PSX Morning Market Brief 22nd April 2022

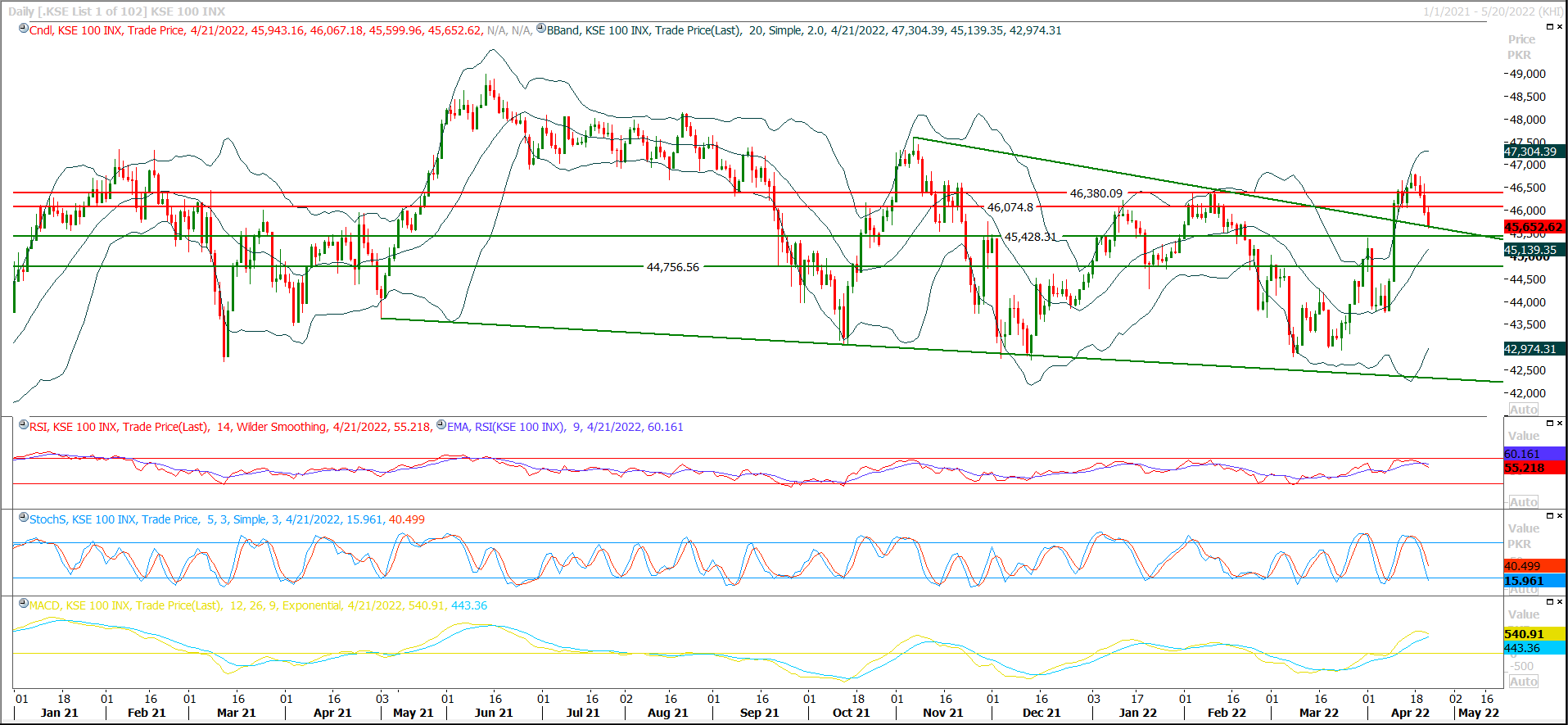

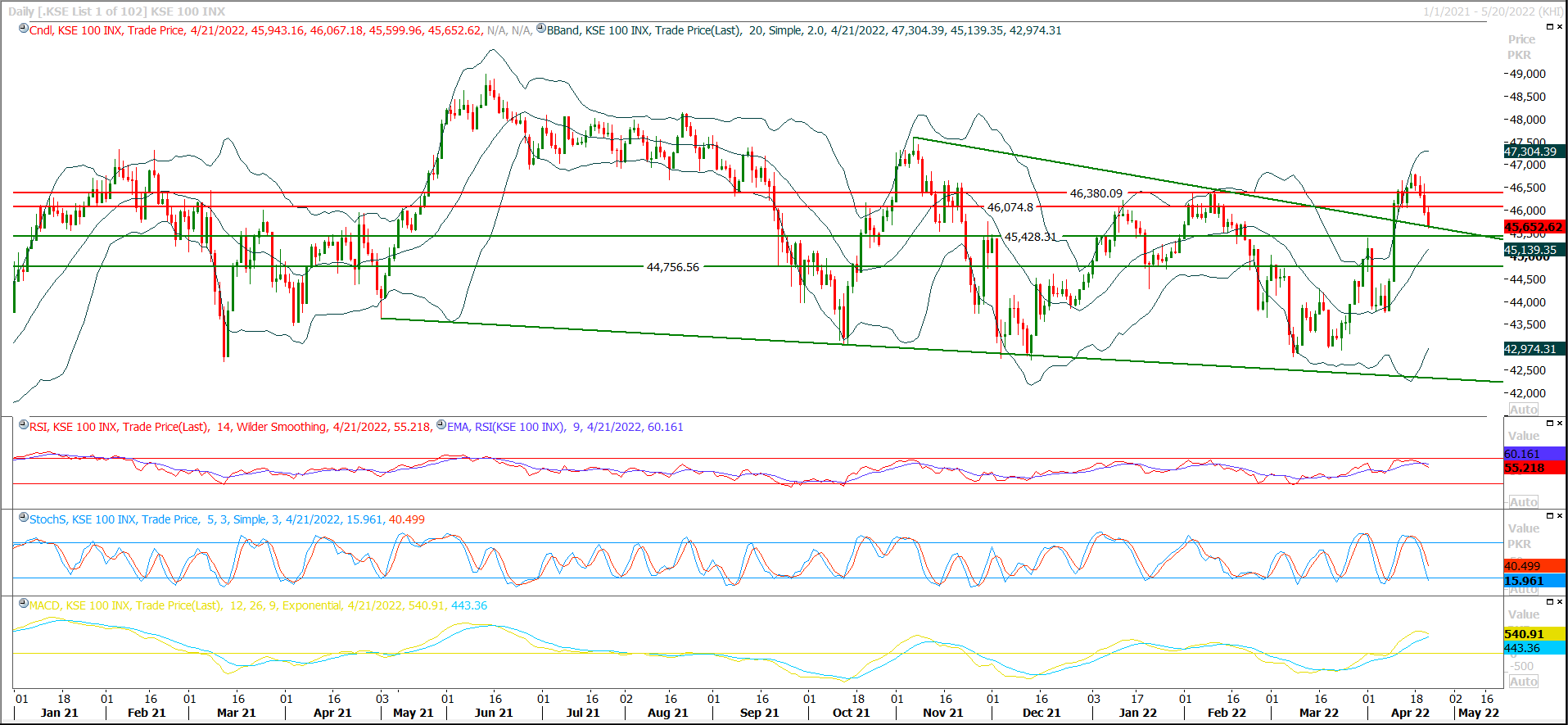

Technical Overview

The Benchmark KSE100 index have completed 38% correction of its last bullish rally on hourly and dialy charts, meanwhile it's being supported by a descending trend line which previously was resistant trend line of its descending wedge therefore it can be said that retesting of this line as supportive region also have been completed. As of now it's expected that index would try to establish ground above 45,540pts-45,450pts region but breakout below this region even on hourly closing basis would push index towards 45,220pts where 50% correction of last bullish rally would be completed and a cheat pattern would take place on daily chart therefore index would need some healthy volumes to recover from that region and in case index would not succeed in getting required volumes it may start sliding further downward till 44,760pts and 44,300pts in coming days. Currently hourly momentum indicators are ready for a pullback but daily momentum is losing strength. For short term trading it's recommended to start buying in chunks with strict stop loss in selective scripts because if index would succeed in maintaining above its correction levels then it would start a bullish rally after cheat pattern in a very brisk way. For current trading session index would face initial resistance at 45,930pts which would be followed by 46,075pts and 46,200pts in case of bullish recovery. On a longer run its good time to build portfolio in chunks on dips.

Asian shares slide on Fed's aggressive tightening stance

sian shares tumbled on Friday as investors fretted about an increasingly aggressive rate-hike outlook for the United States as well as the fallout for the global economy from lockdowns in China.MSCI's broadest index of Asia-Pacific shares outside Japan fell 1.1% in morning trade, its sharpest decline in six weeks.Pulling it lower was a 1.6% loss for Australia's resource-heavy index, a 1.1% drop in Hong Kong stocks and a 0.3% retreat for blue chips in mainland China.Japan's Nikkei lost about 2%.Overnight, U.S. Federal Reserve Chairman Jerome Powell said a half-point interest rate increase will be "on the table" when the Fed meets in May, adding it would be appropriate to "be moving a little more quickly."

Read More...

Business News

FATF begins review of terrorist financing, money laundering

Ministers and officials from the Financial Action Task Force’s (FATF) 37-member countries and affiliates met in Washington on Thursday to discuss actions to tackle money laundering and terrorist financing.The meeting will decide FATF’s strategic direction for the next performance assessment of the countries on its watch list. Pakistan is also on this so-called grey list of countries that are still monitored for terrorist financing and money laundering activities within their jurisdictions.The discussions are part of the spring meetings of the International Monetary Fund and the Board of Governors of World Bank Group that are held annually in Washington.US Treasury Secretary Janet Yellen is also attending the meeting, which marks the first time FATF ministers meet in-person in three years.

Read More...

Miftah leaves for US to meet IMF officials for revival of loan facility

Newly-appointed Finance Minister Miftah Ismail said on Thursday that he was leaving for Washington, where he was expected to meet International Monetary Fund (IMF) officials for the revival of a loan facility that was stalled following the premature end of the Imran Khan government earlier this month. Ismail, who has replaced Shaukat Tarin in the role of the country's finance czar in the new coalition setup, tweeted before leaving for Washington that the purpose of the visit was to "put back on track our IMF program that PTI and IK (Imran Khan) derailed, thus endangering our economy". He added that he would travel to London on the way, where he would meet PML-N supremo Nawaz Sharif.

Read More...

Foreign loans swell to $15b in Jul-Mar

The former government of Pakistan Tehreek-e-Insaf (PTI) took $15 billion gross foreign loans during its last nine months in power, bringing the total gross foreign borrowings to over $57 billion during its rule. The Ministry of Economic Affairs on Thursday released the foreign debt bulletin for July-March period of the current fiscal year. The figures were made public the day Pakistan’s outgoing Finance Minister Shaukat Tarin and his successor blamed each other about the worrying debt situation. Total loans received by the last government of former prime minister Imran Khan from July through March of the current fiscal year amounted to $15 billion, according to the data of the Ministry of Economic Affairs and the State Bank of Pakistan (SBP). These include disbursement of $13.5 billion by the international creditors and nearly $1.4 billion by the overseas Pakistanis.

Read More...

Pakistan to buy expensive LNG again

The tender awarded to Pakistan LNG Limited (PLL) for the month of May is quite costly for the country mainly owing to supply-chain disruptions in the international market on the back of Russia-Ukraine war. The firm selected the lowest bid for liquefied natural gas (LNG) cargoes. Out of seven, six contract prices for LNG cargoes were received. The cargoes were sought on an urgent basis after earlier committed cargoes were cancelled. The lowest contract price for a cargo requested for May 1-2 delivery received at $29.67 per mmbtu from Total Energies Gas and Power. The second bid for the same delivery window was received from Vitol Bahrain at $29.79 per mmbtu. Pakistan, which has increased its dependence on LNG in recent years, due to depleting indigenous natural gas deposits, issued a separate tender for six deliveries in May and June earlier this month. Qatar Energy quoted the lowest bid for May 12-13 delivery at $25.15 per mmbtu and for the June 6-7 delivery window at $27.65 per mmbtu.

Read More...

Disclaimer

Information and opinions contained herein have been compiled or arrived at by Us from publicly available information and sources that We believe to be reliable. Whilst every care has been taken in preparing this research report, no research analyst, director, officer, employee, agent or adviser of any member of Our Team gives or makes any representation, warranty or undertaking, whether express or implied, and accepts no responsibility or liability as to the reliability, accuracy or completeness of the information set out in this research report. This research report is for information purposes only and does not constitute nor is it intended as an offer or solicitation for the purchase or sale of securities or other financial instruments. Neither the information contained in this research report nor any future information made available with the subject matter contained herein will form the basis of any contract.

High Risk Investment

Trading foreign exchange, Commodities and Equities (Stocks) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, Commodities and Equities (Stocks) you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your initial investment. You should be aware of all the risks associated with foreign exchange, Commodities and Equities (Stocks) trading and seek advice from an independent financial advisor if you have any doubts.

Market Opinions

Any opinions, news, research, analyses, prices or other information contained on in this report is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Accuracy of Information

The content of this report is provided for the sole purpose of assisting traders to make independent investment decisions. We have taken reasonable measures to ensure the accuracy of the information on the website; however, it does not guarantee accuracy and will not accept liability for any loss or damage which may arise directly or indirectly from the content or from your inability to assess the report, or for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this report.

RESPONSIVE

12

CSS

3

HTML

1

JAVASCRIPT

28

DESIGN

6

DEVELOPMENT

3