime Minister on Power Tabish Gouhar & Secretary Power Ali Raza Bhutta were also present at the meeting. During the meeting, both sides reviewed the progress of power projects under the China Pakistan Economic Corridor (CPEC) & agreed to continue the cooperation in the field of energy in the mutual interest of both countries. Federal Minister for Energy Omar Ayub said that lowering the cost of power generation is the prime focus of our government.

Read More...

NPMC expresses satisfaction over descending essential items prices

National Price Monitoring Committee (NPMC) on Monday has expressed satisfaction that prices of essential items getting down. Adviser to the Prime Minister on Finance and Revenue, Dr Abdul Hafeez Shaikh chaired a meeting of National Price Monitoring Committee (NPMC) at the Finance Division to discuss the prices and supply position of essential food items. The Finance Secretary while presenting the price trend of essential commodities informed that according to latest SPI released by PBS there is a decline in the prices of 13 essential commodities, for instance, wheat flour, sugar, onions, tomatoes and potatoes. The prices of 17 commodities have increased slightly whereas the cost of 21 items remained stable. The Committee was also informed that the profit margin between the prices of wholesale and retail consumers is also coming down.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3