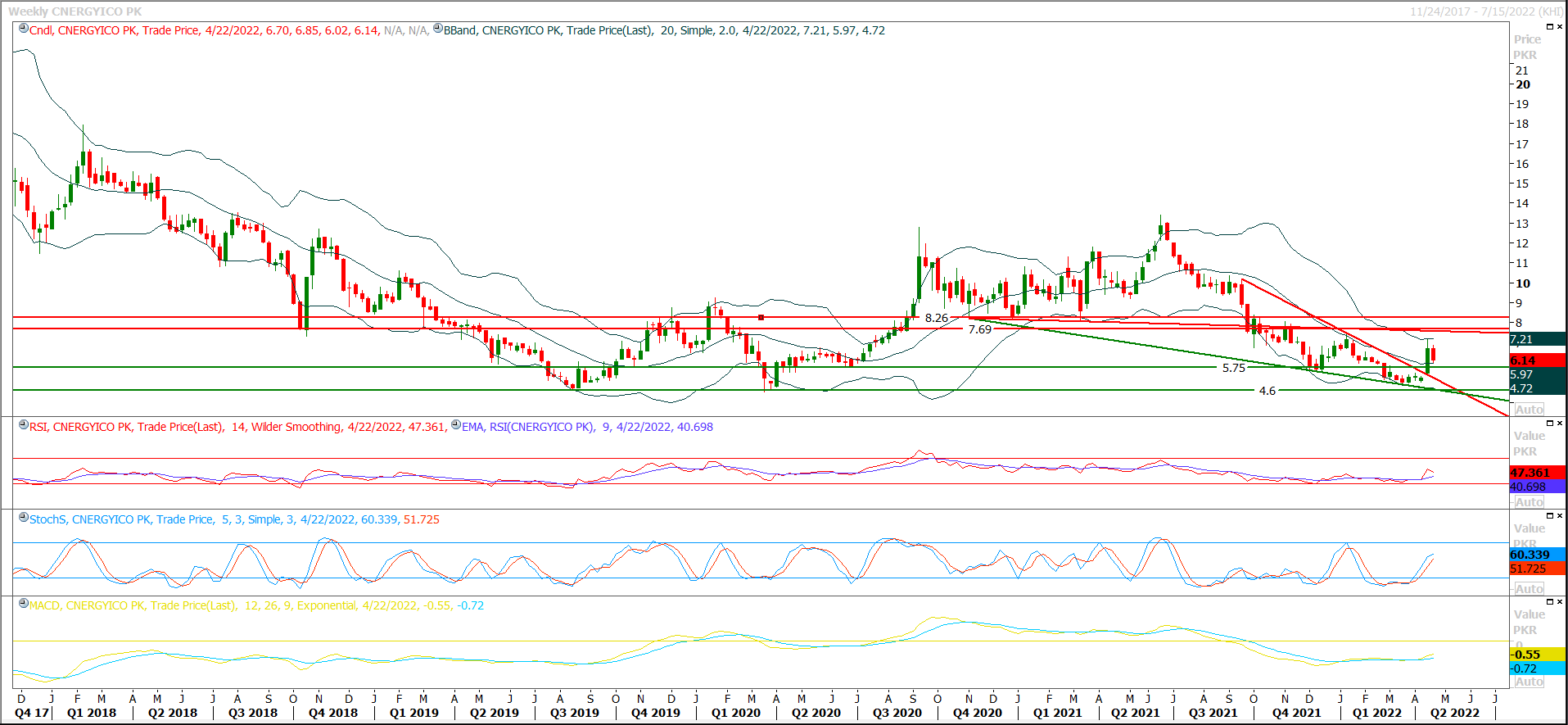

CNERGY Cnergyico PK Ltd. short-term analysis 20th April 2022

Rebound Insight

Our Pivot: 4.60

Our Preference: Start buying CNERGY above 6.00 and average it out till 5.50 with strict stop loss of 4.60 and profit target at 7.70 with extension towards 8.30.

Alternate Scenario: Bearish breakout of 4.60 will call for 3.90 and 3.30 therefore it's recommended to post strict stop loss at this region and adopt cut & reverse strategy on breakout below this region.

NOTE: CNEGY is coming down for retesting purpose after bullish breakout of its descending wedge on weekly chart, meanwhile correction of last bullish rally also would be completed while retesting therefore it's recommended to start buying dip. Currently weekly MACD have started a pull back therefore it's recommended to stay on long side.

Weekly Chart with supports & resistances:

CNERGY 1

Quick Snapshot

0

0

0.00

6.14

52 Weeks Range

Pivots

| Level | 1st | 2nd | 3rd | Supports | 5.91 | 5.68 | 5.34 | Resistances | 6.48 | 6.82 | 7.05 |

|---|