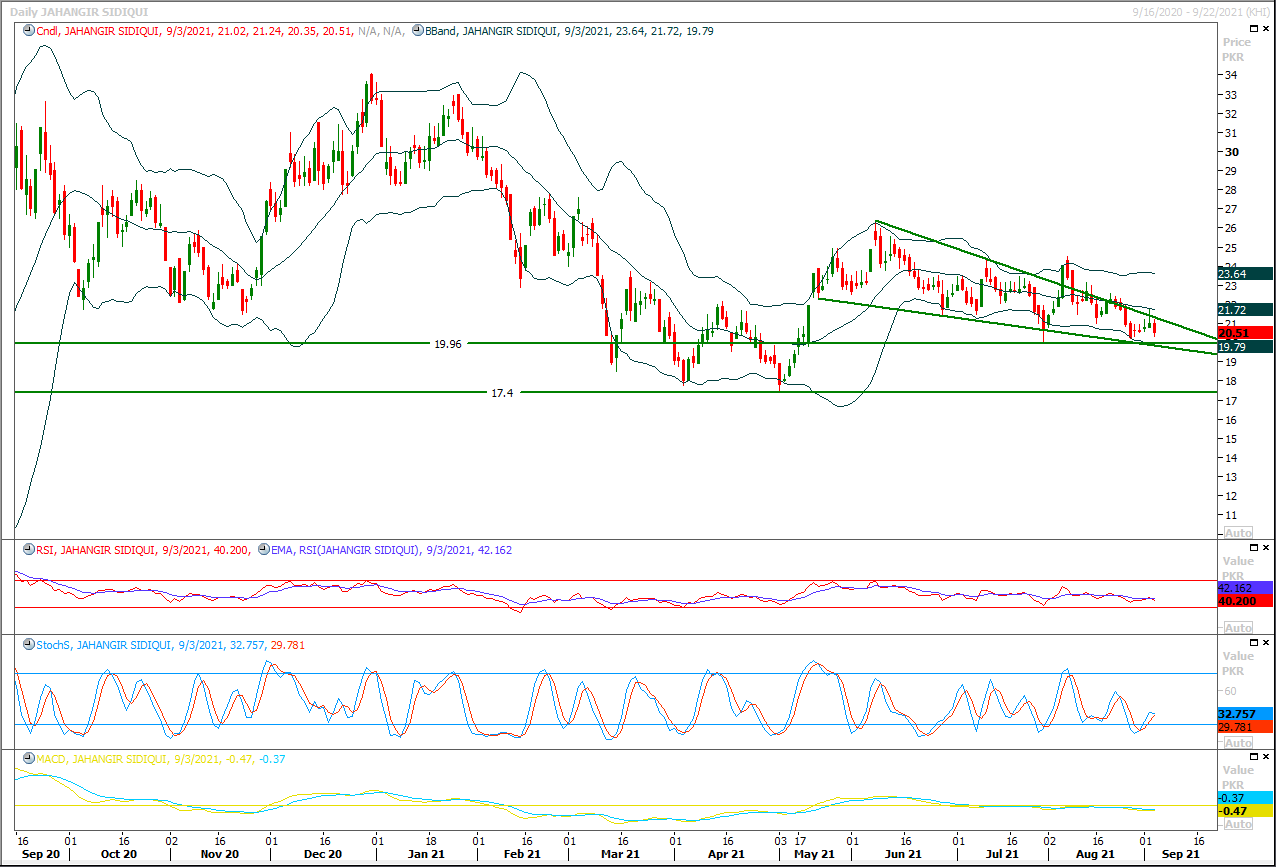

JSCL Jahangir Siddique Company Limited Technical Review Descending Wedge 6th Sep 2021

Descending Wedge Formation On daily chart

JSCL is trading inside a descending wedge on daily chart and its trying to establish ground above supportive trend line of this wedge along with a strong horizontal supportive region which falls at 74.6% correction of its last bullish rally.

As of now it seems that it would try to establish ground above its supportive regions and if it would succeed in giving a bullish breakout of this wedge then current correction would convert into a flag formation and it would start moving towards 22.57 and more. Meanwhile bullish breakout of this wedge would format a morning shooting star on weekly chart which would invite fresh volumes form short term investors.

But in case of bearish breakout of 19.95 it would call for 17.60-17.40 region aggressively. For short to mid-term investors it could be an opportunity with strict stop loss and cut & reverse strategy but this opportunity is for those who can take risk and now how to cut and reverse positions on breakout of either side.

This content is only for education and information purpose only please do your own research or consult with your financial advisor before trading.

Daily chart with supportive formation:

JSCL 1

Quick Snapshot

228,985,597

915,942,388

0.00

28.00

32.50

20.51

52 Weeks Range

Pivots

| Level | 1st | 2nd | 3rd | Supports | 20.16 | 19.81 | 19.27 | Resistances | 21.05 | 21.59 | 21.94 |

|---|